Hello Everyone! Welcome to my July update where I will discuss my returns for June 2020.

Not much has really been happening this month. Corona is still around causing havoc, and the markets have been tracking sideways for a while. This month, my P2P and Crowdfunding investment profile returned an average of 0.40%, bringing my total for crowdlending to a return of 4.77% so far this year. This is money that is in the bank (not theoretical returns like shares or XIRR based on future payments). Additionally, my total value slightly increased by 1% from last month . The highest of my crowdlending returns came from:

- Bondora (+1.03%)

- Mintos (+0.93%)

- Rate Setter (AU) (+0.66%).

Quick Summary

The main items that happened throughout June include:

- Continued corona-virus effects and reductions in P2P and crowdlending payouts

- New article: 4 Reasons I Don’t Share My Finances Online

- Solar energy payouts

Progress on Internal Changes

In a recent update, I made a pledge to update sections of my blog. I will keep this section here until these tasks are fully complete. The remaining tasks are:

- (Priority #1) Adding a page outlining some basic steps for how due diligence can be performed. (started writing this)

- (Priority #2)Adding a section to each platform review with my own due diligence.

- (Priority #3)Placing stronger disclaimers within each platform review page saying how my interests lie within the article, including showing my investment graphs and overall asset allocation.

(Note: currently, there are already disclaimers on all of the pages, however, I will look to have them as more of a focus) .

Overall Asset Allocation

Here I provide a “big picture” showing how crowdlending fits in with my overall asset allocation.

[visualizer id=”36018″ lazy=”no” class=””]

[visualizer id=”35423″ lazy=”no” class=””]

This month my allocations have not changed all that much. I contine to have the majority of my funds in shares (~75%), 9.5% in cash and 14.5% in crowdlending. Within crowdlending, I have more than half of my investments in Crowdestor.

Overall it’s a net gain again this month of 1.2% of my total portfolio . Hopefully, I can reach 15% by the end of the year!

Progress Towards Financial Freedom

[visualizer id=”36059″ lazy=”no” class=””]

The above graph is not related to net wealth, but instead my progress towards a set amount of total investments

I have been on the financial freedom path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages (with the goal being 100%). I have an initial conservative plan of 20 years and have provided a guide as to my current progress.

Once the mortgage is fully paid off in 8 years, I expect to really hit the accelerator on my investments, and hence the progress. This graph will change regularly with new information and calculations etc. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

Why are we focusing on the mortgage rather than FI? That’s another article for another day!

P2P and Crowdlending

My Returns in Crowdlending this month

This month saw my P2P and Crowdfunding profile return on average 0.40% These low returns are still a result of the COVID. As I suggested last month, these results could be lingering around for a while.

This month saw 0 payouts from 3 platforms.

[visualizer id=”36017″ lazy=”no” class=””]

Quick P2P News

Here is a quick one-liner on some interesting things that were happening around the place (in May):

- Fast Invest have provided payment holidays for their borrowers.

- Additionally, Fast Invest have overhauled their public website.

- Bankrupty proceedings are still in progress for Kuetzal and Envestio. Get your claims in by August.

- Grupeer released their progress report which shows which Loan Originators are able to payback their loans.

- Mintos has released information about their pending payments feature.

- Reinvest24 has released a new “insider updates” series.

- Each Solar Cell bought for Boland Wind Cellar (through The Sun Exchange) will go in the draw to win a case of wine.

Crowdlending Summary

Returns this month | Returns Since Inception | Time Invested | |

0.93% | 30.57% | 2.5 years | |

1.03% | 38.01% | 2 years | |

Grupeer | – | 23.60% | >1.5 years |

RateSetter (AU) | 0.60% | 41.39% | 5 years |

– | 18.51% | 1.5 years | |

0.43% | 15.19% | >1 year | |

– | 10.30% | <1 year |

Mintos

Mintos, a.k.a. “old faithful” keeps plodding along doing its thing. Mintos survived the market crash of 2008, so I am pretty happy with my money in there at the moment. They seem to be paying out as expected through the crisis. There have been a few minor issues with some of their Loan Originators, however these haven’t affected any of my payments.

Mintos has also released a blog post about improvements and transparency around pending payments.

Bondora

Bondora is another platform that has been around for a while. I have been invested in Bondora for 3 years now. The returns that I got this month seem to be continuing a downward trend in 2020. This is likely because I have not been reinvesting in the platform at the moment. With the COVID crisis, I am less inclined to pile into personal loans at the moment. Once I confirm no payment problems from borrowers, I can start to look at allocating money towards loans again.

