Welcome to my January 2020 update! Let’s look back over December 2019 to see how my portfolio went.

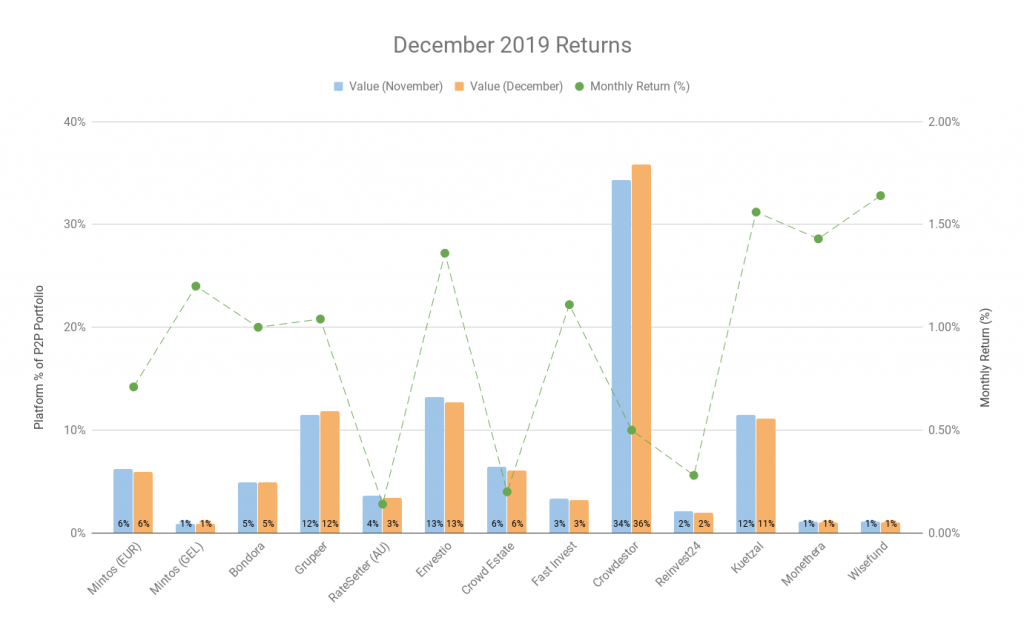

My P2P and Crowdfunding investment profile returned an average of 0.86%. The highest of these returns came from:

- Wisefund (+1.64%)

- Kuetzal (+1.56%)

- Monethera (+1.43%).

Quick Summary

The main items that happened throughout December include:

- New article: How I am paying off my student loan for free

- My recommendations have been listed

- Christmas! and End of year celebrations

Other Exciting News

Before I get into my portfolio, I just wanted to thank everyone who comes and checks out my monthly updates!! I have already started to roll out the new look of my website, utilizing the Astra theme. I am always open to feedback of any kind!

I have noticed that my returns are slightly off due to some poor calculations from me. So I will need to go through them and update all the returns since I opened up my accounts.The mistakes are only small, and overall it means that I have said that I earnt less returns than what I actually did. So look forward to some new reports coming soon!

P2P and Crowdlending

This month saw my profile grow on average by 0.86%, which is less than my average for the previous months. I can attribute this down to my main investment holding Crowdestor. Crowdestor takes up 35% of my portfolio, and a lot of my investments through there are currently in a “grace period”, where interest is delayed for a few months. In the coming year, I expect to see 1-2% gains in the portfolio become a regularity.

This month I didn’t see any out of the ordinary returns.

- Since the start of this year, my P2P and Crowdlending portfolio has returned 12.09% (of real returns!)

- Since the beginning of tracking my portfolio, I have been able to make 17.54%.

My Returns This Month – Passive Income

[visualizer id=”35446″]

This graph shows how my returns have compiled since the start of this year. Both interest rate and size in my portfolio are taken into consideration here.

[visualizer id=”35423″]

My current crowdlending portfolio distribution.

Quick P2P News

Here is a quick one-liner on some interesting things that were happening around the place (in December):

- It’s now been 6 weeks and we haven’t heard anything from the Kuetzal team about their CEO.

