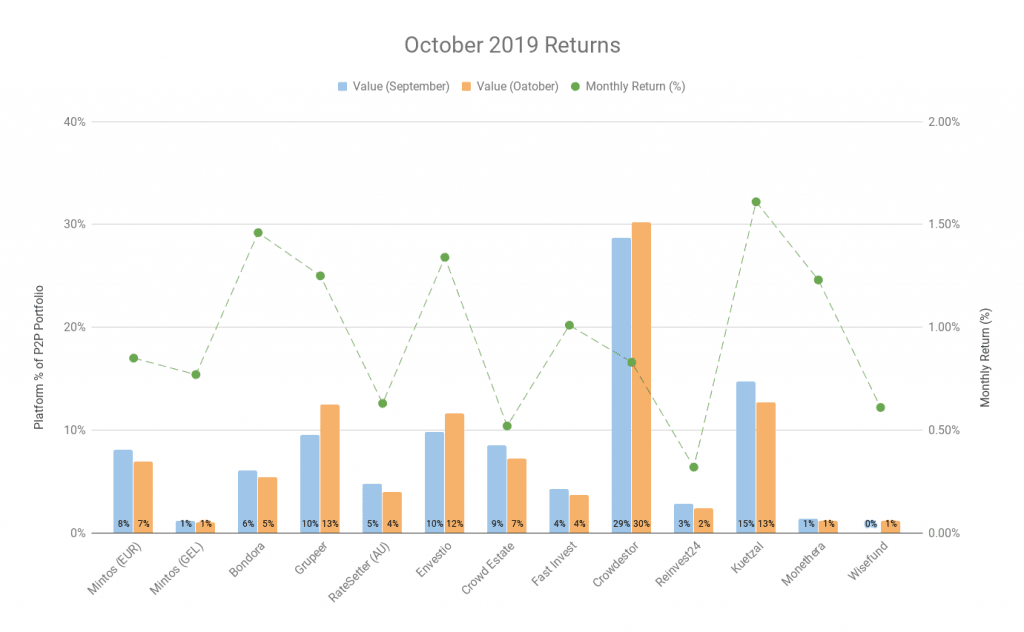

In October my P2P and Crowdfunding investment profile returned an average of 1.03%. The highest of these returns came from:

- Kuetzal (+1.61%)

- Bondora (+1.46%)

- Envestio (+1.34%).

Quick Summary

The main items that happened this month include:

- Started investing in the new platform: Wisefund

- The blog was listed in the Top 20 P2P Lending Portfolios, by P2P Market Data

- New article: Earning Free Bitcoin through RollerCoin

My Returns This Month – Passive Income

[visualizer id=”35446″]

This graph shows how my returns were generated this month. Both interest rate and size in my portfolio are taken into consideration here.

[visualizer id=”35423″]

My current crowdlending portfolio distribution.

P2P and Crowdlending

This month saw my profile grow on average by 1.03%, which is about average for what I have received for the last few months. This month I didn’t see any out of the ordinary returns.

- Since the start of this year, my P2P and Crowdlending portfolio has returned 10.27%

- Since the beginning of tracking my portfolio, I have been able to make 15.78%.

Quick P2P News

Here is a new section that I will continually add. P2P News. Here is a quick one liner on some interesting things that were happening around the place (in October):

- Bondora are continuing to run €100 raffles for reviews on platforms such as Facebook or TrustPilot.

- Crowdestor has updated their webpage, and investors can now see all upcoming payments from all invested projects.

- Fast Invest has some new loan originators and have changed their banking details.

- A lot of other platforms have changed their banking details as well. Always check these when sending money. Word on the street is that it’s about KYC (Know your customer) requirements.

- Grupeer offers 1% Cashback for all new clients that join and invest at least €100 until 17th November 2019. Grupeer now allows top-ups with a NexPay UAB account number.

- Mintos has added and removed loan originators.

*This happens so regularly that it’s not going in this section again, unless there are bigger implications. - The Kuetzal website was attacked and most investors had to update their password.

- Kuetzal had an issue with the SIA “ALPA Buve” project and was required to step in.

