Doing crypto taxes and avoiding issues with the IRS (or other tax agency) without errors can feel like untangling a ticking bomb.

Aside from the slightly confusing laws, keeping up with every single transaction on all platforms can be a huge challenge.

That’s why tools that help you organize your cryptocurrency taxes come in handy. With a crypto tracking service, you can keep things organized and save yourself a lot of headaches.

This is a general introduction to crypto taxes and why you should consider using Cointracking as a solution to help you stay on top of taxation.

Affiliate disclaimer: Some of the links below may be affiliate links (disclosure). If you use these links to buy something we may earn a commission (which come at no additional cost to you). Thanks.

Not Taxation Advice

Please not that this is not taxation advice. This material has been prepared for information purposes only and should not be relied on for any tax, legal or accounting advice. Everyone has a different taxation situation that should be discussed with a professional accountant, which I am not.

Cryptocurrency

Cryptocurrencies have changed the landscape of what we consider an asset. Digital assets like Bitcoin and Ethereum have opened up a new horizon for investment and passive income possibilities.

The underlying technology behind cryptocurrencies, blockchains, allows for a completely decentralized platform for peer-to-peer transactions. The security and reliability of cryptocurrency transactions allow for getting rid of the role of centralized banks and central economic powers.

Due to the inflation happening with fiat currencies, cryptocurrencies like Bitcoin offer an escape for people who want to avoid the negatives of old money. Fiat currencies lose their value, while cryptocurrencies like Bitcoin will never lose their value because a limited number of them circulate. While fiat currency can just be printed, you have no possibility to manipulate cryptocurrencies because everything is out in the open. Every transaction that happens on the blockchain is there where everyone can see it.

Related:

5 Steps to Getting Started with Cryptocurrency

How to Store Your Cryptocurrency

Understanding Cryptocurrency Terminology

The Rise of Cryptocurrency

The world of crypto is mainly interesting to us because of the possibilities for investment. The rise of Bitcoin and Ethereum in the past few years to the mainstream conscious marked a new era of what we value as an asset.

Ever since the Bitcoin project succeeded after its launch by Satoshi Nakamoto in the late 2000s, blockchain has become a hit. By the mid to late 2010s, the story of cryptocurrencies has developed to become one of the most popular topics in the mainstream.

People started to make millions of dollars from very small investments they made a few years ago. And the whole world wanted to join their success. That’s when Bitcoin and Ethereum skyrocketed.

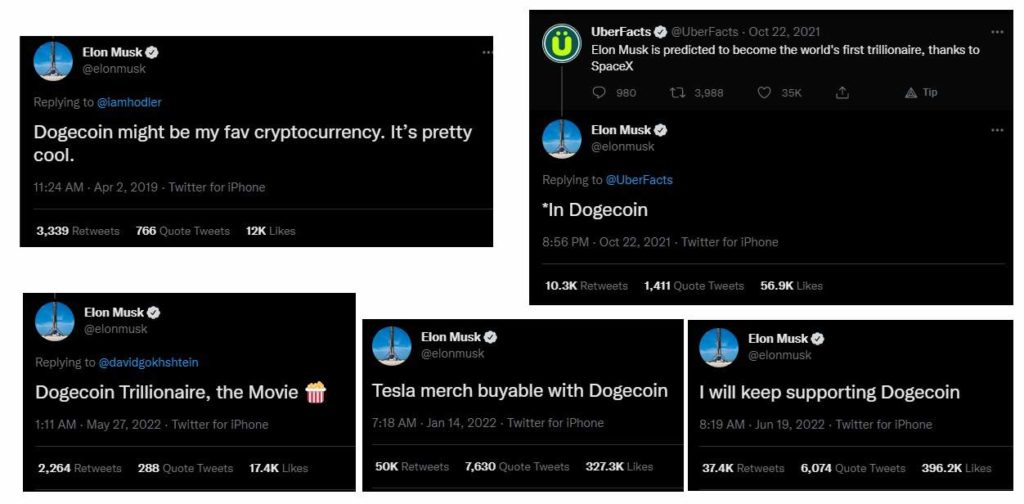

One of the interesting phenomena in the world of cryptocurrencies is the DogeCoin, which was just another insignificant new coin with a little bit of potential. Suddenly, Elon Musk tweeted about DogeCoin and the coin went to the moon, as the holders say.

Governments trying to keep up with the world of crypto

With the rise of cryptocurrencies to the mainstream, governments joined the hype in their own way.

Governments will chase you down and eventually find a way to tax you for any gains you make.

But cryptocurrency is so hard to do taxes – The difficulty of doing crypto taxes. Each transaction triggers a taxable event and people use many platforms for crypto exchanges; it’s so hard to track.

This is where platforms and services like Cointracking and Cointracker come to good use.

How Crypto Is Taxed?

This section will tackle all the most common scenarios for taxable crypto transactions.