- There have been some major issues with a few projects listed on Kuetal (see a review from Explore P2P here).

- Kuetzal are facing massive issues with a lot of investors pulling out due to some seemingly dodgy dealings.

It would be very wise to stay away from Kuetzal just at the moment. - Envestio changed their COO. A video was released, however, it was very bland and uninspiring.

- It was also noticed that you can invest in some older projects through the Envestio platform. Projects become available if an investor sells their share back to the platform.

- It was found out that 2 upper management staff from Grupeer (the Chief Operating Officer and Marketing Manager) have left the company. No information was portrayed to investors.

- The Ex-Marketing Manager of Grupeer is now working for another P2P Player – Boldyield.

- Fast Invest was in the spotlight when it was found out that they received the first notice to be struck off the companies register in the UK, for missing an annual return deadline.

- Wisefund finally sorted out its payment issues and released a new project.

- New “pending payments” functionality on Mintos.

- Bondora and Mintos are in the process of releasing mobile applications, some of these are already being rolled out.

For more information on any of the above items, see the discussions on the P2P Investment Fellows page on Facebook.

My Results

Let’s start with my poorest performing crowdfunding returns. These are the 3 platforms that take up ~15% of my portfolio and have so far returned a less than expected return.

This month I received one interest repayment for one out of the 6 loans that I have. I also did not receive an expected interest and principal repayment on my investment – Kreutzwaldi 59c. This means that now more than 66% of my investments through Crowd Estate have not been paid as expected. For this reason, I am not investing in Crowd Estate anymore. There is no need to be disappointed each month when I can gain similar (or higher returns elsewhere).

Rate Setter (Australia)

The reason that this is performing so badly, is that most of my funds within the platform are not on the market earning a return. I keep holding off, as the best rate I could possibly achieve at the moment is 6.8%. In the new year, I will be re-evaluating where I want to keep this platform in the mix as it may be more advantageous for me to invest in a more tax-efficient account.

Unlike the above two platforms, this one I am still hopeful for!

I have only invested in two projects, (Majaka 54-10 and Majaka 54-13). and only one of those pays dividends from rental income (the other is a capital gain through renovation and sales). I am still waiting patiently for that email saying that the apartment has been sold. It will come, it’s just a matter of when! This month another project launched – High yielding office space in Rocca Al Mare which pays a 7.4% yearly dividend, with capital growth expected at 5.80%.

Now let’s look at the platforms that are adding some solid value to my crowdlending portfolio. This month I only invested in two crowdfunding projects, both of which through secondary purchase in Envestio.

- Production of wood pallets – trade financing 4 (10 months, 16%)

Trade financing/factoring for the purchase of raw timber for production - Financing the construction of Briana 4 residential (1 year. 18%)

Financing of reconstruction and building a premium real estate project in Riga, Latvia

At the moment, when an investor chooses to sell a loan back to Envestio, Envestio will put the loan available for other investors to invest in. Therefore kinda working like a secondary investment.

No new loans were bought from Kuetzal, Monethera, Wisefund or Crowdestor

Agrikaab

There isn’t so much to report here from Agrikaab this month. The pond is only 2 months old, and I don’t think profits are expected for a little while yet. The pond keeps filling!

f you want to see the reasons that I invested in rainwater in Africa, you can have a look at my article here.

Scared you missed out? There is a new Rainwater Project that has just started to take orders. Make sure you get in if you’re interested. Help Somalia to harvest rainwater and fight droughts!

Share Portfolio

Nothing new to report. The market is still close to all-time highs. No buys or sells. Just waiting patiently on the sidelines until an opportunity presents itself.

Journey to 1 free Bitcoin

I have decided that I am going to make 1 Bitcoin without doing any “real work”. This means possibly watching an advertisement here or there, playing games that payout cryptocurrency, use the Brave Browser instead of Google Chrome, and invest current cryptocurrency for investment returns. Here is my progress:

Crypto Idle Miner

Crytpo Idle Miner is a game that provides real cryptocurrency (HORA Tokens) as a reward. Each month the number of my HORA tokens increases, but the value decreases. I now have over 100,000 of these things! Once the developers start to incorporate the tokens more throughout the game, and potentially other games, then I will start seeing the real value. Let’s sit back and watch! You can find my Crypto Idle Miner review here.

