Hello Everyone! Welcome to my August update where I will discuss my returns for July 2020.

This month, my P2P and Crowdlending investment profile returned an average of 1.39%, bringing my total for crowdlending to a return of 6.16% so far this year. This is money that is in the bank (not theoretical returns like shares or XIRR based on future payments). Additionally, my total value increased by 3% from last month. The highest of my crowdlending returns came from:

- Crowdestor (+2.27%)

- Bondora (+1.08%)

- Mintos (+0.66%).

Quick Summary

The main items that happened throughout July include:

- Talk of new lawsuits against more P2P Platforms

- New article: 10 Reasons Why You Should Accept Guest Posts

- Now accepting Guest Posts

Progress on Internal Changes

In a past update, I made a pledge to update sections of my blog. I will keep this section here until these tasks are fully complete. The remaining tasks are:

- (Priority #1) Adding a page outlining some basic steps for how due diligence can be performed. (started writing this)

- (Priority #2) Adding a section to each platform review with my own due diligence.

- (Priority #3) Placing stronger disclaimers within each platform review page saying how my interests lie within the article.

(Note: currently, there are already disclaimers on all of the pages, however, I will look to have them as more of a focus) .

Overall Asset Allocation

Here I provide a “big picture” showing how crowdlending fits in with my overall asset allocation.

[visualizer id=”36018″ lazy=”no” class=””]

[visualizer id=”35423″ lazy=”no” class=””]

The majority of my funds in shares (~75%), ~10% sits in cash, and ~15% sits in crowdlending . Within crowdlending, I have more than half of my investments in Crowdestor.

Progress Towards Financial Freedom

[visualizer id=”36059″ lazy=”no” class=””]

The above graph is not related to net wealth, but instead my progress towards a set amount of total investments

Overall it’s a net gain again this month of 3.1% of my total investment portfolio . Hopefully, I can reach 15% by the end of the year!

I have been on the financial freedom path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages (with the goal being 100%). I have an initial conservative plan of 20 years and have provided a guide as to my current progress. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

P2P and Crowdlending

My Returns in Crowdlending this month

This month saw my P2P and Crowdfunding profile return on average 1.39%, which is mainly due to a few payments from Crowdestor. IF it wasn’t for the Crowdestor payments coming in, this month would have the same return as last month

This month saw 0 payouts from 3 platforms, if I include the measily 0.07% coming in from Fast Invest

[visualizer id=”36017″ lazy=”no” class=””]

Quick P2P News

Here is a quick one-liner on some interesting things that were happening around in the P2P space in June:

- There is now a action against:

- Fast Invest – a group who aim to ensure withdrawals are processed and agreements are honored

- Wisefund – possible legal action here.

- RateSetter UK has been bought by Metro Bank

- RateSetter Australia is looking at an Initial Public Offering (IPO)

- Multiple articles are surfacing about the profitability of Bondora

- Claims to be apart of the bankruptcy proceedings for for Kuetzal and Envestio were recently due.

- Crowdestor was on the receiving end of a DDoS attack, forcing them temporarily go offline and migrate their server to Amazon Web Services.

- Grupeer released their 20 July progress report which identifies issues around corporate governance, loan quality control, AML procedures and licensing.

- Mintos released their Annual Report for 2019

- Reinvest24 are running a 2% cashback bonus when you invest at least 500€. Valid until 10/8/2020

Crowdlending Summary

Returns this month | Returns Since Inception | Time Invested | |

0.66% | 31.24% | 2.75 years | |

1.08% | 39.09% | >2 years | |

Grupeer | – | 23.60% | 2 years |

RateSetter (AU) | 0.62% | 42.01% | >5 years |

0.07% | 18.58% | 1.5 years | |

2.27% | 17.46% | 1.5 years | |

– | 10.30% | >1 year |

Before I get into more details. I want to discuss Wisefund quickly. I invested in Wisefund for a period of 2 months from December 2019. I initially liked the platform and hence, wrote a review about my experience. From February 2020 I decided to get out of Wisefund (and Monethera) as I did not feel safe investing my money there (after problems with Kuetzal surfaced). Hopefully you did not invest in Wisefund, or if you did, you got out early this year. I keep my fingers crossed that Wisefund does not go down the same path as Envestio and Kuetzal, however, legal action doesn’t usually come about without suspected wrongdoings. More information can be found about the legal action here.

