Here is my Quarter 1 update for 2022.

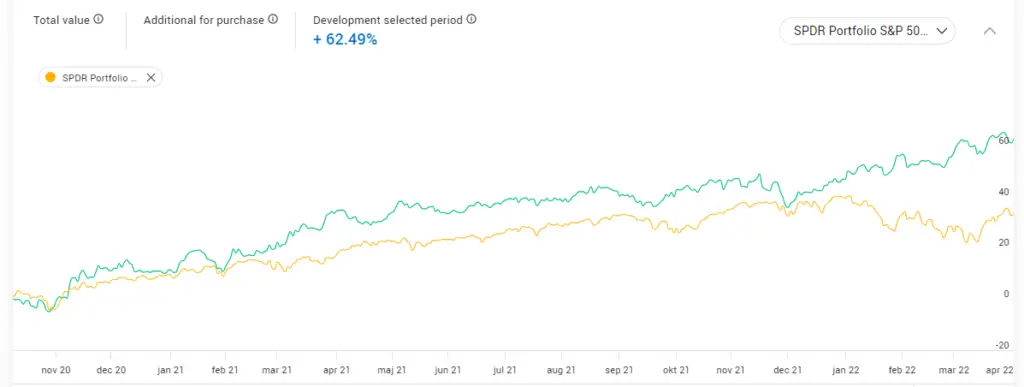

- since inception (Oct 2020) my international share portfolio has returned 62.97% against the SPDR S&P 500 ETF which returned 32.98%

- my P2P and Crowdlending investment profile returned a total of 4.29%.

- my Solar panel system generated:

- 135.128 kWh of energy in January,

- 114.473 kWh of energy in February

- 108.637 kWh of energy in March

All of this beautiful power was paid out in BTC. My total energy generation reached 1,920 kWh. Total carbon reduced – 1,978 kg

- my total investment portfolio increased 0.5%.

If you haven’t signed up for the newsletter, I suggest that you go ahead and do that. The newsletter is sent out once a month with all of the articles that were published during that month.

Quick Summary

The main items that happened throughout the previous months include:

- 8 articles published

- 1 guest posts published

- No shares were bought, some Australian shares were sold.

If you missed some of the articles that were published this quarter, I encourage you to check out:

- Ezoic Affiliate Program Review: How to Make Easy Money

- Introduction To The World of NFTs

- What is a Good Size Emergency Fund?

- 3 Quick Methods to Build an Emergency Fund Fast

- How to Promote Affiliate Products Without a Website in 2022

- Is Affiliate Marketing Worth It in 2022?

- How Can I Become A Freelancer With No Experience?

- How to Make Big Money with Fiverr Affiliate Program

I also had received the following guest post which may be of interest:

Progress Towards Financial Freedom

[visualizer id=”36039″ lazy=”no” class=””]

I have been on the financial freedom path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages (with the goal being 100%). I have an initial conservative plan of 20 years and have provided a guide as to my current progress. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

Investments

I have gained 62.4%% in my Swedish kapitalförsäkring account. This has outperformed the SPDR S&P 500 ETF by about 28%.

My goal is to be able to match the fund, while also being able to generate passive income through dividend growth investing.

If you are interested to see the breakdown of the investments, please see the chart below.

[visualizer id=”37081″ lazy=”no” class=””]

Quarter 4 2021 Buys and Sells

This quarter I made the following transactions:

None! This quarter I haven’t actually made any buys or sells surprisingly.

I have my eye on a few things at the moment, but am waiting for a few stocks to drop before investing more. Always good to have a bit of ammunition ready to go!

This quarter it was good as I received an average return of 4.29%. This already beast my total P2P return for 2021 (which was 3.82%). It was really great to see some money flowing back into my P2P investments, namely:

- a repayment in Reinvest24

- big repayments for some Crowdestor projects.

Once my pay-outs were organised, I did withdraw money away from Crowdestor as to not be so heavy in that platform. Here is my Crowdlending breakdown:

[visualizer id=”35423″ lazy=”no” class=””]

Even though the returns were good this quarter, I don’t expect that it will repeat again next month. The returns of Reinvest24 are lumpy, where you get a bigger pay-out at the end of the project. Crowdestor still has some projects that are delayed, so there is a change to receive some money for these projects (specifically thinking of Warhunt).

Overall, I only have a very small percentage of my wealth in crowdlending, so this can be more of an experiment rather than my whole retirement.

The returns are better this month, but I still plan on reducing my exposure to the crowdlending sector. As can be seen through the pandemic, it can be extremely difficult to get regular return on investment. A lot of the platforms put in delays in payments, with a lot of others not paying out at all (and will likely never pay out – FastInvest, Grupeer, etc).

[visualizer id=”38931″ lazy=”no” class=””]

To see the actual graphs for each of these platforms, head on over to my portfolio page.

The Sun Exchange – Passive Income from the Sun

The Sun Exchange is the world’s first peer-to-peer solar cell micro-leasing platform (if you use the affiliate link, then you will receive 1 free solar cell on your first purchase!). If you are interested in finding our more about the sun exchange, please check out my full platform review.

[visualizer id=”36117″ lazy=”no” class=””]

The last quarter my cells were able to generate 358 kWh of energy (paid out in BTC).

My total energy generated through The Sun Exchange is currently at 1920 kWh,

On average, electric cars consume 34.6kWh to travel 100 miles. That means that I could drive more than 5549 miles with the amount of energy I have produced.

For some comparison, with 1 kWh you can, toast 160 slices of bread. So in that regard, I have generated enough power to toast 307,200 slices of bread.

Blog Side Hustle

So this blog is a bit of a side hustle in itself.

My change from Google AdSense to Ezoic has been going great! So far the amount that I am making is only increasing each month 🚀

If you are interested, I wrote a review about what makes Ezoic a great platform.

Here are the results:

[visualizer id=”38159″ lazy=”no” class=””]

So basically, more site views, more ads, more income.

Socials

Lately I have been focusing a lot on getting my articles out there on my socials. I have enlisted the help of the scheduling genius Tailwind to automate some of the process. The platforms that I am specifically targeting are Instagram and Pinterest. Here are some statistics:

- Instagram: 24 posts, 7 followers, 39 likes (up from 21 post, 5 followers, 39 likes last quarter)

- Pinterest: 55 followers, 605 pins, 331 repines (up from 52 followers, 605 pins, 331 repins last quarter)

- Facebook: 26 page likes (up from 25 page likes)

- Twitter: 583 followers (down from 591 followers)

Let’s keep seeing these go up up up 📈

So that’s all for this month. Thanks for checking out the update, and I encourage you to reach out to me if you want to discuss something further!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.

Matt, you got lots of good content on your blog. Loved the Ezoic review, best one I ever read. We also have many similar investments (I am an investor on The Sun Exchange as well, for years!). I used to have 50,000€ on various P2P platforms (also on Fast Invest!), but pulled it all. Now focusing on dividend stocks, and earning interest on digital assets. Should be receiving a dividend of a private company of 64k USD today, planning to put 50% into my all-weather Portfolio, 25% DCAing into Bitcoin, and 5% into gold! Let’s stay in touch. Cheers from Singapore, Noah

Love it Noah, keep up the good work and keep in touch!