Hello Everyone! Welcome to my February update where I will discuss my returns for January 2020. The update this month is going to be a big one, so you should grab a coffee and a snack and I’ll wait here until your ready.

Ok, are you ready to continue? Let’s begin.

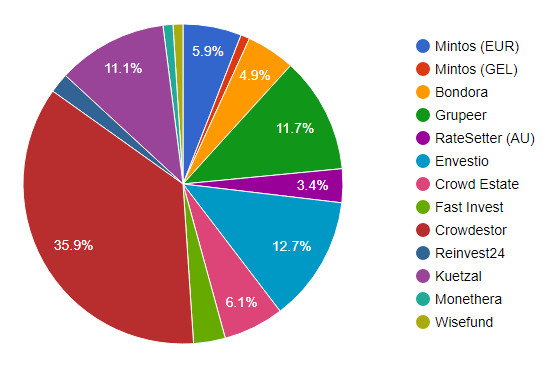

My P2P and Crowdfunding investment profile returned an average of 1.81%, however, I experienced a loss of 24% of my crowdlending portfolio (3% loss of overall investment portfolio) due to the problems with Envestio and Kuetzal. The highest of my crowdlending returns came from:

- Crowdestor (+2.60%)

- Bondora (+1.56%)

- Grupeer (+1.29%).

- Quick Summary

- Kuetzal and Envestio Issues

- Overall Asset Allocation

- Progress Towards Financial Freedom

- P2P and Crowdlending Returns

- Quick P2P News

- Whats changed?

- Crowdlending Summary

- Mintos

- Bondora

- Grupeer

- RateSetter (Australia)

- Fast Invest

- Crowdestor

- Reinvest24

- Agrikaab

- Share Portfolio

- Journey to 1 free Bitcoin

- Money Savings

- Socials and Traffic

Quick Summary

The main items that happened throughout January include:

- The collapse of Kuetzal and Envestio

- Changes to my updates pages

- Portfolio re-alignment

Kuetzal and Envestio Issues

This month has been the most intense month within the European P2P industry. Kuetzal were found to have projects that didn’t exist, then announced that they were winding up their operations. This caused a chain reaction with investors seeking clarification of all other platforms and their projects. It was then found that Envestio had a few “iffy” projects, which caused a “bank-run” (where everyone tries to withdraw all of their money at once). The directors then shut down the website and no one has heard from them since. Further specifics can be found here.

The Estonian Police and Boarder Guard have been inundated with emails about investors not being able to withdraw their money, and have since commenced criminal proceedings against Kuetzal, and have also issued an article detailing the next steps for those involved. Additionally, lawsuits for both Kuetzal and Envestio have been crowdfunded.

What has happened and what you can do?

According to the Estonian Police article: Were Envestio and Kuetzal a fraud? investors that are affected have a few options for where to turn. Here are a few excerpts from the article:

What should I do if I lost money with either Envestio or Kuetzal?

If you placed your money with Envestio, download and fill in the crime report form and email it to us at [email protected]. You will receive an automatic reply and we will ask you to fill out the form attached and enclose any documents in your possession relating to Envestio SI OÜ, proving that you have suffered damage. You can ignore the automated e-mail if you have already complied with the requirements set out in the letter.

If you placed your money with Kuetzal, e-mail us at [email protected]. If we need any additional information, we will contact you.

Estonian Police and Boarder Guard

Will I get my money back?

Estonian Police and Boarder Guard

Usually, in case of international fraud money is quickly shifted between accounts in different countries until it is withdrawn through an ATM. Due to this the chance to recover the money is small.

Unfortunately, it doesn’t look like all of the money we had invested in these platforms will be able to be returned. There is a chance that we could receive some money back, however, that will take a long time to sort out.

These sorts of things are a harsh slap in the face to make sure that we don’t get lost searching for crazy high and unsustainable returns. Due to these platforms collapsing I am now forced to come back to reality with my expectations.

How I will change

I invested in both Kuetzal and Envestio, and I lost money with both Kuetzal and Envestio. As part of documenting my progress towards financial independence, I wrote articles about my experience, which promoted the platforms. I did not pay for any advertising or heavily promote the projects throughout social media. That means now, that I have been promoting what looks like two potential scams. However, it’s up to the police to decide on the legitimacy of the platforms.

