Hello Everyone! Welcome to my March update where I will discuss my returns for February 2020. What a month! Instead of P2P Platforms crashing, it was the stockmarket that went down! Let’s see what it did to my portfolio….

This month, my P2P and Crowdfunding investment profile returned an average of 1.07%, bringing my total for crowdlending to a return of 2.96% so far this year. This is money that is in the bank (not theoretical returns like shares or XIRR based on future payments). However, with the Coronavirus scaring the share market, my total value dropped 8.3%

As I am heavily in stocks (compared to P2P), I will be seeing major swings every time the market goes up or down. The highest of my crowdlending returns came from:

- Bondora (+1.44%)

- Crowdestor (+1.18%)

- Grupeer (+1.13%).

Quick Summary

The main items that happened throughout February include:

- Coronavirus starting to shake the market

- A new stock purchase!

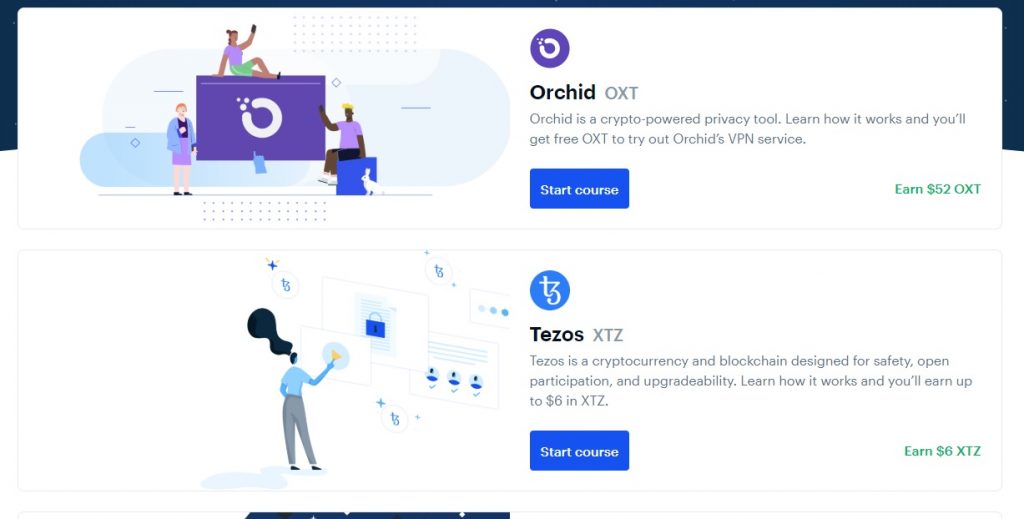

- Up to $58 worth of Cryptocurrency (OXT and XTZ)

Kuetzal and Envestio Progress

Nothing. No sign of any money or any interactions with the Estonian police.

What should I do if I lost money with either Envestio or Kuetzal?

If you placed your money with Envestio, download and fill in the crime report form and email it to us at [email protected]. You will receive an automatic reply and we will ask you to fill out the form attached and enclose any documents in your possession relating to Envestio SI OÜ, proving that you have suffered damage. You can ignore the automated e-mail if you have already complied with the requirements set out in the letter.

If you placed your money with Kuetzal, e-mail us at [email protected]. If we need any additional information, we will contact you.

Estonian Police and Boarder Guard

Progress on Internal Changes

In a recent update, I made a pledge to update sections of my blog based on the issues with Kuetzal and Envestio. I will keep this section here until these tasks are fully complete:

Showing my overall asset allocation.Reducing my crowdlending portfolio from 12 platforms to 7.- Placing stronger disclaimers within each platform review page saying how my interests lie within the article, including showing my investment graphs and overall asset allocation.

(Note: currently, there are already disclaimers on all of the pages, however, I will look to have them as more of a focus) . - Adding a section to each platform review with my own due diligence.

- Adding a page outlining some basic steps for how due diligence can be performed.

Overall Asset Allocation

As I want to provide more information to everyone who comes and visits my page, I will now show how crowdlending fits in with my overall asset allocation.

[visualizer id=”36018″]

[visualizer id=”35423″]

This month my allocations have changed only slightly, due to the reduction of my share portfolio. I now have approx 75% in shares, 11% in cash and 14% in crowdfunding.

Overall it’s a net loss this month of 8.3% of my total portfolio (due to the Coronavirus).

Progress Towards Financial Freedom

[visualizer id=”36059″]

The above graph is not related to net wealth, but instead my progress towards a set amount of total investments

This section is still very new, and was only started to be included last month. I have been on this path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages. As I am also planning to reach my goal (i.e. 100%) within 20 years, I have laid down a guiding path based on my expected returns and estimates. I have set a very conservative estimate of 20 years to become financially independent, as I am currently aggressively paying off the house, and raising a (very) young family.

Once the mortgage is paid off in 8 years, I expect to really hit the accelerator on my investments. This graph will change regularly with new information and calculations etc. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

Why are we focusing on the mortgage rather than FI? That’s another article for another day!