Mintos

[visualizer id=”36035″ lazy=”no” class=””]

[visualizer id=”36027″ lazy=”no” class=””]

This month my returns in Mintos fell slightly. To be honest I haven’t been looking into the platform with too much detail as my investments are automatically invested each month. I have not tried to withdraw any money.

This month Mintos also released its Annual Report, which showed the platform loosing close to 1 million Euros last year. Additionally Mintos updated their terms and conditions this month to include:

- 10.4 Mintos will charge investors to cover legal costs for actions against bad LOs.

- 10.5 Mintos will first take their commissions and then distribute funds to investors.

Bondora

[visualizer id=”36032″ lazy=”no” class=””]

[visualizer id=”36025″ lazy=”no” class=””]

Bondora is another platform that has been generating the same returns for a while. The reduced amounts of return in June and July have mainly been because I have not been reinvesting in the platform at the moment. With the COVID crisis, I am less inclined to pile into personal loans just now. Additionally this month, a few reports have been surfacing around Facebook of people who have investigated the profitability of investing through Bondora. One in particular (here) shows that the whole of Bondora’s portfolio (after write-downs) is actually in a loss. The only profitable market on the platform has been in Estonia.

I am careful in handpicking loans through the secondary market (high rate of return, confirmed borrower, high credit score, payments on time, etc.). Now I will add from Estonia to the list. Additionally this month I will revisit my risk/return for investing through Bondora.

Grupeer

[visualizer id=”36034″ lazy=”no” class=””]

[visualizer id=”36026″ lazy=”no” class=””]

This was another month of 0% interest from Grupeer. There is still no sight of any withdrawals as Grupeer.

Grupeer released their 20 July progress report which identifies issues around corporate governance, loan quality control, AML procedures and licensing.

The Grupeer Armada legal action group continues its journey. More information can be found here.

RateSetter (Australia)

[visualizer id=”36036″ lazy=”no” class=””]

[visualizer id=”36028″ lazy=”no” class=””]

Rate Setter in Australia was the first P2P platform I invested in. I have recently put my money back to work, which can be seen in the higher returns over the last few months. The downside is that it’s earning much less than the other European platforms. However, the upside is higher regulation and trust within the platform. Additionally Rate Setter in Australia has announced their IPO!

Fast Invest

[visualizer id=”36033″ lazy=”no” class=””]

[visualizer id=”35990″ lazy=”no” class=””]

Fast Invest… A lot has happened in the last 3 months. From new website designs, “payment holidays”, reduced ability to withdraw funds, and also using lawyers to attack bloggers. It’s all happening. I, as well as many other investors, have been waiting for a withdrawal of the funds (said to be on my account) for the last few months. Until those funds are released, I will not invest any more in, or on the platform.

Additionally there have been concerns from others, which has created a group who aim to ensure withdrawals are processed and agreements are honored.

Crowdestor

[visualizer id=”35989″ lazy=”no” class=””]

[visualizer id=”36024″ lazy=”no” class=””]

Crowdestor is still my favorite P2P platform to invest in at the moment. Janis and the team have provided so much to like! It’s a very clear comparison to other P2P platforms. This month saw the platform announce the next stage of their growth development – the CROWDESTOR SME automation, which will introduce new products into the Crowdestor portfolio. These include:

- an automated scoring model that uses 500+ databases to provide score and probability of default in few minutes

- a new industry standard of the borrowers assessment report

- a detailed description of the scoring methodology

- a debt collection policy

- project status updates in the investors cabinet

Additionally this month, Crowdestor was on the receiving end of a DDoS attack, which crippled their website. It was said that close to 60 million visits to the website were happening every hour. This forced their website to be down for multiple days, and saw them move their services to AWS (Amazon Web Services), which is considered to provide the highest protection. It was estimated that the attack cost upwards of 100,000 €. The Crowdestor team have said that they will provide a report about the attack.

