So, as you may have guessed from the title, I have moved to quarterly updates.

This makes the most sense with what I have to show you, and also my schedule. So without further adieu, here is my Quarter 3 update, which includes updates for July, August and September 2021.

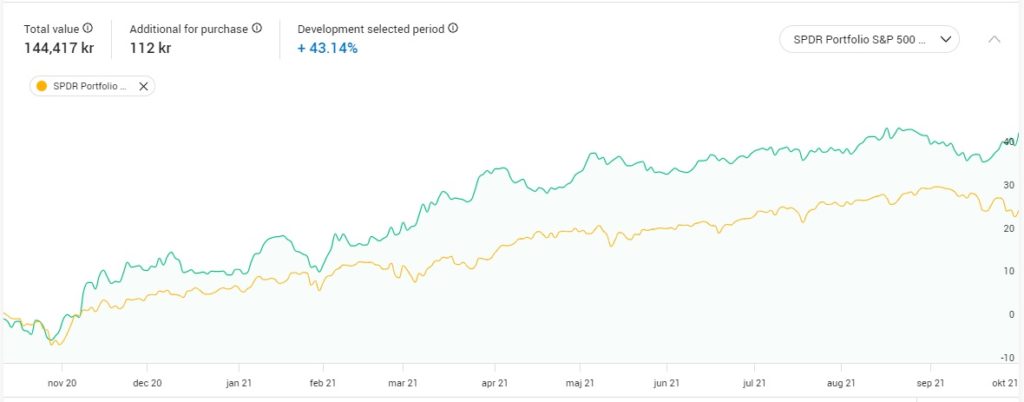

- since inception (Oct 2020) my international share portfolio has returned 43.14% against the SPDR S&P 500 ETF which returned 25.27%

- my P2P and Crowdlending investment profile returned a total of 0,34%, bringing my total for crowdlending to a return of 2.39% for 2021.

- my Solar panel system generated:

- 48.387 kWh of energy in July,

- 64,757 kWh of energy in August

- 87.626 kWh of energy in September

all of this beautiful power was paid out in BTC. My total energy production reached 990 kWh. Total carbon saved – 1019.58 kg

- my total investment portfolio decreased 2%.

There has been a bit of a change in the website over the last couple of months. I have really been trying to push out more and more articles, with the aim of 1 article per week.

If you haven’t signed up for the newsletter, I suggest that you go ahead and do that. The newsletter is sent out once a month with all of the articles that were published during that month.

Quick Summary

The main items that happened throughout the previous months include:

- 11 articles published

- 1 guest post published

- Increased blog revenue after swapping to Ezoic

- Purchased more ABBV and STNE this quarter

- Mintos obtains European investment firm license

If you missed some of the articles that were published this quarter, I encourage you to check out:

- Ezoic Requirements Updated! My Ezoic Review 2021

- How to Improve Your Money Mindset

- Cloudways – Fast Affordable Hosting (Review)

- The Swedish Kapitalförsäkring (KF) Account

- 10 Pros and Cons of Working from Home

- How to Invest in Solar Energy

- 5 Quick Methods to Overcome Financial Anxiety

- Alternative Investment Due Diligence Questionnaire

- What is Litigation Funding?

- Why Use SiteGround? 10 Smart Reasons

- Is it Cheaper to Order Groceries Online?

I was also has an article published in Camp F.I.R.E Finance:

How to Manage a Side Hustle and Life

Progress Towards Financial Freedom

[visualizer id=”37500″ lazy=”no” class=””]

I have been on the financial freedom path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages (with the goal being 100%). I have an initial conservative plan of 20 years and have provided a guide as to my current progress. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

Investments

My goal is to be able to match the fund, while also being able to generate passive income through dividend growth investing.

If you are interested to see the breakdown of the investments, please see the chart below.

[visualizer id=”37081″ lazy=”no” class=””]

Quarter 3 2021 Buys and Sells

As I am a long term holder, there were no sales this month.

This quarter I made the following transactions:

Share | Buy/Sell | Reason |

|---|---|---|

Abbvie | Buy | Bought with dividends from other stocks. >4% dividend, >15% dividend CAGR |

StoneCo | Buy | Dropped >60% from all time highs. Leading digital payments processor. Main business booming, temporary loss in revenue last quarter |

I couldn’t pass up the opportunity to purchase some shares in StoneCo. The shares have dropped more than 60% from their all time high because they had a small setback in one of their segments due to changes in the countries credit registry system. They currently have over 1 million clients, and remain the leading payments processor in Brazil.

Unfortunately P2P and Crowdlending is not what it used to be anymore. It’s one of the main reasons that I got into this blog, but a combination of the scandals that have happened, the ones currently happening, and the mostly poor returns its just not worth it.

Especially when you could instead earn dividends through strong companies in the stock market.

Nevertheless, here is my Crowdlending breakdown:

[visualizer id=”35423″ lazy=”no” class=””]

Some good aspects are that Mintos has received an European Investment Firm Licence. From now on, Mintos is supervised by the FCMC of Latvia.

For this quarter, I received an average return of 0.34%. If you extend that out for the year, my total return would be looking at 1.36%. That’s definitely not good enough.

The main issue for me is that I am heavy in Crowdestor, and the majority of loans on their platform are delayed.

Luckily I only have a very small percentage of my overall wealth in crowdlending, so this can be more of an experiment rather than my whole retirement.

As these returns are extremely poor, I plan on leaving / reducing my exposure to the crowdlending sector.

[visualizer id=”37515″ lazy=”no” class=””]

To see the actual graphs for each of these platforms, head on over to my portfolio page.

The Sun Exchange – Passive Income from the Sun

The Sun Exchange is the world’s first peer-to-peer solar cell micro-leasing platform (if you use the affiliate link, then you will receive 1 free solar cell on your first purchase!).

If you are interested in finding our more about the sun exchange, please check out my full platform review.

[visualizer id=”36117″ lazy=”no” class=””]

The last quarter my cells were able to generate 200.77 kWh of energy (paid out in BTC).

My total energy generated through The Sun Exchange is currently at 1236 kWh,

On average, electric cars consume 34.6kWh to travel 100 miles. That means that I could drive more than 3,500 miles with the amount of energy I have produced.

For some comparison, with 1 kWh you can, toast 160 slices of bread. So in that regard, I have generated enough power to toast 197,760 slices of bread.

Blog Side Hustle

So this blog is a bit of a side hustle in itself. This quarter I swapped from using Google AdSense to Ezoic. I wrote a review about what makes Ezoic a great platform.

I actually couldn’t be more happier with the results. It’s only the third month that I have been using them and I have already seen Ezoic return 4x more than what I was earning through AdSense.

Here are the results:

[visualizer id=”38159″ lazy=”no” class=””]

So basically, more site views, more ads, more income.

Socials

Lately I have been focusing a lot on getting my articles out there on my socials. I have enlisted the help of the scheduling genious Tailwind to automate some of the process. The platforms that I am specifically targeting are Instagram and Pinterest. Here are some statistics:

- Instagram: 1 post, 0 followers, 3 likes

- Pinterest: 18 followers, 79 pins, 39 repins

- Facebook: 23 page links

- Twitter: 584 followers

Watch how these numbers grow over the next quarter.

So that’s all for this month. Thanks for checking out the update, and I encourage you to reach out to me if you want to discuss something further!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.