Are you a Swedish resident who wants to invest in dividend paying shares outside of Sweden? Do you want to make use of the advantageous taxation system to reduce your taxable income? Then you may want to read on. Here I explain everything (in English) about the Swedish Kapitalförsäkring (KF) Account.

The Swedish Kapitalförsäkring (KF) Account

Affiliate disclaimer: Some of the links below may be affiliate links (disclosure). If you use these links to buy something we may earn a commission (which come at no additional cost to you). Thanks.

What is the Swedish KF account?

The Swedish Kapitalförsäkring (Kapitalförsäkring = Endowment Insurance Account) is a flat taxed investment account (like the Investingsparkskonto), but instead uses an insurance to trade shares. What does that mean? I’ll get to that…

Similar to the ISK Account, there are no capital gains when you invest through a KF account. Instead of capital gains, investors are charged an insurance premium on top of a yearly standard tax

No transactions in the account need to be reported to the tax authority (Skatteverket).

What does Endowment Insurance mean?

Endowment insurance is an insurance policy, that is used to trade shares, mutual funds and other securities. The shares and funds are not owned by you, but instead owned by the insurance company.

In case of your death, the beneficiary (that you specify) would receive the account +1% more than you had invested.

An endowment insurance account always includes a repayment protection. This means that the value of your account +1% is paid out when the insured person dies. The extra 1% requires a premium to be paid each month.

Risk premium for the KF account

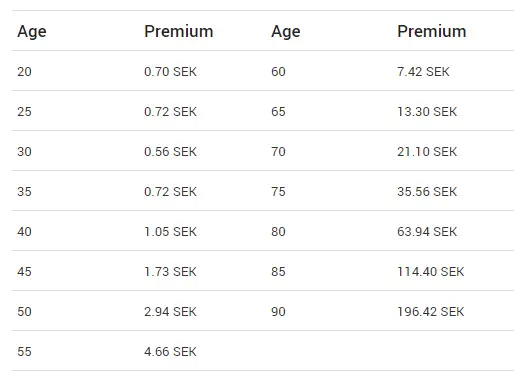

To cover the repayment protection (which is 1% in addition to the value in the event that you die), you pay a risk premium fee based on your age.

Here is an example of how much you pay each month for the risk protection at (SEK 1 million in insurance value). For those of you living overseas, 1 SEK = ~0.12 USD.

A full detailed description of the taxes, risks, returns and terms can be found on Avanza’s website (in Swedish).

Who can Open an (KF) Investment Savings Account?

Both Swedish Individuals and Swedish Companies are eligible to open up a KF account.

An individual will need to have a personnummer (Swedish social security number) and a company will need to be registered in Sweden.

The account can also be opened for minors and is popular with individuals who save for another person, such as children or grandchildren.

Most banks and financial institutions in Sweden are able to set up a KF account for you. Some of these will have their own restrictions on what can be purchased, but generally, they all include funds and shares.

For my KF account, I use AVANZA, which is the largest stockbroker in Sweden. You can see some of my returns here.

Trading Company Shares through a KF Account

Unlike an ISK, A KF account is allowed to be owned by a company and by children.

Company-owned endowment insurance is taken out without a pension commitment or pledge and can therefore be booked as a pure asset for your company.

In January each year, the trading platform will generate a value statement that can be used for your bookkeeping.

Selecting Beneficiaries

A KF account is great for those who would like to save funds for a specific beneficiary. A beneficiary is the person to whom the insurance amount is transferred upon the insured’s death. This means that you are able to decide on who would receive your account when you die (this is not applicable to company accounts).

If you don’t select anyone, then the money will be paid out in accordance with Swedish inheritance law (in Swedish)(Firstly to spouse / registered partner / cohabitant, secondly to children and thirdly heirs).

Are you saving for another person and want to earmark the money? With a endowment insurance, you can choose a beneficiary who receives the money when you pass away. It can be anyone, such as a child or a grandchild. You decide. If you do not choose a specific person, the standard appointment applies and the money is then paid out primarily to a spouse / registered partner / cohabitant, secondarily to children and thirdly to heirs.

Calculating Tax through the KF Account

Since the Kapitalförsäkring account is a standard taxed account, you do not have to pay 30% in tax on profits and dividends. Instead, you pay a certain percentage per year based on the value of the account and deposits made to the account. The tax is deducted quarterly from your account and is paid regardless of whether your holding has increased or decreased in value.

To calculate the tax, you take:

- the value of endowment insurance at the beginning of the year

- plus deposits (Deposits made after June 30 are only accepted up to 50%)

- multiplied by the government loan interest rate on November 30 the year before

- + 1.0 percent (however, there is a floor that says that this figure must not be lower than 1.25%).

That amount is then taxed at 30%, which is the return tax.

In 2020, the government loan interest rate was -0.10%.

This would give a standard income of -0.10 + 1.0 = 0.9%

Note: the standard income must not be lower than 1.25%.

The standard income in 2021 will thus be 1.25%.

1.25% x 30% = 0.375% in standard tax in 2021.

Here is an example with real numbers, taken from Avanza’s site:

- The total value of the endowment insurance on 1 January 2021 is SEK 200,000.

- You pay SEK 50,000 into the endowment insurance during the first, and SEK 50,000 during the second, half of 2021.

- Standard income in 2021 is 1.25%.

- The tax rate is 30%.

- The total account value and deposits amount to: (200,000 + 50,000 + 1⁄2 (50,000) = SEK 275,000.

The return tax will then be: 275,000 x 1.25% x 30% = SEK 1,031.

Done! The tax would be SEK 1,031 (or 0.375% of SEK 275,000).

Standard Tax Calculator

We have developed a standard tax calculator for you to work out how much tax you would pay on your endowment insurance account. Follow the prompts, and work out how much your are likely to be required to pay each year.

Foreign Withholding Tax (Dividends)

When you receive a dividend from a foreign company, you will pay withholding tax to the country from which you bought the shares (usually 15%). In the case of a normal trading account, you would pay 30%. 15% would go to the country of origin, and the other 15% would go to the Swedish Tax Agency. However, with a KF account, foreign dividends are treated differently.

With a KF account, the funds are in the insurance companies name. Therefore, it is the insurance company that applies for a deduction for the foreign withholding tax. The tax that the insurance company receives back from the Swedish Tax Agency is then deposited in your endowment insurance account.

This is one of the major reasons why the KF account is better for foreign shares – with the KF account, the capital base is determined on the group of shares, where as on the ISK account, it capital base is solely linked to your account. (Read more about about the differences between the ISK and KF account) The collective group of shares owned by the insurance company will have a much higher ceiling, than you would as an individual. Generally an individual will receive the whole tax back, but this is not guaranteed (as there is a ceiling as to how much the insurance company can deduct).

The return tax generally takes 2-3 years to receive into your personal account due to the process that the insurance company takes to receive tax from the tax agency. Here is an example for the insurance company that Avanza uses (Försäkringsaktiebolaget Avanza Pension): The tax paid during 2020, for example, we can apply for a deduction against the return tax paid in 2021. We will declare this in 2022 and wait for the final tax notice. If our settlement is approved, we can start a refund to our customers’ endowment insurance in early 2023.

When Should I Open a KF Account?

An endowment insurance account could be best suited to those that are receiving dividends from companies outside of Sweden. It is perfect for businesses or individuals that are happy to invest under the Insurance.

Final Thoughts

The KF account should be investigated further for those investing in dividend paying shares outside of Sweden.

Disclosure: I own both a ISK and KF account.