I have also been extremely happy with the high level of communication between Janis Timma (the CEO of Crowdestor) and the investors. We get a lot of information about all of the projects and the current scenario at Crowdestor. The investors were also involved in making a decision on the way forward with obtaining payments from the borrowers.

In July I was able to invest in:

- Government medical supply contract (2 months, 36% p.a.).

This funding was for a Romanian government procurement of ventilators – for the development of a European reserve of medical countermeasures, intensive care equipment, and personal protective equipment.

Since I have started investing with Crowdestor, I have earnt on average close to 1% p/month. Read more as to the platform’s offerings in my Crowdestor review.

Reinvest24

[visualizer id=”36037″ lazy=”no” class=””]

[visualizer id=”36029″ lazy=”no” class=””]

No news to report with Reinvest24 this month.

The Sun Exchange

A few months ago, I purchased some solar cells from The Sun Exchange (if you use the affiliate link, then you will get 1 free solar cell on your first purchase!). The Sun Exchange is the world’s first peer-to-peer solar cell micro-leasing platform.

[visualizer id=”36117″ lazy=”no” class=””]

The platform works by people purchasing solar cells, which are then leased to companies (such as schools, nursing homes, shopping malls etc), who will pay for the electricity that is generated by your cells. The companies generally can’t afford the outright cost of the systems themselves, which is where the crowdfunding aspect comes in. The solar system will be split up into many smaller cells, that are sold at a reasonable price. Solar cells can be bought in either BTC or the local currency (ZAR). I will write a more detailed article about the platform in the future, so look out for that!

In June my cells were able to generate 44 kWh of energy. This month I didn’t purchase any new cells, as the only project available was The Boland Wine Cellar (which I already invested in over the last 2 months).

There are a few new projects coming online soon, including a 189.8kW system for Rondebosch Boys’ High School, and a 53.6kW system for Norman Henshilwood High School. Watch out for these!

My total energy generated is currently at 199 kWh, which would allow me to drive 740 American miles in a Tesla Model 3

For some comparison, with 1 kWh you can, toast 160 slices of bread. So in that regard, I have generated enough power to toast 31.840 slices of bread.

Share Portfolio

A few months ago I set up an automatic share purchase system, where I automatically pick up 4 index funds, and one investment fund each month. This is a real set and forget strategy that works well. As they say, its not about timing the market, but instead, time in the market.

I have set set up my Capital Insurance account and now I am waiting to get into some international hares. Currently, I am happy to hold cash and watch as everything unfolds.

Journey to 1 free Bitcoin

My journey is still an ongoing work in progress. Playing games, making Coin.

I have decided that I am going to make 1 Bitcoin without doing any “real work”. This means possibly watching an advertisement here or there, playing games that payout cryptocurrency, use the Brave Browser instead of Google Chrome, and invest current cryptocurrency for investment returns. Here is my progress:

Crypto Idle Miner

Crytpo Idle Miner is a game that provides real cryptocurrency (HORA Tokens) as a reward. Each month the number of my HORA tokens increases, but the value decreases. I now have over 150,000 of these things! Once the developers start to incorporate the tokens more throughout the game, and potentially other games, then I will start seeing the real value. Let’s sit back and watch! You can find my Crypto Idle Miner review here.

RollerCoin

I haven’t been so active with my Rollercoin account, but the value of the satoshi (i.e. BTC) keeps accruing! This game is addictive as it’s easy to reach the top 5% of players (if you have the time). Check out my RollerCoin review article if you are interested in learning more. Each new player using the specific link receives 200 satoshi for free!