I now only handpick loan through the secondary market, but this is time-consuming and there are no buyback guarantees! This way I am taking an active approach in picking quality loans (high rate of return, confirmed borrower, high credit score, payments on time, etc.). I am hoping that this will be more rewarding than automatically investing.

Grupeer

This was another month of 0% interest from Grupeer. There is still no sight of any withdrawals as Grupeer is yet to have an operating bank account. Just recently, Grupeer released a progress report regarding portfolio performance audit and payments to the investors. All loan originators have been split up into 5 groups, with Group 1 ready to pay principal, and Group 5 still unkonwn.

The Grupeer Armada legal action group continues its journey. More information can be found here.

RateSetter (Australia)

Rate Setter in Australia was the first P2P platform I invested in. I have recently put my money back to work, which can be seen in the higher returns over the last few months. The downside is that it’s earning much less than the other European platforms. However, the upside is higher regulation and trust within the platform.

Fast Invest

To my surprise this month, Fast Invest returned no interest. I am not sure if I missed an important email, but I had to look around to find that Fast Invest introduced “payment holidays” for their borrowers. Maybe payments will come in this month as per my investment schedule, or maybe next. I am actually unsure.

Also interesting to note is that Fast Invest have updated the look of their website. The new website has been completely redesigned and now doesn’t include standard “about us” pages, but instead includes things like “Our heart” and “Engine perks”.

Crowdestor

Crowdestor is still my favorite P2P platform to invest in at the moment. There is just so much to like!! This month saw only a few small returns, but that was expected due to the crisis. I have also been extremely happy with the high level of communication between Janis Timma (the CEO of Crowdestor) and the investors. We get a lot of information about all of the projects and the current scenario at Crowdestor. The investors were also involved in making a decision on the way forward with obtaining payments from the borrowers.

In 4 days. Crowdestor will run the fourth tier of their equity campaign. This campaign will fund platform expansion, and will allow investors to take part in the success of Crowdestor. The current interest rate is set at 26%, but you can gain an extra 1% by using this link.

Since I have started investing with Crowdestor, I have earnt on average over 1% p/month. Read more as to the platform’s offerings in my Crowdestor review.

Reinvest24

As I received a 7% payment last month, I’m OK not recieveing a payment this month.

Once the investments for the Modern office in the business center of Tallinn are complete, I will start to receive a monthly payment again. This project offers a rental yield of 7.14% as well as a capital appreciation of 7%. In total it’s estimated to grow at over 14% a year. A video overview of the project can be found below:

The Sun Exchange

A few months ago, I purchased some solar cells from The Sun Exchange (if you use the affiliate link, then you will get a bonus solar cell on your first purchase!). The Sun Exchange is the world’s peer-to-peer solar cell micro-leasing platform.

[visualizer id=”36117″ lazy=”no” class=””]

The platform works by people purchasing solar cells, which are then leased to companies (such as schools, nursing homes, shopping malls etc), who will pay for the electricity that is generated by your cells. The companies generally can’t afford the outright cost of the systems themselves, which is where the crowdfunding aspect comes in. The solar system will be split up into many smaller cells, that are sold at a reasonable price. Solar cells can be bought in either BTC or the local currency (ZAR). I will write a more detailed article about the platform in the future, so look out for that!

In June my cells were able to generate 66.2 kWh of energy. This month I topped up my purchase of cells in

- Boland Wine Cellar (IRR 12.48%)

Boland Wine Cellar (founded in 1941) is an internationally-recognised, award-winning wine producer

My total energy generated is currently at 151 kWh, which would allow me to drive 580 American miles in a Tesla Model 3

For some comparison, with 1 kWh you can, toast 160 slices of bread. So in that regard, I have generated enough power to toast 24,160 slices of bread.

Share Portfolio

A few months ago I set up an automatic share purchase system, where I automatically pick up 4 index funds, and one investment fund each month. This is a real set and forget strategy that works well. As they say, its not about timing the market, but instead, time in the market.

At the start of last month I got our of all of my American holdings (at a gain). This was for 2 reasons:

(1) The Swedish account I set up should have been a Capital Insurance, rather than an Investing Account.

(2) I was not happy with being in Foot Locker, or Delta Airlines while cases of Corona are increasing in USA, and WFC will reduce their dividend.

I will set up my Capital Insurance account and get back into the American shares, but I am happy to hold cash and wash as everything unfolds. New earnings reports will be released in the coming month.

Journey to 1 free Bitcoin

My journey is still an ongoing work in progress. Playing games, making Coin.

