If recent activity by the US Government is anything to go by, you’ll quickly realise that the world of cryptocurrency is anything but a bubble. In September alone, the US Government has introduced the Digital Commodity Exchange Act of 2020 and alongside that, the President of the US Federal Reserve has confirmed that work is actively underway to create a US central bank digital currency (CBDC).

As activity gathers pace across the cryptocurrency landscape, now might be the time to consider investing in some cryptocurrency of your own. But where do you start? Here are five steps helping you get started with cryptocurrency:

Step 1 – Do Your Homework And Learn The Lingo

Cryptocurrency, despite all of the horror stories told in the legacy media, has lots going for it – and it’s important that you understand what the benefits of cryptocurrency are from the start. So here are some of the main ones to get you started:

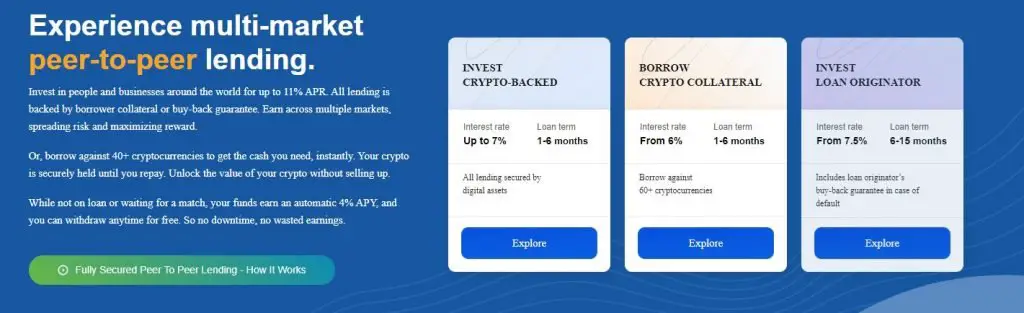

It provides a fairer finance system for all: Cryptocurrencies operate through something called a decentralized Peer-to-Peer Network. That might sound a little confusing at first, but what it means in Plain English is that when it comes to the buying and selling cryptocurrencies, there is no central authority, like a government, calling the shots. And what makes cryptocurrency even more appealing is that you don’t need a middleman – or a bank as they’ve become better known to us. Cryptocurrencies operate on the basis of Peer-to-Peer trading, meaning the currency leaves Person A (the seller) and goes directly to person B (the buyer).

It tackles the problem of inflation: Many of this world’s governments have caused economic ruin and strife by printing endless amounts of money – the result of which is crippling inflation. Cryptocurrencies bring a thankful end to the problem of inflation due to the limited number created.

It guarantees low cost transaction fees: it’s typically much cheaper to move money through Bitcoin’s peer-to-peer network, and transactions are also very fast. It doesn’t matter who you are or where you live, transactions happen at the same speed and the fees remain the same.

It’s an open, honest and transparent system: Every cryptocurrency transaction can be viewed and tracked on a blockchain – or for want of a better description, a digital public ledger. In fact, it’s so open that you can see for yourself every transaction that’s being made – in real time!

Ok, so you can see the benefits of cryptocurrency, but you’ve done a cursory Google search on the subject and quite frankly, it all just seems like a whole other language. To help get your head around what this foreign language all means, let’s try and understand cryptocurrency terminology, and put some of the jargon into Plain English:

Cryptocurrency – What exactly is it? For use of a better term, cryptocurrency is digital wonga! That’s right, it’s a digital form of currency that you can trade just like any other traditional currency – but the difference is you can complete all of your transactions in the digital world. The first cryptocurrency to be traded was Bitcoin – and even today, Bitcoin remains the most popular cryptocurrency with traders worldwide. But Bitcoin is by no means the only currency you can chose to trade in. In fact, at the time of writing, there are in excess of 2,000 cryptocurrencies in existence, so the world really is your oyster!

Blockchain Ledger – I know this sounds scary, but don’t be put off – because it’s not actually that complicated. Firstly, let’s take the word ledger. As you probably already know, a traditional ledger is defined as, a book in which a company or organization writes down the amounts of money it spends and receives. Well, that’s essentially what a Blockchain Ledger is. The only real difference between the two is the form the ledger takes. Traditionally, a ledger is a physical book, which contains individual handwritten entries of every commercial transaction made. When we refer to the Blockchain Ledger, what we have is a digital list – that looks very similar to a database – of every transaction ever made. And as I’ve said above, the ledger is open for all to see at any time of day.

Cryptocurrency Wallet – The cryptocurrency wallet is quite literally the heart and soul of cryptocurrency. It is the key to the crypto kingdom and if you don’t have one, you’re not getting in! The reason being, the crypto wallet is one of the fundamental pieces of the crypto jigsaw because it’s the the central component that physically enables you to buy and sell currency. The reason it’s called a wallet is because it basically stores all of your valuables – that is, all of the crucial information you’re going to need to make transactions in the crypto world.

Crypto Exchange – If you think of your typical currency exchange, you won’t go far wrong here. Because as with your more traditional currency exchange, that’s exactly what we have here – but for your cryptocurrencies. Finding a good crypto exchange platform is a key part of your investing journey as that’s where you’ll be doing all of your buying and selling.

There’s lots to learn about the world of cryptocurrency, so if you want to continue your learning journey, there are lots of useful resources out there to help you.

Step 2 – Select Your Cryptocurrency And Bag Yourself Secure Wallet

Now, as I’ve just mentioned, buying a wallet is a key part of your journey into the world of cryptocurrency. But you can’t just buy any old wallet – it has to be compatible with the specific cryptocurrency you are looking to invest in. So do your homework first and make sure the wallet you purchase supports the cryptocurrency you want to invest in.