- The UKs biggest payday lender (QuickQuid) collapsed after failing to determine how many customers they should compensate over past loans.

- Peer-to-peer lender Funding Secure (also UK based) went into administration after borrowers struggled to pay back their loans.

My Results

Last month I mentioned that about 15% of my portfolio had only brought in an average of 6%p.a. The platforms contributing to this were Crowd Estate, RateSetter Australia and Reinvest24. Lets see how they went this month:

Crowd Estate – Out of the 6 projects that I have invested in, 3 are late on their payments:

- Baltic Forest OÜ filed a reorganization application on October 21 to reschedule the repayment of creditors’ claims. According to the updated repayment schedules, interest payments on all loan agreements will be suspended until mid-2020. The company aims to pay all interest and repay all principal amounts by 30 June 2021.

- Tammelehe 4 is in negotiation with a new financial investor to acquire their development. If the transaction takes place, the interest debt will be repaid from the transaction. If the transaction doesn’t take place, then the interest payment will be repaid at the maturity date of the loan, with the loan obligations being refinanced.

RateSetter Australia –

Currently half of my portfolio through RateSetter is sitting in the holding

account and not earning interest. With the lending rates in Australia at an

all-time low at the moment, the highest percentage I can achieve is 7%, with

the money tied up for 5 years.

This is the lowest percentage in my whole portfolio!

Reinvest 24 – Unfortunately my two Majaka properties didn’t get sold this month (however one of the other Majaka properties on the platform was!). It shouldn’t be too long before the properties I invested in get sold..

Tanel and the team did sell an office in Tallinn in October, which earnt investors over 18%. Too bad I wasn’t apart of that one! Hopefully I have some better / more exciting news next month.

If you are interested in trying out Reinvest 24, use this link and you get a bonus €10 upon registration.

I invested in only 3 loans from the P2B platforms this month. These include:

- Loan facility buyout – part 1 (10 months, 20%)

Loan facility buyout – part 2 (10 months, 20%)

Financing a buyout of a loan for a Latvian power producing company.

- Organic fertiliser manufacture (14 months, 20% p.a.)

Biofarming company seeking funding for global expansion and marketing.

No new loans were bought from Kuetzal, Crowdestor, Monethera, Crowd Estate or Reinvest 24.

Other crowdlending platforms such as Mintos, Fast Invest, Grupeer, Rate Setter, and Bondora kept churning away.

Agrikaab

Agrikaab has completed the Galkacyo rain pond, and water has already started to be collected! So far, 6-10% of the ponds capacity has been filled. Lets keep those rains coming!!!

The first revenue report and payment will come through on January 1, 2020.

First rainwater has been collected in the new farm pond in Galkacyo, #Somalia. Heavy rain is forecast for the next days. pic.twitter.com/rzqfMpk0lD

— Agrikaab (@agrikaab) November 4, 2019

If you want to see the reasons that I invested in rainwater in Africa, you can have a look at my article here.

Scared you missed out? There is a new Rainwater Project that has just started to take orders. Make sure you get in if you’re interested. Help Somalia to harvest rainwater and fight droughts!

Share Portfolio

Nothing new to report. No buys or sells. Just waiting patiently on the sidelines until an opportunity presents itself.

Journey to 1 free Bitcoin

I have decided that I am going to make 1 Bitcoin without doing any “real work”. This means possibly watching an advertisement here or there, playing games that payout cryptocurrency, use the Brave Browser instead of Google Chrome, and invest current cryptocurrency for investment returns. Here is my progress:

Crypto Idle Miner

Crytpo Idle Miner is a game that provides real cryptocurrency (HORA Tokens) as a reward. As of today, my free HORA tokens are worth ~0.00094300 BTC, which equates to even less than last month (~8 USD). There seems to be a trend with these dropping. You can find my Crypto Idle Miner review here.

RollerCoin

Last month I started to play a game called RollerCoin (it’s free). It’s quite addictive and teaches you about cryptocurrency mining. The game has currently paid out a total of 3.41 Bitcoin. So far I am sitting on 0.00008263 BTC, for not doing any real work.

How the game works:

- 3,000 real satoshi (0.00003000 BTC) is released every 5 minutes.

