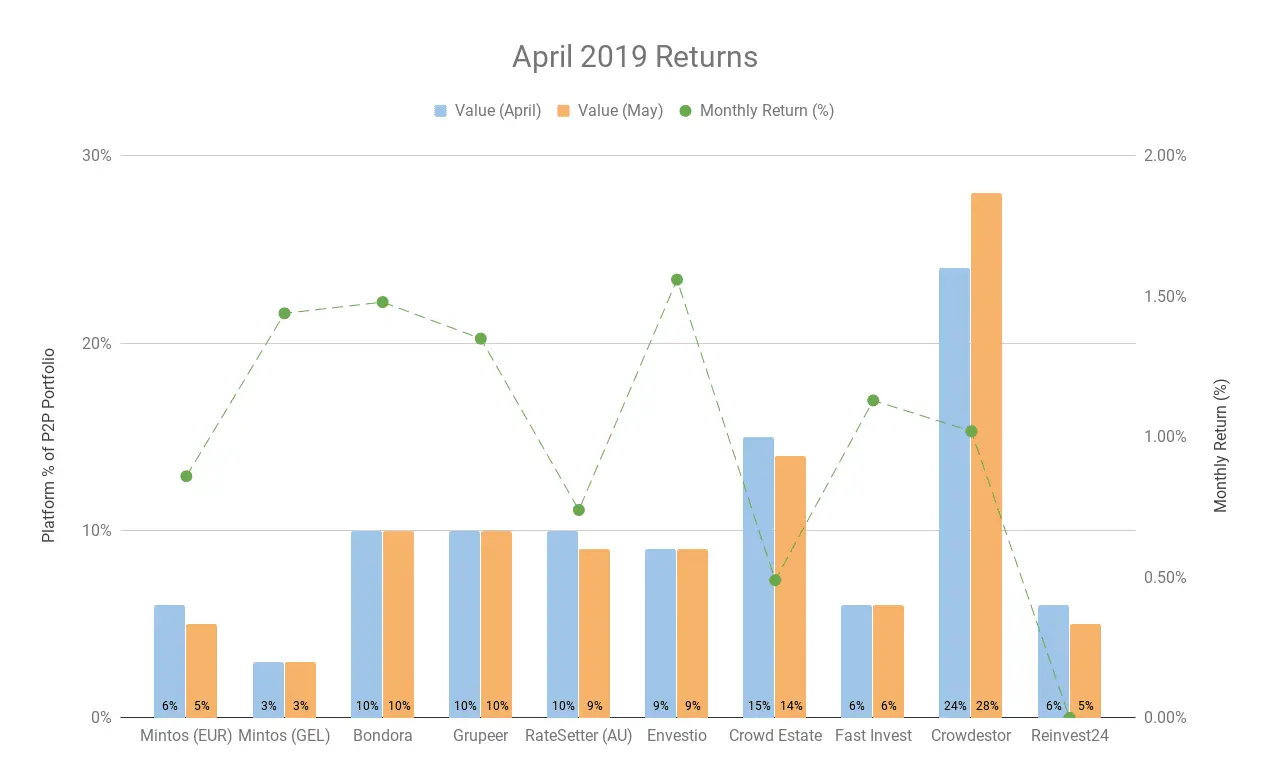

This past month has seen my P2P investment profile return an average of 0.99%. This month my highest returns were through

- Envestio (+1.56%)

- Bondora (+1.48%)

- Mintos(GEL) (+1.44%).

I would like to apologise for the lateness of this update. I have had family over for the last couple of weeks and have been travelling around Scotland (tasting a few whiskeys). Due to this reason as well, I haven’t had a chance to write any new articles. Maybe I need to consider setting a goal of writing at least one article a week?

This month I only invested in Crowdestor and Envestio, as my 2018 tax is due very soon. I need to make sure that I have enough to cover my capital gains from the year!

However, let’s have a look at the returns this month:

P2P Platforms

Mintos

This month some new GEL loans (paying 16%) enter the primary market. As I was just saying last month that I was going to move out of GEL loans due to their scarcity. Now that there are more loans available, I will leave that account active for the moment.

