Hello Everyone! Welcome to my September update where I will discuss my returns for August 2020.

This month, my P2P and Crowdlending investment profile returned an average of 0.68%, bringing my total for crowdlending to a return of 6.84% so far this year. This is money that is in the bank (not theoretical returns like shares or XIRR based on future payments). Additionally, my total value increased by 18% from last month. The highest of my crowdlending returns came from:

- Fast Invest (+1.80%)

- Bondora (+0.95%)

- Crowdestor (+0.89%).

Quick Summary

The main items that happened throughout July include:

- Fast Invest processed my withdrawal and processed the delayed payout interest

- New articles:

- New passive income stream through litigation platform – AxiaFunder

Overall Asset Allocation

Here I provide a “big picture” showing how crowdlending fits in with my overall asset allocation.

[visualizer id=”36018″ lazy=”no” class=””]

[visualizer id=”35423″ lazy=”no” class=””]

This month I was able to get my hands of a bit more free cash which now brings that to over 17% of my portfolio. Crowdlending has dropped form 15% of my portfolio to just over 10%. Within crowdlending, I have more than half of my investments in Crowdestor. This month I have started to include an “other seciton” which comprises things such as unlisted shares, litigation funding platforms, and the sun exchange.

Progress Towards Financial Freedom

[visualizer id=”36059″ lazy=”no” class=””]

The above graph is not related to net wealth, but instead my progress towards a set amount of total investments

I am back over my guideline! This month I had a net gain of ~18%, which was a result of favorable share market returns, as well as a few small windfalls. Now I just have to stay above the line!

I have been on the financial freedom path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages (with the goal being 100%). I have an initial conservative plan of 20 years and have provided a guide as to my current progress. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

P2P and Crowdlending

My Returns in Crowdlending this month

This month saw my P2P and Crowdfunding profile return on average 0.68%, which is actually fairly poor, but higher than my average returns from March, April and May.

[visualizer id=”36017″ lazy=”no” class=””]

Quick P2P News

Here is a quick one-liner on some interesting things that were happening around in the P2P space in August:

- Fast Invest has started paying out the withdrawals, and adding delayed withdrawal interest to accounts.

- RateSetter Australia has changed their name to Plenti

- Reinvest24 are going to soon reduce their project entry fee from 2% to 1%

- Mintos applied for the Investment Firm License as well as an Electronic Money Institution Licence earlier in the year. Soon they will implement changes and policies from this.

- Crowdestor will purchase a payment platform to meet upcoming Crowdlending Regulations.

- Grupeer released a new update, allocating all late loans to a new company – Recollecta (A company created by Grupeer, 5 days before the announcement).

Crowdlending Summary

Returns this month | Returns Since Inception | Time Invested | |

0.83% | 32.07% | >2.75 years | |

0.95% | 40.05% | >2 years | |

Grupeer | – | 23.60% | 2 years |

RateSetter (AU) (now Plenti) | 0.54% | 42.55% | >5 years |

1.80%* | 20.38% | 1.75 years | |

0.89% | 18.35% | 1.5 years | |

– | 10.30% | >1 year |

Mintos

[visualizer id=”36035″ lazy=”no” class=””]

[visualizer id=”36027″ lazy=”no” class=””]

My Mintos returns rose slightly this month. I still haven’t paid too much attention to this platform as its mostly on autopilot. This month I did reduce my holding in Mintos, as I am becoming shy about the current situation with COVID and personal loans, I don’t like the fact that Mintos lost money last year, and I don’t like the changes to the terms and conditions (discussed last month)

Additionally this month, the Mintos team answered a lot of questions about various matters including new loan originators, withdrawals, due diligence, legal expenses to investors and the future of Mintos. The information can be found here.

Mintos applied for the Investment Firm License as well as an Electronic Money Institution Licence earlier in the year. Now they have decided to share some of the ways that these will affect investors (summary below, but more can be found here):

- Mintos will introduce new policies and investment frameworks according to regulations

- Investors will have two separate accounts for investments and payments

- There will be suitability and appropriateness assessments for investors

- Loans on Mintos will be transformed into financial instruments linked to loans

- Underlying risks of investing in loans will still remain present, as always.

Bondora

[visualizer id=”36032″ lazy=”no” class=””]

[visualizer id=”36025″ lazy=”no” class=””]

This month I also reduced my holding in Bondora, due to similar reasons with Mintos. Unlike Mintos, Bondorra don’t have any buyback guarantees on the loans. That means that if a loan was not paid back, it is unlikely that you will receive the full amount of your investment back. Obviously with a health crisis on our hands, it is very risky to be providing loans to individuals.

When I do pick loans through Bondora, I am careful in handpicking loans through the secondary market (high rate of return, confirmed borrower, high credit score, payments on time, etc.). Now I will add from Estonia to the list. Additionally this month I will revisit my risk/return for investing through Bondora.

Grupeer

[visualizer id=”36034″ lazy=”no” class=””]

[visualizer id=”36026″ lazy=”no” class=””]

This was another month of 0% interest from Grupeer.