RollerCoin

I haven’t been so active with my Rollercoin account, but the value of the satoshi (i.e. BTC) keeps accruing!

This game is addictive as it’s easy to reach the top 5% of players (if you have the time). Check out my RollerCoin review article if you are interested in learning more.

Coinbase Earn

I have now maxed out my allowance of $130 USD worth of free cryptocurrency gained through Coinbase Earn. A big thank you to everyone that used my links! Hopefully, you were able to get your free cryptocurrency!

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From this, I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Brave Browser

I have been using the Brave Browser for the last couple of months. Find out here why I changed to a more secure and rewarding browser. Basically, you get paid to watch advertisements (if you choose to). It allows users to earn a bit of cryptocurrency and allows advertisers to promote materials to a more select crowd.

Money Savings

I am still loving some of the great picke ups I got from the Black Friday Sale (mainly the new theme, pCloud storage, and my investments). All of my purchases were “single life purchases”, meaning that I don’t have to keep sending money out of my account each month. By using both of the products for more than 4 years will earn back the cost of buying them.

I also decided to buy myself a little Christmas present this year. Spoiler alert, it relates to my hydroponic indoor garden! Due to my recent failures with a half set up system, I decided to invest some more time, and a bit of resources to have a real go at running hydroponics. So now I have bought a few shelves, some aquarium supplies, a few big buckets, and also a much better LED grow light. I ended up choosing the Mars Hydro TS1000 which has some really good results and specifications for a really good price. I will write a future article about the purchase and my setup. Why should the winter stop me from growing produce inside?

Socials and Traffic

A few things have slowed down this month, as I haven’t been so active with content over the last few weeks.

- My twitter followers have increased past 500!

- My website sessions have decreased massivly again this month 🙁

I switched from Yoast to the SEO Framework and obviously the site is taking a bit of a hit.

Summary

Here is the summary of how my investments turned out this month:

[table id=19 responsive=scroll /]

Thanks again for checking out my update this month! I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.

Another pleasant update to read Matt, congrats on hitting 500 followers 😉

Looking forward to seeing your site after the theme renovation.

I am sure stats will soon spike back up 🙂

It’s got nothing on your 1500, but its slowly growing!

Thanks for the positive words. Hopefully a big year for all of us!

Kuetzal is now out of business and all money invested by users gone, I have lost just over €1700 with them, not even interest from my other P2P loans will make that up, I am pulling out of P2P all together now, this is a sign of things to come unfortunately with it being unregulated, people can set up as they please with no checks and after a year disappear with everyone’s money and no repercussions.

Hi Gav,

It’s unfortunate, but yes, Kuetzal today announced a wind-down of their platform.

I have specifically asked for more information about the “wind-down” process, and for them to specify what will happen with all current loans.

Their email did say that they will perform buy-backs and withdrawals once the AML issues have been addressed.

I assume they are being bombarded with requests for more information, so we will see if they release another information email early in the week.

Matt

Hi Matt,

I like your updates a lot. One question why do you choose to report the interest rates in monthly percentages instead of an extrapolated XIRR (annual return)?

Hi Mr Cheese,

Thanks for stopping by!

I like to report the actual percentages that I receive each month as this is the real gain from the platform. Someone looking to invest in these platforms could look at the returns each month and know exactly how much to expect.

XIRR the rate of return over the whole period, missing out on those smaller monthly changes. I have started to go back through the platforms to work out all of the inputs and outputs to show XIRR as well. I think this will take a little while to sort out!

Matt

Some big hits to your portfolio this month!

Envestio and Kueztal are big parts

Yes, the situation with Kuetzal and Envestio is not looking great (with those two taking up ~24% of my crowdlending portfolio). It just shows how “high-risk” these platforms can be.

Next month I will also show a % breakdown of my whole portfolio (shares, free cash etc) for a bit of a clearer picture of how I try to spread out risk.