I grew up and went to University in Australia (studying a Bachelor of Science). However, as the costs of universities are not fully covered by the Government, I was required to fork out some extra cash to pay for my course. Being a poor student at the time, I needed to find some support through the Australian Governments HELP loans. In this article I will initially talk about the HELP Loan program that I used, then I will discuss how I am paying off my student debt for free!

My Current Student Debt Balance

My Current Student Debt Balance = ~$18,000. The debt initially started out at a bit over $25,000.

How does student debt work in Australia?

In Australia, University studies cost money. However, if you’re a citizen of Australia, you are generally covered for part of the fees by the Australian Government. The types of loans available include:

- HECS-HELP Loan– for those that have the majority of fees covered by the Government, but need help paying the remainder.

- FEE-HELP Loan – for those who have to pay full price for their fees.

- SA-HELP Loan – for those needing help to pay for student services and amenities.

- OS-HELP Loan – for those looking to study overseas.

Generally, students don’t have the money upfront to pay for their studies, so that have to take out a loan. As I was enrolled in a Commonwealth supported place, I only needed to pay for some of my fees, and therefore only needed to take out a HECS-HELP Loan.

How much do universities in Australia cost? The average cost of a commonwealth supported Business Degree or Science Degree is about $8,5000 AUD. However, if you are an international student (i.e. not supported by the government) the average tuition fee is closer to $32,000 (~US$22,700) per year.

What is the HECS / HELP Loan?

The HECS/HELP loan is the Higher Education Commonwealth Supported – Higher education loan program (HELP). The HELP loans provide up to $100,000 for the majority of courses, but those studying veterinary science, dentistry, or medicine can apply for up to $150,000. To apply for money from the HECS-HELP program, a person must:

- be studying in a Commonwealth supported place.

- be an Australian citizen and meet the residency requirements (you must study at least part of your course in Australia).

- be a New Zealand Special Category Visa (SCV) holder or permanent humanitarian visa holder and meet the residency requirements.

- submit the Request for Commonwealth support and HECS-HELP form to your provider by the census date.

- be enrolled in each unit/subject at your provider by the census date.

More information about the Australian StudyAssist program can be found here

HELP Loan Repayments

Loans can either be repaid through compulsory repayments (through the taxation system) or voluntary repayments (after-tax payments). Initially, there was a 10% discount bonus for paying the loan off early, however in January 2017, the Australian Government removed the discount.

Compulsory payments

The HECS-HELP loan, and other forms of loans, are repaid through the tax system once the borrower earns over a certain limit. Each year the compulsory repayment threshold changes. The compulsory repayment threshold for the last couple of years was:

- 2018-19 income year – $51,957.

- 2019-20 income year – $45,881.

The actual percentage rate (i.e. how much you will repay each year) is based on a sliding scale. The scale can range from 1%, if you earn over $45,881, up to 10% if you earn more than $134,573 p.a. It does not matter if you are living overseas, as worldwide income determines how much you have to pay.

Unfortunately though, if you are earning an amount that brings your repayments under the indexation limit, then your loan will still be increasing.

For example: If you earn $50,000 for the year, your interest payment would be 1%. However, the average indexation rate has been closer to 2%, meaning that the loan is actually increasing (i.e. 1% paid off, 2% increased), and you will face higher repayments in the following year. More about the payment threshold can be found on the StudyAssist website.

Voluntary payments

Loans can also be paid through voluntary means. For borrowers that want to quickly reduce their loans, this is the preferred method. When making voluntary repayments, its important to take note of the indexation day. Indexation occurs each year on 1 June, so you should make repayments before then. For example, if you have a loan for $10,000, and pay $10,000:

- before the indexation date, there is no indexation and your loan is finished

- after the indexation date, you will still have a balance that needs to be paid off ($10,000 x 1.80% = $180)

HECS-HELP Indexation Rate

The HECS-HELP loan is indexed yearly, with past indexation rates found on the Australian Taxation Offices website. Between 2012 and 2019, the indexation rate has varied from 1.5% to 2.9%.

The idea of indexing the loan (and not adding interest per se), maintains the real value of the debt. This brings debt payments in-line with the cost of living.

How Am I Paying Off My Student Debt

Now onto the fun stuff!

Initially, I didn’t worry too much about paying off my student debt, as it was going to be paid off once I finished University and started to earn some money! I was also not worried about any “missed payments” or any drops in credit rating, as all of the compulsory repayments came out of tax. The money was put into the loan before it was even paid to me. If I wasn’t earning enough, I didn’t have to make any repayments. Simple.

Any money that I did have saved up during that time, I placed in the share market. All I was trying to do was to beat that 2% indexation rate (and to be honest, it was pretty easy when my dividends payout over 5%).

What changed?

Once I moved overseas, my tax situation changed. My student debt is now not automatically coming out of my tax, and I am required to pay a lump sum at the end of each financial year. To be honest, it is not something that I look forward to each year.

How am I paying my student debt off for free?

Do you know that spare money that I used for investments instead of initially paying off my student loan? Well, those investments have grown substantially since my purchase, and are now paying dividends which are paying off my debt. The best news is that initially, those investments were worth only half of the cost of the debt. That’s the power of compound investing.