- Your share of satoshi is based on your power level (hash rate).

- You earn a higher hash rate for playing mini-games (i.e. flappy bird, memory, space invaders etc) that last < 1 min each

- To work out your percentage of the block, your power is divided by the power of the whole server (i.e. 106,402 people) and then multiplied by the 3,000 Satoshi.

This game is addictive as it’s easy to reach the top 5% of players (if you have the time). Check out my RollerCoin review article if you are interested in learning more.

Coinbase Earn

I have nearly maxed out my allowance of $130 USD worth of free cryptocurrency gained through Coinbase Earn.

It’s very easy to gain – you just have to have about 20 mins and be interested in watching some short videos on how various cryptocurrencies work. From this, I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI).

I wrote an in-depth article that you can find here.

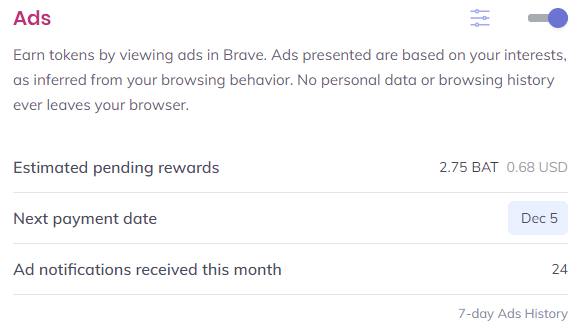

Brave Browser

I have been using the Brave Browser for the last couple of months. Find out here why I changed to a more secure and rewarding browser.

This month has been more exciting than the last, as I have now started to get some advertisements coming through! They are these little not so intrusive popups that you can can ignore, close, or accept. As a result, I am getting paid to view the advertisements!

All in all, more than last month, but a long way from earning that free BTC. The journey continues…

Money Savings

My hydroponic setup is looking a little worse for wear at the moment. I was away for a couple of weeks and when I got home I noticed that two of the plants had fallen over, putting them out of reach of the sunlamp. I have righted these now, and will give some nutrients, so they hopefully come bursting back to life. Hopefully there are some pictures for you next month!

Socials and Traffic

A few things have slowed down this month, as I haven’t been so active with content over the last few weeks.

- My twitter followers have increased from to 460 this month.

- My website sessions have decreased by 15% this month ☹. It’s OK though, I haven’t had heaps of time to publish many articles

- Pinterest I don’t even bother tracking anymore!

Summary

Here is the summary of how my investments turned out this month:

[table id=17 responsive=scroll /]

Thanks again for checking out my update this month! I do encourage you to comment below, and sign up to my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.

Great update Matt, as usual.

Congrats on getting published on “Top 20 P2P Lending Portfolios”!

I have recently started to invest in Kuetzal, I hope to get similar returns than you.

One question, do you have a target amount of money that you would like to achieve? If so, it would be good to see your progress on the monthly updates!

Keep up the good work

Hi Gonzalo,

Thanks for dropping in!

I do have a little target of trying to reach an amount that I can live off each month (through passive income), however I am not at the stage where I am comfortable to put full numbers up on my profile.

I am in the process of writing an article as to why I am not showing numbers, however, I have been fairly busy lately! Hopefully I can get it out soon!

I could possibly put a percentage bar, or a little note saying “i’m XX% financially free!”

Matt

Yes, I am also not comfortable with showing all my numbers, that’s why I only show percentages, like the one you have mentioned “I’m XX% financially free”

Looking forward to seeing that article, and your progress 🙂

Well, your returns are pilling up month by month so good work, constancy is key.

Congrats on being listed as a top 20 p2p lending portfolio, mine was too 🙂

Although you seem to be busy I wouldn’t worry much as long as you can keep with the updates. You can always give the blog a push later on.

Shame on Crowdestate loans. I was lucky enough to get rid of them in the secondary market. Crowd estate is a platform for more active investors, time is needed to read the updates and asses your investments. If you would have had time to read them I’m sure you would have sold them as I did before blocking trading.

Have a nice time.

I find that the updates really keep you on track with managing your investments!

Hopefully those Crowd Estate loans pull back.

I think I will be looking at staying away from the platform at the moment.