As the crypto landscape expands, so do does the market for your crypto accessories. And it goes without saying that there are lots of different wallets to chose from. Some of the choices available include:

- Hot (or online) Wallets

- Cold (or offline) Wallets

- Desktop Wallets

- Paper Wallets

- Hardware Wallets.

To give you a helping hand in understanding the different wallets available, you can learn more about it in one of my previous blog posts on how to store your cryptocurrency.

While I do encourage you to do your own investigations into the different wallets available, I’m going to offer you a bit of advice here and recommend that you strongly consider a hardware wallet as your preferred storage method. Why? Put simply, there’s no other wallet out there right now that offers the same levels of security as the hardware wallet.

Step 3 – Identify A Reputable Exchange Platform to Trade On

So, you’ve chosen your currency, you’ve purchased a reliable wallet – now it’s time to start investing. But where should you invest?

When it comes to trading your cryptocurrency, I can’t emphasise enough just how important security is. You see, while the world of cryptocurrency offers you great levels of freedom and total control of your assets, that comes with a significant level of responsibility.

Indeed,when it comes to owning cryptocurrencies, the weight of the world is literally on your shoulders. There will be no contacting your bank to issue a replacement card if yours is lost or stolen. And there’s no bank watching over your assets 24/7 to protect you from fraudulent activity.

If you take a lax approach to crypto trading and storage, there’s every chance you’ll get burnt. And if you think I’m scaremongering, let me give you an example.

With over five million registered users, KuCoin is one of the largest and most advanced cryptocurrency exchanges out there. In fact, one in every four of the world’s crypto traders is signed up to the platform and when you look at its credentials, it’s easy to see why.

Sadly, things changed dramatically on 26th September 2020, when the crypto giant released details of a security breach that saw $150 million Bitcoin hacked from its exchange, along with an undisclosed sum of other crypto assets.

As I said, there’s a lot of responsibility that comes with owning cryptocurrency, so be cautious in your decision making. To guide you in the right direction, the two exchanges I commonly use are Coinbase and Binance. I even wrote an article on how I purchase Bitcoin fast and cheap through Coinbase.

But allow me to offer a word of warning. If you want to keep your cryptocurrency as safe as possible, don’t consider storing it within an exchange. As secure as many exchanges are these days, it really isn’t worth the risk.

Step 4 – Start Small to Think Big

As a newcomer to the world of crypto, it’s wise to plan your journey – and I’d highly recommend planning for a marathon rather than a sprint! You might well have seen numerous reports in the media claiming that this world is a bubble that’s soon about to burst, but don’t let that scare you into thinking you need to invest quickly and invest big before you dip out of the race for good.

As someone who has been actively engaged in the crypto world for quite some time now, I’m confident that we have gone way past the point of no return with the crypto bubble by now and I’d bet my bottom Bitcoin on it that when it comes to crypto, the only way is up.

Step 5 – Identify Sensible Trading Opportunities

Just as you wouldn’t put all of your hard-earned dollars into a throwaway investment, shop around with your cryptocurrency and you’ll find some really good investment opportunities for your assets. As well as shopping around, there are a few pretty solid rules of thumb that you might also want to consider when it comes to trading:

Sell when its high, buy when its low – There’s no great surprise here. Just as you’d buy and sell your traditional dollars when the market peaks and troughs, that’s also good advice for trading your cryptocurrency.

Trust the law of averages – Because you can never be 100% sure how high your crypto will peak, or how low it will trough, sometimes it’s safer to act on the law of averages. Many crypto exchange platforms out there will help you to do this by tracking the past performance of your chosen crypto assets and offer what it calls a moving average’. Use this to monitor how your currency is performing in the market and trade at a safe and sensible point in time.

Go with the Yale method – Over the years, there’s been lots of debate about when to buy and sell crypto currencies, so two economists from Yale University did their homework and came up with two methods to help us crypto traders in our decision-making.

As this five-step tutorial towards crypto confidence draws to a close, I want to end by introducing you to two last concepts that have become somewhat famous in the world of cryptocurrency. The first is FOMO – fear of missing out. Whatever you do, never act on a whim and don’t let people scare you. If you take an irrational approach to investing because you’re worried you might miss out, then you’ll end up on the losing end. So please, don’t let your emotions guide you.

And secondly, when you think you need to make a swift exit from the crypto world because your crypto assets have taken a sudden nosedive, think again and HODL. That’s right, when the going seems to be getting a bit tough and your palms start sweating, I strongly encourage you to hold on for dear life. Trust me and you’ll thank me in the long run.

Hi ,

I live in Sweden and i have huge interest in trading and investing in bitcoin, ethereal etc. I’ve been doing some research on these but my biggest worry is how to pay tax on any profit i make because i do not want to incure the wrath of the law and would rather my pay tax diligently. However this is my 1st attempt at investing for financial freedom and would love to have your input on how to go about it. Does it require opening an ISK account or what ! Thank you so much in advance !

Hi Temi,

If you are looking at investing in BTC and ETH, there are some certificates that you can have a look at through Avanza. Bitcoin XBT and Ethereum XBT are certificates that aim to follow the development of the two coins. The certificates allow you to trade BTC / ETH like funds, however you don’t own the underlying coins. There is also a small management fee (like 2.5%) and a standard tax (like 0.5%) that also gets added. But you can have it in the ISK and you don’t need to pay profit tax on it!

Hope that helps

Matt