Hello Everyone! Welcome to my April update where I will discuss my returns for March 2020.

What a month! Another roller coaster ride following on from the P2P crashes and stock market crashes that we experienced earlier in the year. I feel as though I am bringing bad news with each monthly update. I promise this is not my intention with these updates!

Before I get into it, I first have to apologies for the lateness of this update. Due to having a full house at home for the moment, it has been hard to find any time to get some writing done! I’ll try and make this a quick one, and get the April Update out on time.

This month, my P2P and Crowdfunding investment profile returned an average of 0.75%, bringing my total for crowdlending to a return of 3.71% so far this year. This is money that is in the bank (not theoretical returns like shares or XIRR based on future payments). However, with the Coronavirus still causing havock the share market, my total value dropped 22% from last month.

As I am heavily in stocks (compared to P2P), I will be seeing major swings every time the market goes up or down. The highest of my crowdlending returns came from:

- Bondora (+1.43%)

- Grupeer (+1.20%)*

- Fast Invest (+1.09%).

see further down for more information about possible causes of concern about Grupeer.

Quick Summary

The main items that happened throughout March include:

- Coronavirus causing the sharemarket to react irrationally, so I bought shares

- First solar generation (and income) from The Sun Exchange

- Many P2P platforms are getting into trouble

Kuetzal and Envestio Progress

Nothing. No sign of any money or any interactions with the Estonian police. See past updates if you are unsure what has happened

What should I do if I lost money with either Envestio or Kuetzal?

If you placed your money with Envestio, download and fill in the crime report form and email it to us at [email protected]. You will receive an automatic reply and we will ask you to fill out the form attached and enclose any documents in your possession relating to Envestio SI OÜ, proving that you have suffered damage. You can ignore the automated e-mail if you have already complied with the requirements set out in the letter.

If you placed your money with Kuetzal, e-mail us at [email protected]. If we need any additional information, we will contact you.

Estonian Police and Boarder Guard

Progress on Internal Changes

In a recent update, I made a pledge to update sections of my blog based on the issues with Kuetzal and Envestio. I will keep this section here until these tasks are fully complete:

Showing my overall asset allocation.Reducing my crowdlending portfolio from 12 platforms to 7.- Placing stronger disclaimers within each platform review page saying how my interests lie within the article, including showing my investment graphs and overall asset allocation.

(Note: currently, there are already disclaimers on all of the pages, however, I will look to have them as more of a focus) . - Adding a section to each platform review with my own due diligence.

- Adding a page outlining some basic steps for how due diligence can be performed.

Overall Asset Allocation

As I want to provide more information to everyone who comes and visits my page, I will now show how crowdlending fits in with my overall asset allocation.

[visualizer id=”36018″]

[visualizer id=”35423″]

This month my allocations have changed a fair bit, but this is due to the negative returns of my share portfolio. I now have approx 70% in shares, 12% in cash and 18% in crowdfunding.

Overall it’s a net loss this month of 22% of my total portfolio (due to that pesky Coronavirus).

Progress Towards Financial Freedom

[visualizer id=”36059″]

The above graph is not related to net wealth, but instead my progress towards a set amount of total investments

This section is still very new and was only included near the start of the year. I have been on the financial freedom path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages. As I am also planning to reach my goal (i.e. 100%) within 20 years, I have laid down a guiding path based on my expected returns and estimates. I have set a very conservative estimate of 20 years to become financially independent, as I am currently aggressively paying off the house, and raising a (very) young family.

Once the mortgage is paid off in 8 years, I expect to really hit the accelerator on my investments. This graph will change regularly with new information and calculations etc. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

Why are we focusing on the mortgage rather than FI? That’s another article for another day!

P2P and Crowdlending

P2P Platforms getting into Trouble

Before I get into details of my returns, I will fill everyone in on some news about a couple of the P2P platforms:

Monethera

Monethera has sent out a newsletter to everyone invested saying that “Unfortunately, we are forced to inform you about the temporary complete cessation of the work of our platform until the end of the state of emergency all over the EU due to the pandemic of COVID-19. We understand that now the most crucial question for every investor is, “What happens to my money, and how can I return it?” At the moment, we can’t offer you any final solution.”

Since the newsletter (23rd March), there has been no communication from Monethera, with the suspicion that they may not return. As per my earlier updates, I decided to get out of Monethera as I deemed it too risky, and I was unable to do any proper due diligence on the platform. Hopefully many of you are in a similar boat

Sorry to tweet this, but we are forced to suspend all activities due to the coronavirus crisis. We want to explain all the details, so there is a newsletter on your emails. We don’t tell you goodbye and hope to see you after the pandemic. pic.twitter.com/HnxFbygo1e

— Monethera (@monethera) March 27, 2020

Grupeer

There is a lot of chat about Grupeer at the moment, which has prompted the platform to release multiple statements about the state of affairs.