This month Grupeer did release a Status Update about the next steps in regarding payments to investors. Basically, Grupeer transferred the right of claims to a new company called Recollecta. The catch – Recollecta was created 5 days before the announcement, by the Grupeer company.

The Grupeer Armada legal action group continues its journey. More information can be found here.

RateSetter (Australia)

[visualizer id=”36036″ lazy=”no” class=””]

[visualizer id=”36028″ lazy=”no” class=””]

Rate Setter has now transfered their name to Plenti. The returns through RateSetter are pretty low, however the Australian platform is much more secure and resulted than its European counterparts.

Fast Invest

[visualizer id=”36033″ lazy=”no” class=””]

[visualizer id=”35990″ lazy=”no” class=””]

Fast Invest has now paid out on the withdrawal request that I had sitting there for the last 3 months. Additionally, they paid the withdrawal interest (interest that was accrued for not transferring my money back to me) into my account this month. Thats the 1.80% outlier. There were no payments from loans as Fast Invest are currently still enforcing their “payment holidays”.

There is no new news on the lawyer attacking the blogger (can find out more in my last update). The concerned group (who aim to ensure withdrawals are processed and agreements are honored) still seems to be active.

Crowdestor

[visualizer id=”35989″ lazy=”no” class=””]

[visualizer id=”36024″ lazy=”no” class=””]

Crowdestor is still my favorite P2P platform to invest in at the moment. Janis and the team have provided so much to like! It’s a very clear comparison to other P2P platforms.

Last month saw the platform announce the next stage of their growth development – the CROWDESTOR SME automation, which will introduce a new scoring process for new projects on the platform. Some of these new projects have already filtered through and been successfully funded. Its great to now be able to see how each project is rated, including and appropriate risk. See more in my Crowdestor Review!

There was a special project this month, which was for Crowdestor Pay. This project is to integrate a payment service provider with the Crowdestor platform. One of the main reasons that Crowdestor want to integrate with a payment provider, is to be able to segregate investors funds with the funds on the platform. This is said to be in the draft Regulation on European Crowdfunding Service Providers, which may come in at some stage. All in all, thats great news!

Reinvest24

[visualizer id=”36037″ lazy=”no” class=””]

[visualizer id=”36029″ lazy=”no” class=””]

No news to report with Reinvest24 this month.

The Sun Exchange

A few months ago, I purchased some solar cells from The Sun Exchange (if you use the affiliate link, then you will get 1 free solar cell on your first purchase!). The Sun Exchange is the world’s first peer-to-peer solar cell micro-leasing platform.

[visualizer id=”36117″ lazy=”no” class=””]

The platform works by people purchasing solar cells, which are then leased to companies (such as schools, nursing homes, shopping malls etc), who will pay for the electricity that is generated by your cells. The companies generally can’t afford the outright cost of the systems themselves, which is where the crowdfunding aspect comes in. The solar system will be split up into many smaller cells, that are sold at a reasonable price. Solar cells can be bought in either BTC or the local currency (ZAR). I will write a more detailed article about the platform in the future, so look out for that!

This month my cells were able to generate 52 kWh of energy., and I was able to purchase more solar cells in:

- Westville Girls’ High School (IRR 11.66%)

Westville Girls High School one of the best public schools in South Africa with an unbroken pass rate of 100% since 1991.

Unfortunatly that project has closed, but there is an project with cells available for Bothaville High School (IRR 11.69%). Soon there will aslso be a project for Norman Henshilwood High School (IRR 11.74%).

My total energy generated is currently at 252 kWh, which would allow me to drive 937 American miles in a Tesla Model 3 (just need to buy one first).

For some comparison, with 1 kWh you can, toast 160 slices of bread. So in that regard, I have generated enough power to toast 40,320 slices of bread.

AxiaFunder

This month I decided to develop another passive income stream that is not controlled by borrowers ability to pay on time, the currency exchange rate, the markets, or other global health pandemics. The income stream I chose, was commercial litigation funding.

This month I invested in AxiaFunder, that are a litigation funding platform that connects investors with carefully pre-vetted commercial litigation opportunities. AxiaFunder invests in legal cases where there is a high probability of winning at court, with potential returns of 20%-30% pa.

This month I was able to invest in:

- Breach of Employment Contract Case (1.6x if settlement within 12 mths, 2.5x if case resolves at trial, 0 if case looses)

High value employment dispute case in relation to non-payment of contractual commission entitlements.

The only downside with litigation funding – returns are not guaranteed, there is a risk of loosing all of the investment if the case fails, and in some very extreme circumstances, could have to pay more than the amount you put in. (every case is insured, but if the insurance company was to default, then the investors would need to fund more of the project).

Share Portfolio

A few months ago I set up an automatic share purchase system, where I automatically pick up 4 index funds, and one investment fund each month. This is a real set and forget strategy that works well. As they say, its not about timing the market, but instead, time in the market.

I have set set up my Capital Insurance account and now I am waiting to deploy some of my capital. Currently, I am happy to hold cash and watch as everything unfolds.