P2P and Crowdlending Returns

This month saw my P2P and Crowdfunding profile return on average 1.07% This was a bit of a slower month due to there being shorter days in February. Expect this to be a bit higher next month!

[visualizer id=”36017″]

Quick P2P News

Here is a quick one-liner on some interesting things that were happening around the place (in February):

- The P2P Conference 2020 in Riga looks to still be going ahead. The conference is on June 19 and 20.

- Mintos has released a mobile application version of its website.

- Grupeer has added two-factor authentication options to their accounts. and updated its statistics module.

- Monethera issues with bank accounts, suspending deposits at various times throughout the month.

- Monethera also released an autoinvestment feature, and issued a statement on transparency including information on their due diligence process.

- Agrikaab now has nothing to do with farming and water collections

Didn’t I Have More Platforms?

Yes. But after the collapse of Kuetzal and Envestio, I decided to move away from the “diversified experimental phase” and re-align my crowdlending portfolio with platforms that I am happy with. As part of the change, I have reduced my initial 12 platforms to just 7. Apart from Kuetzal and Envestio, the additional 3 platforms that I am stepping back from including Monethera, Wisefund and Crowd Estate. Read my update last month for the reasons I exited those platforms.

Crowdlending Summary

Returns this month | Returns Since Inception | Time Invested | |

Mintos | 0.69% | 27.38% | 2 years 4 months |

Bondora | 1.44% | 33.02% | 1 year 7 months |

Grupeer | 1.13% | 22.33% | 1 year 6 months |

RateSetter (AU) | 0.14% | 38.88% | 4.5 years |

Fast Invest | 0.96% | 15.58% | 1 year, 3 months |

Crowdestor | 1.18% | 14.19% | 1 year, 1 month |

Reinvest24 | 0.32% | 2.51% | 8 months |

Mintos

[visualizer id=”36027″]

[visualizer id=”36035″]

Mintos, a.k.a. “old faithful” keeps plodding along doing its thing. ItA bit less interest this month compared to a “usual February”. This could come down to the changes I made last month moving out of “Invest & Access” and set up a new automatic investment strategy. I was not happy with the limited amount of customization with Invest & Access, and I wanted to solely invest in originators that paid interest on delayed payments.

Bondora

[visualizer id=”36025″]

[visualizer id=”36032″]

Bondora is another one that I have been invested in now for nearly 3 years. The returns that I got this month were a bit less than last month, but held up compared to February of the year before.

I am a little worried about Bondora, as the last few months, I have been seeing my returns reduce. I have started to handpick each loan through the secondary market, but this is time-consuming and there are no buyback guarantees!. This way I am taking an active approach in picking quality loans (high rate of return, confirmed borrower, high credit score, payments on time, etc.). I am hoping that this will be more rewarding that automatically investing.

Grupeer

[visualizer id=”36026″]

[visualizer id=”36034″]

Grupeer is another that is coming up to its 3rd birthday in my portfolio this year. I have nothing bad to say about Grupeer, and I am extremely happy with the consistent returns over the last year and a half.

RateSetter (Australia)

[visualizer id=”36028″]

[visualizer id=”36036″]

Rate Setter in Australia is one of those that I was actually contemplating to get out of after I was getting so much higher returns through other platforms. However, following recent events, I am leaning towards staying with this platform and its 7% estimated return.

Currently the interest rate is so poor because I have most of the money sitting in the account doing nothing.

Fast Invest

[visualizer id=”35990″]

[visualizer id=”36033″]

Fast Invest is another platform that has produced extremely consistent returns since I have started investing with them. I am averaging between 1 and 1.3% return each month.

Crowdestor

[visualizer id=”36024″]

[visualizer id=”35989″]

Crowdestor is still my favourite P2P platform to invest in at the moment. There is just so much to like!! This month wasn’t anywhere near the crazy 2.60% from last month, but it has still been better than my results from the last quarter of 2019. It’s good to finally see the average return start to move upwards.

In Feburary I was able to invest in:

- WarHunt Movie – Pre-production started with Mickey Rourke as one of leading actors (16 months, 18% p.a. + 12% bonus).

Third funding stage funding the Warhunt – an American Action/Horror WWII movie directed by Mauro Borrelli. IMDB link.

Another WarHunt project, and guess what, there is another round of funding that will come online early March (with another lead actor announced). Remember Jackson Rathbone from Twilight?

The pre-production phase has now concluded and official production of the movie has started!

Since I have started investing with Crowdestor, I have earnt on average 1.09% p/month. Read more as to the platform’s offerings in my Crowdestor review.

Reinvest24

[visualizer id=”36029″]

[visualizer id=”36037″]

For now, I am happy to keep plodding along with Reinvest24. The apartment has still not sold yet :(. ,

I only have interests currently in two projects, one which is paying dividends (as can be seen in the chart), and the other which I am waiting to receive capital gains once it is sold. If the apartment is sold soon, then I will happily invest that into the new High yielding office space in Rocca Al Mare property

Agrikaab

This month I received an email from Agrikaab with some sad(ish) news.