New updates in the game mean that you can now earn ETH and DOGE as well as BTC!

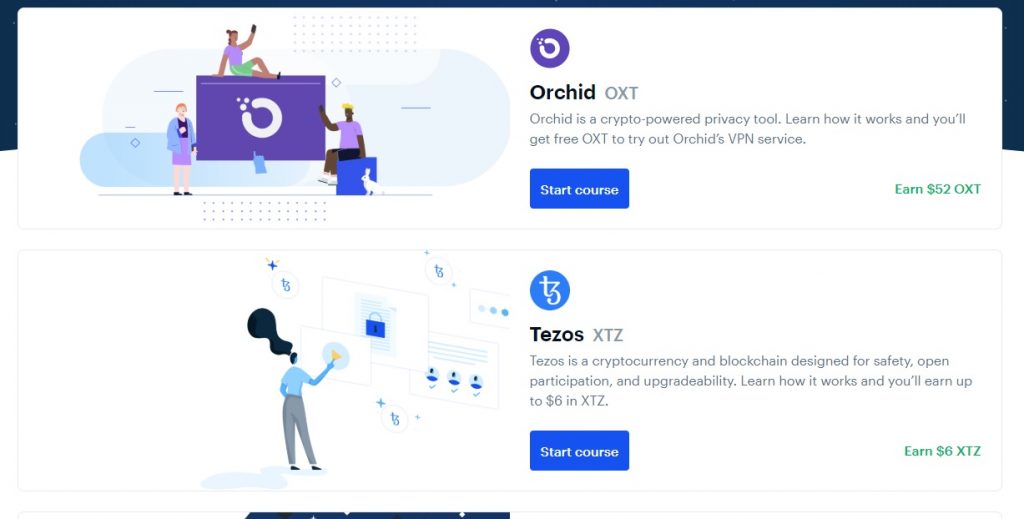

Coinbase Earn

There are now more options to earn cryptocurrency through Coinbase Earn! I have now maxed out my allowance of $130 USD worth of free cryptocurrency. If you haven’t checked it out you should do that already! You can earn some coins simply by watching videos.

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From this, I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Brave Browser

I have been using the Brave Browser for the last couple of months. Find out here why I changed to a more secure and rewarding browser. Basically, you get paid to watch advertisements (if you choose to). It allows users to earn a bit of cryptocurrency and allows advertisers to promote materials to a more select crowd.

Money Savings

This month has been a holiday for the wife and myself. We have been enjoying time with the chickens, and picking fresh vegetables from our garden!

We also picked up a great tent, for under $4 USD! This was a great pickup from our local second hand shop. We even got to test it a few times:

With so much work, and not a lot of time to be on Twitter, but here are some of my recent tweets:

#secondhand shopping is fun.

— Matt | thewahman (@MattWAHman) July 6, 2020

Picked up a 4 person tent for under $4USD ⛺️

Many people passed on it as you could not open it in-store, and the store couldn’t confirm the contents.

Worth the risk. Perfect tent. Went camping on the weekend. ?️#savings

Currently saved over 5 hours using the #BraveBrowser

— Matt | thewahman (@MattWAHman) July 13, 2020

I wonder what I’m going to do with all of this extra time?

Check it out if your interested: https://t.co/GP9WR9plaf pic.twitter.com/HyLPbHKSIK

Socials and Traffic

Things seem to have remained steady this month

- My twitter followers fell a few this last month. Hovering around 575

- My website sessions increased 30%. With a few new articles each month I’m hoping that this really starts to take off

You read it all the way through to the end (or you just skipped half of it)! Regardless, thanks for checking out my update this month!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.

I found some incomplete sentences for which I would have liked to read the rest. Search for „This month I topped up my purchase of cells in“, „This month saw the“

Hi Mr Cheese!

Apologies for those inconsistencies. Looks like there was an issue with autosaves (and my lack of reading over the update). Good pickups!

Matt

Great update Matt, keep it on man 😉