Crowdestor

My Crowdestor returns for this month started to pick up. As you can see from the graph at the top of the page, Crowdestor is my biggest holding by far. I am really enjoying their platform and the projects that are available to invest in. This month I have only invested in one project through Crowdestor:

Inch2 (24 months, 18%)

INCH2 is a rapidly growing brand seeking funding to expand its business. INCH2 are looking to enter the Asian market and expand the brand’s product range to include footwear, women’s bags, and other accessories.

Envestio

My Envestio returns are continually providing the biggest returns each month. This month I was able to invest in:

- Crypto-mining Farm 1100GTX1080ti (10 months, 17.45%)

Financing of a crypto-mining hardware production process

- Fish processing for export market expansion-5 (6 months, 18%)

Financing “Senga” SIA production activity, completion of order of canned fish goods

Bondora, Grupeer, Crowd Estate, Fast Invest

No news with any of these investments. Everything is tracking nicely.

Reinvest24

Reinvest24 has updated the status of my invested projects to now include information about repayments:

- [Repayment date: 30.09.2019] Apartment development in Tallinn´s tech hub

- [First payout: July 2019] Rental apartments in Tallinn’s tech hub

Without sitting down and calculating for myself what the returns will be, I am happy to just watch. It’s a similar feeling to a kid waiting for a Christmas present. Who knows what will come!

Kuetzal

If you are interested in trying out Kuetzal (paying up to 21%) and making use of a free €10, you should use this link and code SPRING2019 in the registration form. The link provides a bonus of 0.5% extra on your investments, and the code provides the bonus €10.

Be aware that the SPRING2019 campaign is scheduled to end 31 May 2019, so get in quick if you are interested.

Shares

My US share portfolio went up nicely this month (+10.27%), however, this is not a locked in gain (compared to the P2P investments above). Once I have paid my taxes for 2018 and saved up a bit of capital, I will look at investing in some low-cost index funds.

Other

Once I had returned home after Easter, the garden had come to life. There were leaves on every plant and our outside vegetables have started to grow!

Before we went away, I tried a little experiment planting lots of different vegetables in egg cartons. Unfortunately, when I returned home, none of the seedlings had grown ☹.

I since realised that I was maybe a bit too frugal with the amount of water I initially provided. I have now watered them properly and am waiting to hopefully see some results soon. Here is a photo:

Maybe this could be a side hustle – providing various seedlings to the local community? I will have to try it a few more times and determine (1) if I am even able to grow anything, and (2) how viable it would be. There must be some demand for seedlings, as in the end its saving time, and people always want more time!

Socials and Traffic

The traffic to the website has increased a fair bit in the last few months. I think it’s mainly because I have actively been trying to be part of the FIRE (Financially Independent, Retire Early) community. As a result of making a few new friends, and commenting on others updates and blogs, I am seeing more visitors to my site.

Summary

Here is the summary of how my investments turned out this month:

[table id=10 responsive=scroll /]

Thanks for checking out my update this month. I do encourage you to comment below and also sign up to my newsletter. The newsletter comes out once a month with this update here, and any of my most recent blog posts.

Amazing summary Matt,

I really like the way you lay it out and LOVE that graph (massive excel geek right here!)

How do you find out about all of these investments? I personally have only really used index funds but I can see the benefit to doing a bit on the side yourself.

Thanks for checking out my podcast. I love the design of your website too, very simple and easy to follow

Mike

Hi Mike,

Thanks for stopping by and your lovely comments!

Each month I look at that graph and usually change it in one way or another. The blog is still fairly new so I probably won’t settle on a design for a while! I do have more interactive graphs under the “My Returns” page. Maybe I should start to incorporate some of those on my monthly updates as well.

Investing in P2P loans started when I was living in Australia. I was looking for alternate ways to invest money. I ended up finding RateSetter, which was the most similar to LendingClub in America. Once I moved to Europe, I found that there were a lot more platforms offering similar types of investments.

Funny for you to mention index funds – I will be getting some of them soon as well!

I definitely think it’s important to have multiple sources of income, where that be interest, dividends, capital appreciation etc.

I will have a look into the Pinterest course!

Matt