Agrikaab has decided to withdraw from greenhouse, camel, water storage and shop projects. They have instead decided to completely refocus on microfinance services for farmers, livestock herders, and small agrifood businesses. This new direction is meant to be much more scalable and helpful to many more people.

The previous projects mentioned were not scalable or profitable enough to guarantee the amount of work and risks involved, including logistics and security issues for running physical projects in Somalia.

We have decided to make a difficult but necessary change to be able to build a profitable, scalable business that makes a big impact. Learn more about the new Agrikaab 2.0 https://t.co/k1B6llGosI pic.twitter.com/Fesy3EhhUF

— Agrikaab (@agrikaab) February 18, 2020

With the new Agrikaab Microfinance platform our goal is to support up to 1000 farmers and agrifood entrepreneurs in #Somalia in 2020. pic.twitter.com/1MtESd88Bq

— Agrikaab (@agrikaab) February 22, 2020

In terms of current projects, these will be sold with funds generated and profits received to be returned to investors. All payouts on the platform have been paused until May 31.

This is sad news for investors who wanted to make a difference by investing in physical projects in Africa. On the other hand, it can be a good sign that the company realised that the old methods weren’t working, and a new business structure was needed. Once my money is returned I will decide whether I will keep it in the platform, or move it into other investments.

Likely it will be removed and placed elsewhere.

Share Portfolio

Since my last update, I have purchased shares!!

The downturn in the market with the effects of Corona virus allowed some great buying opportunities. This month I bought:

Foot Locker (FL)

Reason for purchase: Low debt/equity, current ratio above 1.5, 21% ROE (5yr avg), current share repurchase plan, good free cash flow, 5% dividend, and a price similar to that of 2013.

I have more shares on my radar to pick up soon!

Journey to 1 free Bitcoin

My journey is still an ongoing work in progress. Playing games, making Coin.

I have decided that I am going to make 1 Bitcoin without doing any “real work”. This means possibly watching an advertisement here or there, playing games that payout cryptocurrency, use the Brave Browser instead of Google Chrome, and invest current cryptocurrency for investment returns. Here is my progress:

Crypto Idle Miner

Crytpo Idle Miner is a game that provides real cryptocurrency (HORA Tokens) as a reward. Each month the number of my HORA tokens increases, but the value decreases. I now have over 100,000 of these things! Once the developers start to incorporate the tokens more throughout the game, and potentially other games, then I will start seeing the real value. Let’s sit back and watch! You can find my Crypto Idle Miner review here.

RollerCoin

I haven’t been so active with my Rollercoin account, but the value of the satoshi (i.e. BTC) keeps accruing!

This game is addictive as it’s easy to reach the top 5% of players (if you have the time). Check out my RollerCoin review article if you are interested in learning more.

Coinbase Earn

This month I found out that there are more options to earn cryptocurrency through Coinbase Earn! I have now maxed out my allowance of $130 USD worth of free cryptocurrency gained through Coinbase Earn. If you haven’t checked it out you should do that already!

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From this, I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Brave Browser

I have been using the Brave Browser for the last couple of months. Find out here why I changed to a more secure and rewarding browser. Basically, you get paid to watch advertisements (if you choose to). It allows users to earn a bit of cryptocurrency and allows advertisers to promote materials to a more select crowd.

Money Savings

I have set up Mars Hydro growth lamp, and I have started to grow my little babies (yes, my plants) inside! Below is a picture of some of my finest produce!

I have lots and lots of tomato seeds that arrived during February, and a lot more coming in the mail. This coming month I will set up a lots of pots with plants, ready to plant them outside (or sell them!)

I have also started backing up everything onto pCloud which is an online storage that you only pay a once off lifetime fee for. If I use it more than 4 years, its cheaper than things like Dropbox, Google Drive, etc.

Here are some of my other adventures this month (they mainly relate to tomatoes):

I need to stop buying seeds!

— Matt / thewahman (@MattWAHman) February 10, 2020

I just purchased another two packets of tomato seeds. (~450 st) ?

To be fair, they were cheaper than buying half a kilo of tomatoes. ?

Just think of the potential…

Need summer to come soooon. ☀️

You know you have a problem when you have 8 different varieties of tomato seeds to grow. ?

— Matt / thewahman (@MattWAHman) February 12, 2020

70% of families lose their wealth in the 2nd Generation.

— Matt / thewahman (@MattWAHman) February 13, 2020

90% in the third.

So important to teach children how to manage funds and invest money properly.#LifeLessons

Socials and Traffic

Things seem to have remained steady this month

- My twitter followers are over 550

- My website sessions have only decreased by about 5% last month, which is expected seeing as it was a shorter month. Following on from loading up AMP, I have decided that I wasn’t happy with how the website was behaving, or the reduced traffic. This month I removed that, so hopefully we see views start to increase!

You read it all the way through to the end (or you just skipped half of it)! Regardless, thanks for checking out my update this month!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.

Nice March report Wahman. Website looking great. Very good analysis.