Many investors are coming off the Envestio and Kuetzal issues and are extremely involved in finding out everything about a company if they suspect any wrong-doings. Well as it turns out it has been alleged that there have been fake loan originators represented on the platform. This has now gathered the attention of the full P2P community, as many investors (including myself) thought that Grupper was one of the safer options. However, it has since been found out that only some of the loan originators were fake, with connections to other loan originators proving legitimancy.

The situation has reached the stage where many loan originators are withholding payments to Grupeer until the situation has been sorted out. This has caused Grupeer to threaten legal action against these platforms, but all the time sidestepping the question about the fake originators. As a result many investors are looking towards legal action.

All payments from the platform have been suspended to investors.

My Returns in Crowdlending this month

This month saw my P2P and Crowdfunding profile return on average 0.75% This was much lower than the previous month, but sadly looks much higher than what I am expecting next month.

[visualizer id=”36017″]

Quick P2P News

Here is a quick one-liner on some interesting things that were happening around the place (in February):

- The P2P Conference 2020 in Riga looks to still be going ahead, however, it will be interesting if Grupper shows up. The conference is on June 19 and 20.

- Wisefund is cleaning up its ship, removing affiliates that don’t cast them in a an extremely good light.

- Additionally, it has been noted that Wisdfund may have suspended accounts that haven’t made any deposits or withdrawals.

- Bondora is running a competition where you can win a BMW 330i.

- Monethera is likely gone, similar to Envestio and Kuetzal.

- Agrikaab now has nothing to do

with farming and water collectionswith anything. The company announced bankruptcy due to not receiving enough investment into the platform.

Didn’t I Have More Platforms?

Yes. But after the collapse of Kuetzal and Envestio, I decided to move away from the “diversified experimental phase” and re-align my crowdlending portfolio with platforms that I am happy with. As part of the change, I have reduced my initial 12 platforms to just 7. Apart from Kuetzal and Envestio, the additional 3 platforms that I stopped investing in, and withdrew my money was from were Monethera, Wisefund, and Crowd Estate. Read my earlier update for the reasons I exited those platforms. I seem to have been quite lucky in getting out of Monethera in time.

Crowdlending Summary

Returns this month | Returns Since Inception | Time Invested | |

0.59% | 27.98% | 2 years 5 months | |

1.43% | 34.47% | 1 year 8 months | |

Grupeer | 1.29% | 23.53% | 1 year 7 months |

RateSetter (AU) | 0.57% | 39.41% | 4.75 years |

1.09% | 16.65% | 1 year, 4 months | |

0.53% | 14.71% | 1 year, 2 month | |

Reinvest24 | 0.32% | 2.84% | 9 months |

Mintos

Mintos, a.k.a. “old faithful” keeps plodding along doing its thing. Less interest this month for obvious reasons. Mintos survived the market crash of 2008, so I am pretty happy with my money in there at the moment.

Bondora

Bondora is another one that I have been invested in now for nearly 3 years. The returns that I got this month were consistant with my other returns for this year.

I have started to handpick each loan through the secondary market, but this is time-consuming and there are no buyback guarantees!. This way I am taking an active approach in picking quality loans (high rate of return, confirmed borrower, high credit score, payments on time, etc.). I am hoping that this will be more rewarding that automatically investing.

Grupeer

Grupeer is another that is coming up to its 3rd birthday in my portfolio this year, which is why its sad to hear the news that it may have issues (see above).

RateSetter (Australia)

Rate Setter in Australia was the first P2P platform I invested in. I have recently put my money back to work, however its earning much less than the other European platforms.

Fast Invest

Fast Invest keeps producing consistent returns, with my portfolio averaging between 1 and 1.3% return each month. There are many investors that are spooked by the other platforms shutting down, and have also withdrawn their money from Fast Invest. This may be because their loan originators remain a mystery, and can’t be verified.

Due to all of the withdrawals, Fast Invest has bumped up their returns to a max of 18%.

Crowdestor

Crowdestor is still my favorite P2P platform to invest in at the moment. There is just so much to like!! This month did not produce any amazing returns, but it has still been better than my results from this time last year. It’s good to finally see the average return start to move upwards. I made no new investments this month.