Journey to 1 free Bitcoin

My journey is still an ongoing work in progress. Playing games, making Coin.

I have decided that I am going to make 1 Bitcoin without doing any “real work”. This means possibly watching an advertisement here or there, playing games that payout cryptocurrency, use the Brave Browser instead of Google Chrome, and invest current cryptocurrency for investment returns. Here is my progress:

Crypto Idle Miner

Crytpo Idle Miner is a game that provides real cryptocurrency (HORA Tokens) as a reward. Each month the number of my HORA tokens increases, but the value decreases. I now have over 175,000 of these things! Once the developers start to incorporate the tokens more throughout the game, and potentially other games, then I will start seeing the real value. Let’s sit back and watch! You can find my Crypto Idle Miner review here.

RollerCoin

I haven’t been so active with my Rollercoin account, but the value of the satoshi (i.e. BTC) keeps accruing! This game is addictive as it’s easy to reach the top 5% of players (if you have the time). Check out my RollerCoin review article if you are interested in learning more. Each new player using the specific link receives 200 satoshi for free!

New updates in the game mean that you can now earn ETH and DOGE as well as BTC!

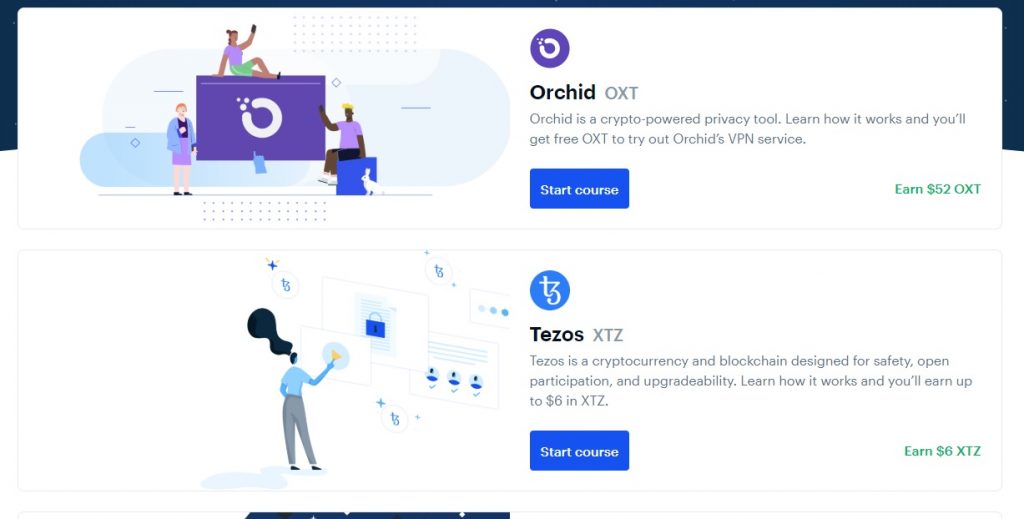

Coinbase Earn

There are now more options to earn cryptocurrency through Coinbase Earn! I have now maxed out my allowance of $130 USD worth of free cryptocurrency. If you haven’t checked it out you should do that already! You can earn some coins simply by watching videos.

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From this, I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Brave Browser

I have been using the Brave Browser for the last couple of months. Find out here why I changed to a more secure and rewarding browser. Basically, you get paid to watch advertisements (if you choose to). It allows users to earn a bit of cryptocurrency and allows advertisers to promote materials to a more select crowd.

Money Savings

This month we have been back into reality after our break. We have been enjoying time with the chickens, and picking fresh vegetables from our garden! This month we picked up a few new chickens into our flock. They are industry chickens (about 16 months old) but only one of them is laying eggs! Hopefully they get comfortable enough to lay more soon!

With so much work, and not a lot of time to be on Twitter, but here are some of my recent tweets:

Bought 3 rescue industry hens last week for 60sek (~7 USD).

— Matt | thewahman (@MattWAHman) August 27, 2020

Only 18 months old and were being swapped out of a farm.

Its only been a week, but we have already seen a ROI of over 100%#highROI #chickens

And their eggs taste just like the ones you get in a shop ?

One of our chickens laid her first egg today ♥️

— Matt | thewahman (@MattWAHman) August 26, 2020

Progress on Internal Changes

In a past update, I made a pledge to update sections of my blog. I will keep this section here until these tasks are fully complete. The remaining tasks are:

- (Priority #1) Adding a page outlining some basic steps for how due diligence can be performed. (started writing this)

- (Priority #2) Adding a section to each platform review with my own due diligence.

- (Priority #3) Placing stronger disclaimers within each platform review page saying how my interests lie within the article.

(Note: currently, there are already disclaimers on all of the pages, however, I will look to have them as more of a focus) .

Socials and Traffic

Things seem to have remained steady this month

- My twitter followers fell a few this last month. Hovering around 575

- My website sessions increased 10%. With a few new articles each month I’m hoping that this really starts to take off

You read it all the way through to the end (or you just skipped half of it)! Regardless, thanks for checking out my update this month!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.