For the IRS, cryptocurrencies are considered more like assets than currencies. So, they’re taxed for any capital gains you get from selling them.

Purchasing a Cryptocurrency

For example, if you bought ETH for $1,000 one year ago, and that ETH is now $3,000 when you want to sell it, there are some tax implications.

The seller has to report the transaction as gross income based on the market value of the U.S. dollar at the time.

The buyer has to report the transaction as capital gain based on the value of the coin at the time of the transaction.

Taxable Events Using Cryptocurrency

Cryptocurrency brokers have no need to issue the 1099 forms to their buyers, just like stockbrokers. But, traders have to disclose all their transactions to the IRS to avoid tax evasion charges.

Taxable events include:

- Exchanging cryptocurrency for fiat currency.

- Paying for goods or services.

- Trading cryptocurrencies.

- Receiving mined or forked cryptocurrencies.

Not taxable events according to the IRS:

- Buying cryptocurrency with fiat money

- Donating cryptocurrency to for non-profit or charity

- Giving away cryptocurrency as a gift

- Transferring your cryptocurrency between your wallets

Determining your capital gains and taxable income can be a challenging task if you do a lot of transactions.

Cashing Out Cryptocurrency

Just like with any other asset, taxable profits or losses on cryptocurrency are registered as capital gains or capital losses.

When exchanging cryptocurrency for fiat money, you need to keep track of the numbers in the transaction.

Any profits you make from a transaction are subject to taxes. Suppose, you’ve been holding a coin for a while and it’s now double its price. All that profit you made will be taxed according to the terms of the IRS.

Mining Cryptocurrency

Mining cryptocurrency has different rules. It’s considered earnings. You need to subtract the hardware and electricity costs from the capital gains you make before you turn to the taxable capital.

Paying for Purchases With Cryptocurrency

Paying for goods using cryptocurrency works like selling it for fiat currency. Even if you use a very small fraction of the coin, you’ll still need to pay taxes for it.

Taxes are subtracted from the capital gain you’ve made from the time you’ve purchased the coin to the time you used for purchasing what you purchased.

Swapping Cryptocurrencies

Swapping one cryptocurrency for another is also a taxable event.

If you buy ETH with Solana, you’re effectively selling Solana. That means you owe taxes on the difference in the price between the two currencies in the U.S. dollar.

The Solution to Keeping Track of Crypto Taxes

Most of the trading platforms offer you free exports of all your data to keep all your crypto transactions organized.

Cointracking offers the ultimate solution to manage your crypto taxes. It has all the tools and features you’ll need to keep track of all your transactions and calculate your taxes.

You get direct imports from all of the most used platforms and wallets. And you also get a legacy track for all the closed transactions.

Cointracking allows you to analyze and generate real-time data in the form that suits you the most.

With Cointracking, you get real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes, and more.

When you have everything organized, you leave nothing for the IRS to pursue you for.

Crypto Taxes FAQs

How to Report Cryptocurrency Earnings on Your Taxes?

All the profit you make from trading cryptocurrency or from purchasing stuff is taxable and considered a capital gain.

Your earnings from mining cryptocurrencies should be reported as income.

The added value you receive from buying or trading cryptocurrencies is considered earning.

The value of your transactions is valued at the price of the U.S. dollar at the time of the transaction.

When to Pay Taxes on Cryptocurrency?

You trigger a taxable event whenever you exchange cryptocurrencies for a value more than the value you bought it for.

Whenever you make a profit from a cryptocurrency transaction, you’re required to report that to the IRS and expect to pay a tax for it.

How Do I Avoid Paying Taxes on Cryptocurrency?

As long as you don’t cash your cryptocurrency assets into fiat currency, you’re not required to pay any taxes. It’s the act of transacting with them that triggers a taxable event.

If you’re a crypto miner, your crypto earnings are considered a regular income and taxed accordingly. You’re eligible to deduct your business expenses, like hardware and electricity, and make your taxes less expensive.

Do Different Cryptocurrencies require a Different Tax Rate?

Short answer is NO. The value of the transaction is always based on the U.S. dollar at the time of the transaction. That’s how the taxable event is calculated.

Further Questions

The IRS (or your local taxation authority) will have set information on how to deal with cryptocurrencies (or other virtual assets). You should find a list of helpful questions and answers as to what applies. As an example, check out the frequently asked questions on virtual currency transactions on the IRS.

The Bottom Line

You can visit this blog on Investopedia on Taxes and Crypto to learn more about the subject. There are many details about the subject of Crypto Taxes that I haven’t tackled in this article.

If you feel like getting to know more, you can check out Cointracking for more info. You should also consider signing up to understand the full weight of the importance of such a platform for people who deal with cryptocurrencies.

To avoid all the unnecessary problems with the IRS, you might want to schedule a meeting or sign up for a consultation session with a crypto consultant or a tax consultant.