These mistakes are apart of learning and are important to document so that people (aka myself) can become better investors. I understand if you want to hit the unsubscribe button or clear me from your browsing history. If I have lost your trust, I am truly sorry. I only hope to learn from this, improve, and hopefully regain some trust down the line. As a result, there are a few things that I am changing about the blog, including:

- Showing my overall asset allocation.

This way potential investors reading my updates each month can see that crowdlending is a high-risk investment, and should only have a small portion of capital allocated to it. - Reducing my crowdlending portfolio from 12 platforms to 7.

Having a smaller number of platforms allows me to better assess and manage where my money is working. - (to do) Placing stronger disclaimers within each platform review page saying how my interests lie within the article, including showing my investment graphs and overall asset allocation.

Nothing in my articles is financial advice, however, I realize that prospective investors may use my review article in their own due diligence practices.

(Note: currently, there are already disclaimers on all of the pages, however, I will look to have them as more of a focus) . - (to do) Adding a section to each platform review with my own due diligence.

- (to do) Adding a page outlining some basic steps for how due diligence can be performed.

Additionally, but not related to the aforementioned problems, I have started to show individual breakdowns of each crowd lending platform. These breakdowns show my actual return (i.e. how much money I was paid each month from the platform), rather than theoretical returns (i.e. shares left in the market, or XIRR with future calculations). I choose not to show things like XIRR as this shows a theoretical rate that assumes that a loan will be paid back on time. Unfortunately with P2P platforms, this is not always the case (i.e. Bondora, Crowd Estate, Kuetzal, Envestio, Reinvest 24 etc).

Each month I will follow up on the above items to ensure they have been completed.

Overall Asset Allocation

As I want to provide more information to everyone who comes and visits my page, I will now show how crowdlending fits in with my overall asset allocation.

[visualizer id=”36018″]

[visualizer id=”35423″]

This compares to my distribution from last month when I was invested in both Kuetzal and Envestio. As can be seen from the below screenshot, the allocations have changed quite a bit…

Last month (before the issues with Envestio and Kuetzal, my asset allocation was close to 10% in cash, 16% in Crowdlending and 74% in Shares. However, as Kuetzal and Envestio took up 11% and 13% of my P2P portfolio, my crowdlending allocation now lies at only 13% of my total portfolio.

Overall it’s a net loss this month of 3% of my total portfolio.

Progress Towards Financial Freedom

[visualizer id=”36039″]

The above graph is not related to net wealth, but instead total investments.

This is the first month, that I have included my progress towards financial independence. I have been on this path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages. As I am also planning to reach my goal (i.e. 100%) within 20 years, I have laid down a guiding path based on my expected returns and estimates. I have set a very conservative estimate of 20 years to become financially independent, as I am currently aggressively paying off the house, and raising a (very) young family. Once the mortgage is paid off in 8 years, I expect to really hit the accelerator on my investments. This graph will change regularly with new information and calculations etc.

Why are we focusing on the mortgage rather than FI? That’s another article for another day!

P2P and Crowdlending Returns

This month saw my P2P and Crowdfunding profile return on average 1.81% (before taking into account the issues with Envestio and Kuetzal). This high return was skewed from my big returns from Crowdestor, which takes up over 50% of my crowdlending portfolio.

If there is no money being returned from Envestio and Kuetzal, I am down all of my interest since I started investing in crowdlending. ?

Quick P2P News

Here is a quick one-liner on some interesting things that were happening around the place (in January):

- The P2P Conference 2020 in Riga has been announced. The conference is on June 19 and 20. Tickets are on sale now.

- The P2P industry is under immense pressure as investors are flooding platforms, directors, issuers and borrowers with thousands of emails seeking clarification information.

- Many platforms have issued direct communication addressing such concerns.

- Grupeer, Monethera, Wisefund, Crowdestor all released statements following issues with Kuetzal and Envestio. Most likely because they couldn’t open their inbox with the number of questions they had received.

- Monethera and Wisefund also suspended their buybacks for a month.

- In the middle of these issues, Fast Invest, send a nice update around to everyone to show how much fun they had in Dubai.

- Fast Invest also changed bank accounts for the nth time, which raised a few questions. However, they also released a few of their loan originators which overlap with Mintos.

Whats changed?

After the collapse of Kuetzal and Envestio, I have decided to move away from the “diversified experimental phase” and re-align my crowdlending portfolio with platforms that I am happy with. This means that I will only focus on the platforms that I am currently invested in, as well as transferring more money into the sharemarket. As part of the change, I have reduced my initial 12 platforms to just 7. Apart from Kuetzal and Envestio, the additional 3 platforms that I am stepping back from include Monethera, Wisefund and Crowd Estate.