I have also been extremely happy with the high level of communication between Janis Timma (the CEO of Crowdestor) and the investors. We get a lot of information about all of the projects and the current scenario at Crowdestor. The investors were also involved in making a decision on the way forward with obtaining payments from the borrowers.

Since I have started investing with Crowdestor, I have earnt on average 1.09% p/month. Read more as to the platform’s offerings in my Crowdestor review.

Reinvest24

For now, I am happy to keep plodding along with Reinvest24. The apartment has still not sold yet :(. If the apartment is sold soon, then I will happily invest into the newer properties on offer.

Agrikaab

Following on from the withdrawal from greenhouses, camels, and water storages last month, this month the investors in Agrikaab received the terrible news that the platform has shut down. This means that any money used on the platform, or held on the platform is likely gone. Here is the status of each of the projects:

- Camel farms: We are moving the animals to the countryside under the care of nomads to save costs until we can find buyers.

- Greenhouses: We will transfer to local investors or the employees who work there to continue earning their livelihoods. In Mogadishu, we are also talking to a local university to use one of the greenhouses for training.

- Farm ponds: We will transfer the farm pond in Galkacyo to the local employees there to benefit the community. For the incomplete Farm Pond Mudug, we are looking for a buyer to take over the materials and if we find them, we will refund the proceeds.

- Store: We still have not received the materials, we will sell them once they arrive if we find buyers and refund the proceeds.

- Microfinance, this project will continue under a separate company with the support of local investors. Users who invested in this project will get their money back in the next 6 months but will not take any new investments.

The platform was a novel idea of investing in a country that was seeking investment in basic things like food, and water. I am extremely disappointed at the collapse of this platform, however, if I helped at least one person with my investments (i.e. needing food, a job, or water), then I think it was worth it.

The below message can be found on their website –

Dear users,

Regrettably, Agrikaab is shutting down due to the impact of the economic crisis. We have exhausted all options to keep this company alive as we have reached a point where we are unable to pay staff salaries, buy feed and fertilizers for animals and farms.

Two months ago we announced that we want to focus on the new microfinance service and wind down existing projects. Unfortunatley, it has proven difficult to find investors or buyers for the projects as there is a very low interest in new investments due to the current economic crisis. Somalia’s economy is heavily dependent on remittances from Europe/US, foreign aid and trade which are all badly impacted by the coronavirus crisis. In addition, external funding we expected to receive from our global users has dried up.

We have put every bit of our energy into this company, but we weren’t able to turn the corner on creating a profitable business due to the difficult working environments and unforeseen situations. Although as a business we didn’t succeed we are proud of the impact and contribution we have made to the community.

We have sent an email with more details to users who have participated in our projects. Please direct any questions to [email protected] (only this email will work). We will answer at the earliest convenience.

Best regards

Agrikaab Team

The Sun Exchange

Here I would love to introduce you to my newest platform that I have been using since November. The platform is called The Sun Exchange (if you use the affiliate link, then you will get a bonus solar cell on your first purchase!). The Sun Exchange is the world’s peer-to-peer solar cell micro-leasing platform.

The platform works by people purchasing solar cells, which are then leased to companies (such as schools, nursing homes, shopping malls etc), who will pay for the electricity that is generated by your cells. The companies generally can’t afford the outright cost of the systems themselves, which is where the crowdfunding aspect comes in. The solar system will be split up into many smaller cells, that are sold at a reasonable price. Solar cells can be bought in either BTC or the local currency. I will write a more detailed article about the platform in the future, so look out for that!

This month my cells generated a total of 39 kWh, which is enough to fully charge an Nissan Leaf Electric Car!

In a new @TEDTalks @TEDxJoburg talk, @TheSunExchange CEO, Abe, discusses how individuals from across the globe can #solarpower the world and speed up the clean energy revolution! Spread the word, by liking & sharing this revolutionary message! Watch here: https://t.co/R50RV92t22

— The Sun Exchange (@TheSunExchange) March 20, 2020

Share Portfolio

Since my last update, I have purchased even more shares!!

The downturn in the market with the effects of Corona virus allowed some great buying opportunities. This month I bought:

- Delta Airlines (DAL)

- Prudence Financial (PRU)

- Wells Fargo (WFC)

- more Foot Locker (FL)

Journey to 1 free Bitcoin

My journey is still an ongoing work in progress. Playing games, making Coin.