I have decided that I am going to make 1 Bitcoin without doing any “real work”. This means possibly watching an advertisement here or there, playing games that payout cryptocurrency, use the Brave Browser instead of Google Chrome, and invest current cryptocurrency for investment returns. Here is my progress:

Crypto Idle Miner

Crytpo Idle Miner is a game that provides real cryptocurrency (HORA Tokens) as a reward. Each month the number of my HORA tokens increases, but the value decreases. I now have over 150,000 of these things! Once the developers start to incorporate the tokens more throughout the game, and potentially other games, then I will start seeing the real value. Let’s sit back and watch! You can find my Crypto Idle Miner review here.

RollerCoin

I haven’t been so active with my Rollercoin account, but the value of the satoshi (i.e. BTC) keeps accruing! This game is addictive as it’s easy to reach the top 5% of players (if you have the time). Check out my RollerCoin review article if you are interested in learning more. Each new player using the specific link receives 200 satoshi for free!

New updates in the game mean that you can now earn ETH and DOGE as well as BTC!

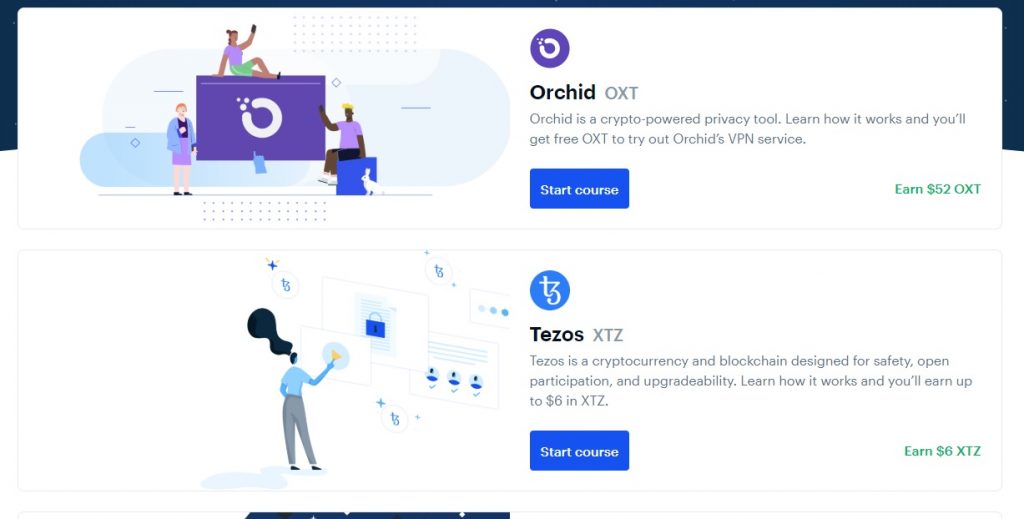

Coinbase Earn

There are now more options to earn cryptocurrency through Coinbase Earn! I have now maxed out my allowance of $130 USD worth of free cryptocurrency. If you haven’t checked it out you should do that already! You can earn some coins simply by watching videos.

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From this, I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Brave Browser

I have been using the Brave Browser for the last couple of months. Find out here why I changed to a more secure and rewarding browser. Basically, you get paid to watch advertisements (if you choose to). It allows users to earn a bit of cryptocurrency and allows advertisers to promote materials to a more select crowd.

Money Savings

This month we had to say goodbye to one of our chickens. It turns out that 2 of the 4 chickens we bought last month were roosters. These guys (only at 7 weeks old) were starting to fight all the time over the other 2 hens. We ended up finding a good home, so we are happy. Now we are on the lookout for 2 new additional hens!

With so much work, and not a lot of time to be on Twitter, but here are some of my recent tweets:

Just purchased more solar cells to supply Boland Wine Cellar with clean #SolarEnergy ☀️

— Matt | thewahman (@MattWAHman) June 23, 2020

If you’re interested in providing #cleanenergy to an internationally-recognised wine producer check out The Sun Exchange! https://t.co/fSv2X9Ksp0 (free solar cell on signup ?) pic.twitter.com/0hHp3j4JQu

$lk getting smashed today cause of delisting.

— Matt | thewahman (@MattWAHman) June 26, 2020

Wonder how many new Robinhood investors have just been burned?

Socials and Traffic

Things seem to have remained steady this month

- My twitter followers fell a few this last month. Hovering around 575

- My website sessions decreased 25% which brings it back to where it was last month

You read it all the way through to the end (or you just skipped half of it)! Regardless, thanks for checking out my update this month!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.