Monethera and Wisefund were both smaller holdings for me, making up a total of 2% of my P2P portfolio (less than 0.5% of my overall portfolio). They are the platforms that I invested in most recently, and the ones that I feel least confident about. As I don’t have time to go through proper due diligence with these, I will hold off investing for a while. If they are still around in a couple of years, I will reassess the situation then.

After yet another disappointing month in Crowd Estate (issues with 4 out of 6 loans), I have put the loans that are not locked on the secondary market. When I can, I will exit the platform. It’s not the fault of the platform, however the fault of the projects and the system. The problem doesn’t seem to lie with my projects either, when I look through the market there are many other projects that have had issues. When there are so many other platforms paying constant returns each month, I don’t need to have my money stuck in an underperforming platform.

Now we have gone through what’s changed, let’s look at my new revamped crowd lending portfolio:

Crowdlending Summary

Returns this month | Returns Since Inception | Time Invested | |

Mintos | 1.00% | 26.70% | 2 years 3 months |

Bondora | 1.56% | 31.60% | 1 year 6 months |

Grupeer | 1.29% | 21.20% | 1 year 5 months |

RateSetter (AU) | 0.14% | 38.70% | 5 years |

Fast Invest | 1.04% | 14.60% | 1 year, 2 months |

Crowdestor | 2.60% | 13% | 1 year |

Reinvest24 | 0.32% | 2.20% | 7 months |

Mintos

[visualizer id=”36027″]

[visualizer id=”36035″]

Mintos, a.k.a. “old faithful” keeps plodding along doing its thing. It’s good to see that the average interest for January for the last 3 years has been nearly identical.

This month I moved all of my money out of “Invest & Access” and set up a new automatic investment strategy using a select few originators with a high rating through both Mintos, and Explore P2P, as well as insuring to only invest in originators that paid interest on delayed payments.

Bondora

[visualizer id=”36025″]

[visualizer id=”36032″]

Bondora is another one that I have been invested in now for nearly 3 years. In the last few months, I have been seeing my returns start to creep a bit lower. As a result, I stopped automatically investing in loans, and I will now handpick each loan through the secondary market. This way I am taking an active approach in picking quality loans (high rate of return, confirmed borrower, high credit score, payments on time, etc.). This takes a bit more work, but I think it will be rewarding when I don’t see so many defaults.

Grupeer

[visualizer id=”36026″]

[visualizer id=”36034″]

Grupeer is another that is coming up to its 3rd birthday in my portfolio this year. I have nothing bad to say about Grupeer, and I am extremely happy with the consistent returns over the last year and a half.

RateSetter (Australia)

Rate Setter in Australia is one of those that I was actually contemplating to get out of after I was getting so much higher returns through other platforms. However, following recent events, I am leaning towards staying with this platform and its 7% estimated return.

Currently the interest rate is so poor because I have most of the money sitting in the account doing nothing.

Fast Invest

Fast Invest is another platform that has produced extremely consistent returns since I have started investing with them. I am averaging between 1 and 1.3% return each month.

Crowdestor

As can be seen from my crowdlending allocations, Crowdestor is my favourite P2P platform to invest in at the moment. This month I earnt the highest return (in percentage) I have ever made through crowdlending. This month Crowdestor brought in a crazy 2.60%!

This return is not sustainable (otherwise I would be looking at >30% a year!) and is just an alignment of some of the projects that I purchased in the middle of last year. It’s good to finally see the average return start to move upwards.

In January I was able to invest in:

- WarHunt – Mickey Rourke hired as one of leading actors (II) (17 months, 18% p.a. + 12% bonus)

Since last investing, Mickey Rourke has been signed as one of the leading actors of Warhunt – an American Action/Horror WWII movie directed by Mauro Borrelli. - Limp Bizkit – summer tour 2020 (9 months, 21% p.a.)

Financing used to cover organisational costs for the shows, including artist fees, stage construction, promotion activities, etc. Loan and interest will be repaid from ticket sales. - Fertilizer Export Financing (3 months, 21% p.a.)

- Fertilizer Export Financing (II) (3 months, 21% p.a.)

- Loan to cover Cotton Fertilizer product purchase cost, loading at the export port and vessel freight from EU, Latvia to a state-owned Cotton Factory in Cameroon.

Since I have started investing with crowdestor, I have earnt on average 1.08% p/month.

Read more as to the platform’s offerings in my Crowdestor review.