I have decided that I am going to make 1 Bitcoin without doing any “real work”. This means possibly watching an advertisement here or there, playing games that payout cryptocurrency, use the Brave Browser instead of Google Chrome, and invest current cryptocurrency for investment returns. Here is my progress:

Crypto Idle Miner

Crytpo Idle Miner is a game that provides real cryptocurrency (HORA Tokens) as a reward. Each month the number of my HORA tokens increases, but the value decreases. I now have close to 150,000 of these things! Once the developers start to incorporate the tokens more throughout the game, and potentially other games, then I will start seeing the real value. Let’s sit back and watch! You can find my Crypto Idle Miner review here.

RollerCoin

I haven’t been so active with my Rollercoin account, but the value of the satoshi (i.e. BTC) keeps accruing! This game is addictive as it’s easy to reach the top 5% of players (if you have the time). Check out my RollerCoin review article if you are interested in learning more. Each new player using the specific link receives 200 satoshi for free!

New updates in the game mean that you can now earn ETH and DOGE as well as BTC!

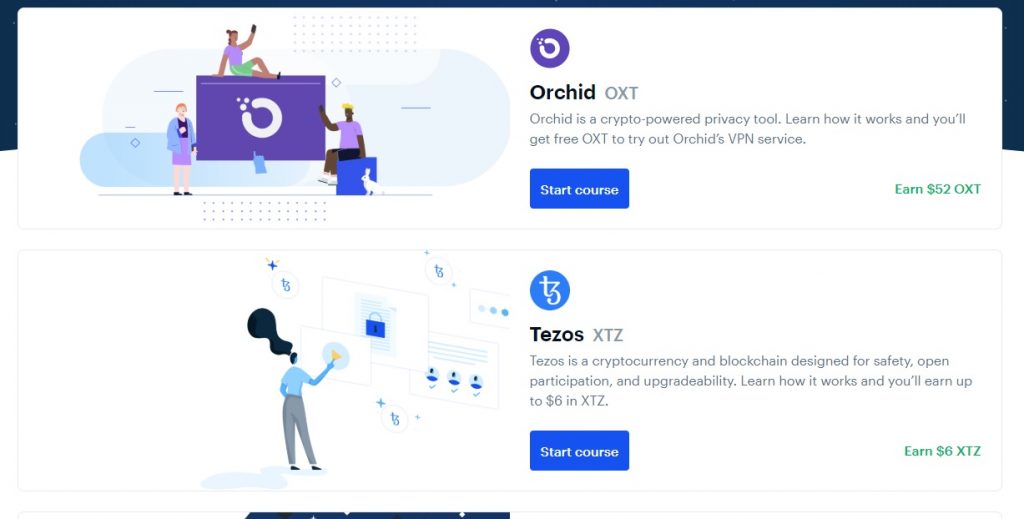

Coinbase Earn

Last month I found out that there are more options to earn cryptocurrency through Coinbase Earn! I have now maxed out my allowance of $130 USD worth of free cryptocurrency. If you haven’t checked it out you should do that already! You can earn some coins simply by watching videos.

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From this, I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Brave Browser

I have been using the Brave Browser for the last couple of months. Find out here why I changed to a more secure and rewarding browser. Basically, you get paid to watch advertisements (if you choose to). It allows users to earn a bit of cryptocurrency and allows advertisers to promote materials to a more select crowd.

Money Savings

My Mars Hydro growth lamp settup is working extremely efficiently, and I am getting ready to transplant some plants outdoors. I’ll include some more photos next update (in about 10 days).

I am also loving the ease of use with pCloud online storage. I moved all of my photos from my phone into the cloud now, and can access them on any device. I include this as a money saving, as it was only a one time purchase for a lifetime supply of 2TB in the cloud. If I use it more than 4 years, its cheaper than things like Dropbox, Google Drive, etc.

Here are some of my other adventures this month (they mainly relate to tomatoes):

With #shares at the moment, I am like a kid in the candy store for the first time.

— Matt / thewahman (@MattWAHman) March 23, 2020

I want a bit of this, some of that, a little of those, maybe a few of these, and I have to try one of them. ??

I bought $WFC a few days ago at a really good price.

— Matt / thewahman (@MattWAHman) March 17, 2020

Yesterday the CEO directly purchased $5 million worth of the stock.

I am extremely happy with my purchase!!!!#ValueInvesting

Seeds were 50% off at our local shop yesterday. #savings

— Matt / thewahman (@MattWAHman) March 23, 2020

Spent the weekend making the #vegetablegarden 3x as big.

Who needs shops when you can live cheaply off the land!

Socials and Traffic

Things seem to have remained steady this month

- My twitter followers are over 570

- My website sessions only slightly increased, which would be expected, seeing as I haven’t been releasing so many articles!

You read it all the way through to the end (or you just skipped half of it)! Regardless, thanks for checking out my update this month!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.