Assuming that the compound annual growth rate of the dividend stays above 8%, and assuming inflation stays around 2%, the loan would have paid itself off in by 2028. Without me needing to spend any extra money. Once it has been paid off, that dividend money will just keep growing in my account.

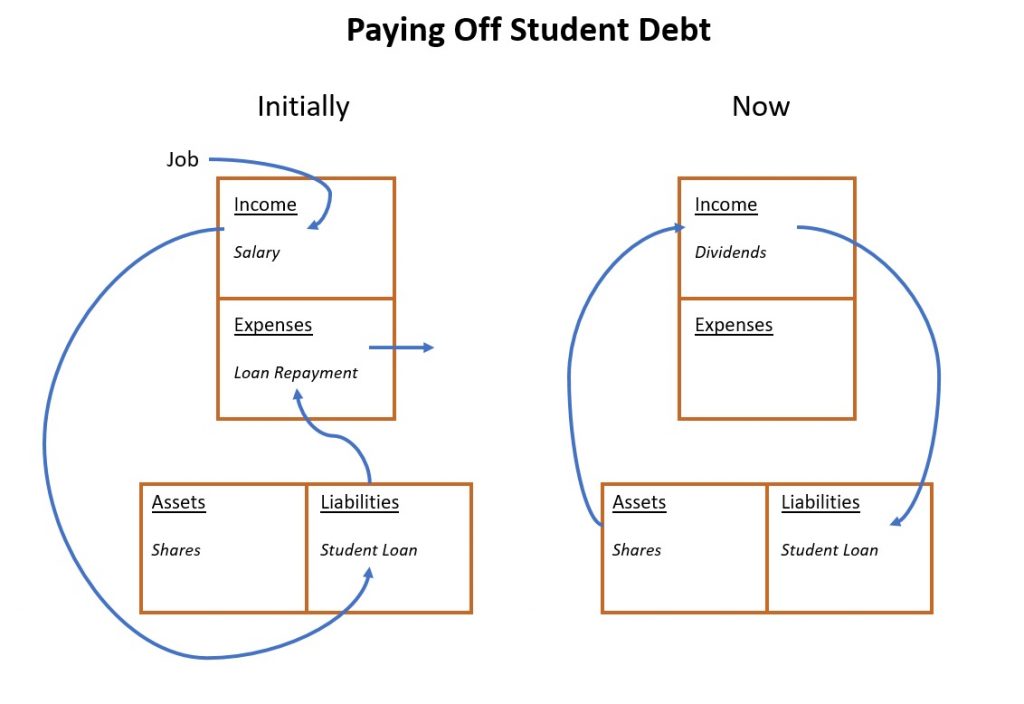

As can be seen in the picture above, I was initially paying off my student debt using the money I received from my salary. At this stage, I was using any spare money to invest in the sharemarket (mainly dividend-paying stocks). As time passed, those dividend-paying stocks doubled and tripled in value, resulting in larger dividend payments. Those dividend repayments now cover the loan repayments each year.

Should I pay off my HECS debt?

This has been a common question that many students face, and one that many other financial blogs have also covered. To answer this question you will need to consider a few things yourself:

- How adverse are you to risk – if you were to invest that money instead of paying the loan, do you have a high-risk tolerance?

- What are your feelings towards a student loan – does it hang over your head, or do you not mind having it for 10 years?

- Do you think of the loan as purely financial – can you beat inflation each year?

Additionally, there are other things to consider as well. Like, for example, would it be easier to take on another loan (i.e. mortgage) if you can prove that you are financially responsible for paying off your student loans earlier? One could also argue that an investment portfolio would do just as well as having the loan paid off.

The Three Scenarios

The way I see it, is there are three main scenarios that you can choose to take when paying off the student loan:

- Scenario 1

The Student loan is paid back as soon as possible through both compulsory and voluntary repayments. (fastest possible time) - Scenario 2

Only compulsory payments are made. All other money is invested or used elsewhere. No voluntary repayments are made. (slowest possible time) - Scenario 3

All compulsory repayments are made with additional money being used for a mixture of other assets and paying down the loan through voluntary means. (average time, best of both)

There is no one answer that suits all, and everyone will have to choose their own path!

My Conclusion

Generally, most students from Australia will not have to worry about paying back any of their student loans until their income reaches a certain level. This means that it’s very easy to lower the priority of repaying the loan. Also, since 2017, there is no benefit to paying off the loan early. As the loan is only indexed yearly, and no extra interest is charged, for me personally, I found it more useful to invest in dividend-paying shares and other P2P and crowdfunding investments. In terms of loan repayment priority, a student loan from Australia is at the lowest priority. Any other loans for credit cards, personal loans or even mortgages, generally have a higher interest cost and should be paid off first.

My current dividend returns are fully covering the compulsory repayments that are required by my HECS loan. The additional dividend money that is left over, is then put back into the loan as a voluntary repayment (before 1 June). This will reduce the indexation and compulsory payments for the next year.

The current perfect scenario – assets that are increasing in value which are paying off liabilities that are decreasing in value. Once the loan is paid off, the dividends can then pay off other liabilities, or be placed into my other investments which contribute to my returns.

In the end, the student loan will need to be paid off either sooner or later, whether you make voluntary repayments or not.