Reinvest24

For now I am happy to keep plodding along with Reinvest24. I only have interests currently in two projects, one which is paying dividends (as can be seen in the chart), and the other which I am waiting to receive capital gains once it is sold. If the apartment is sold soon, then I will happily invest that into the new High yielding office space in Rocca Al Mare property

Agrikaab

This month I received my first (quarterly) update from Agrikaab. Unfortunately, it didn’t rain so much over the pond, and only 600 m3 of water was caught (the pond holds 10,000 m3), since construction in August 2019.

The next report is due on 1 June, depending on how much rain comes. Spring rainfall in Somalia usually runs from March-May. If you want to see the reasons that I invested in rainwater in Africa, you can have a look at my article here.

There is a new Rainwater Project that has just started to take orders. Make sure you get in if you’re interested. Help Somalia to harvest rainwater and fight droughts!

Share Portfolio

Since my last update, I have not purchased or sold any shares. I have however started to compile a list of shares that I will buy once they come into value territory. More about this soon.

Journey to 1 free Bitcoin

My journey is still an ongoing work in progress.

I have decided that I am going to make 1 Bitcoin without doing any “real work”. This means possibly watching an advertisement here or there, playing games that payout cryptocurrency, use the Brave Browser instead of Google Chrome, and invest current cryptocurrency for investment returns. Here is my progress:

Crypto Idle Miner

Crytpo Idle Miner is a game that provides real cryptocurrency (HORA Tokens) as a reward. Each month the number of my HORA tokens increases, but the value decreases. I now have over 100,000 of these things! Once the developers start to incorporate the tokens more throughout the game, and potentially other games, then I will start seeing the real value. Let’s sit back and watch! You can find my Crypto Idle Miner review here.

RollerCoin

I haven’t been so active with my Rollercoin account, but the value of the satoshi (i.e. BTC) keeps accruing!

This game is addictive as it’s easy to reach the top 5% of players (if you have the time). Check out my RollerCoin review article if you are interested in learning more.

Coinbase Earn

I have now maxed out my allowance of $130 USD worth of free cryptocurrency gained through Coinbase Earn. A big thank you to everyone that used my links! Hopefully, you were able to get your free cryptocurrency!

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From this, I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Brave Browser

I have been using the Brave Browser for the last couple of months. Find out here why I changed to a more secure and rewarding browser. Basically, you get paid to watch advertisements (if you choose to). It allows users to earn a bit of cryptocurrency and allows advertisers to promote materials to a more select crowd.

Money Savings

I am yet to use my new Mars Hydro growth lamp, however I have set up some plants in smaller chambers, which I will move under the light soon. Why should the winter stop me from growing produce inside?

This month I want on a bit of a shopping spree and bought lots of different kinds of tomato seeds. I am hoping I now never need to buy these seeds again!

I have also started backing up everything onto pCloud which is an online storage that you only pay a once off lifetime fee for. If I use it more than 4 years, its cheaper than things like Dropbox, Google Drive, etc.

Here are some of my other adventures this month:

I managed to save 17% on the weekly food shop this week.

— Matt / thewahman (@MattWAHman) January 27, 2020

How you ask?

Utilize 2-for-1’s, specials, and buy things in season!#frugallife

Just did a quick #diy car battery replace after the 15/yr old car wouldn’t start this morning.

— Matt / thewahman (@MattWAHman) January 15, 2020

Knew it was coming, so picked up a spare battery 2 weeks ago.

Feeling #frugal – saving a call out to road assistance or a tow to the mechanics. ?

Socials and Traffic

A few things have slowed down this month, as I haven’t been so active with content over the last few weeks.

- My twitter followers are still climbing. Now its closer to 550!

- My website sessions have decreased massively again this month. Fourth month in a row. I switched from Yoast to the SEO Framework and obviously the site is taking a massive hit. I also tried to load up amp pages for mobile viewers, however, I am thinking this was not such a smart idea.

You read it all the way through to the end (or you just skipped half of it)! Regardless, thanks for checking out my update this month! I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.

Wow! such an extended and well detailed monthly update. Good job Matt.

I admire the approach you have taken out of all the unfortunate news. Accepting your mistakes, learning out of them and making and readapting with some changes is a positive attitude.

It’s good to see your full portfolio allocation, 10-15% of my investable assets is what I am aiming for my P2P investments from now on (had been over 40%!).

Hopefully will have now a quieter month after a noise January. Have a great one Matt. 🙂