Hello Everyone! Welcome to my February update, where I will discuss my returns for January 2021. This one is out a lot quicker than the last, so lets jump straight in.

- Since inception (Nov 2020) my American share portfolio returned returned 22.6% against the SPDR S&P 500 ETF which returned 11.07%

- my P2P and Crowdlending investment profile returned an average of 0.35%, bringing my total for crowdlending to a return of 0.35% for 2021. My highest returns came from Mintos (0.83%), Bondora (0.71%), and Plenti (0.54%)

- my Solar panel system generated 104 kWh of energy this month (paid out in BTC), bringing my total energy production to 715 kWh. Total carbon saved – 736.76 kg

- my total investment portfolio decreased by 1% from last month.

Quick Summary

The main items that happened throughout January include:

- Purchased additional solar cells in Nhimbe Fresh – Packhouse & Cold Store and Spar Plaza through The Sun Exchange.

- Purchased shares in the newest project from Reinvest24 – A residential building in Spain!

Overall Asset Allocation

Here I provide a “big picture” of my asset diversification. I also drill down into the differences within my crowdlending portfolio

[visualizer id=”36018″ lazy=”no” class=””]

[visualizer id=”35423″ lazy=”no” class=””]

This month I withdrew some money from Crowdestor, and added it into the new Spanish project through Reinvest24 (more about the below).

Progress Towards Financial Freedom

[visualizer id=”37500″ lazy=”no” class=””]

The above graph is not net wealth, but instead my progress towards a set goal for my investment portfolio.

This month I was able to increase my investment portfolio way over my proposed guideline. This month I had a loss of 1%. Nothing to worry about – just movements in the market.

What is really encouraging to see is that I have beat my expected return for 2020 by just over 5%. I wasn’t expecting to hit this point until year 4. As long as I continue with my investment plan, I should now reach financial freedom much earlier than initially planned. However, I do understand that we are in a massive bull run at the moment, and that value can drop 20% quite easily. I am in it for the long haul, so I’m not worried.

I have been on the financial freedom path for a while, however, I have not documented my progress until now. Instead of using actual values, I am using percentages (with the goal being 100%). I have an initial conservative plan of 20 years and have provided a guide as to my current progress. You can also see my longer-term graph (i.e. the next 20 years) back on my main returns page.

Share Portfolio

As can be seen below, this month I extended my lead over the over SPDR S&P 500 ETF. Obviously this is early early days, however, my goal is to be able to match the fund, while also being able to generate passive income through dividends.

Now, my portfolio is not solely based on dividend companies. I do have other growth stocks that don’t pay dividends, however these are in other currencies and exchanges, and not a part of this account shown here.

[visualizer id=”37079″ lazy=”no” class=””]

If you are interested to see the breakdown of the investments, please see the chart below. I have a list of additional companies that I am interested in purchasing soon, however I am just waiting for a cheaper entry point.

Dividends received last month:

- CSCO

- MSM

[visualizer id=”37081″ lazy=”no” class=””]

P2P and Crowdlending

Quick P2P News

Here is a quick one-liner on some interesting things that were happening around in the P2P space in January:

- Reinvest24 have released their first project in Spain and are offering a 1% cashback to celebrate (until 22/02).

- The Sun Exchange have held a conference call on how they conduct their due diligence.

- Mintos updated their Risk Score and subscores for loans available.

- Grupeer has said nothing and repaid nothing (3 months now).

My Returns in Crowdlending this month

This month saw my P2P and Crowdlending profile return on average 0.35%, which is a lot smaller than expected. The last few months of 2020, I was starting to see over 1% average return. The new year has brought a bit more clarity to my position on various P2P platforms. With the problems of various platforms in previous year, I will only be adding more money into a select few companies that cater for different sectors:

- Mintos – for investing in consumer loans.

- Crowdestor – for investing in business loans.

- Reinvest24 – for investing in Real Estate.

Unfortunately the other P2P platforms in my portfolio haven’t performed as well as I would have liked, and hence, I am slowly reallocating money into other platforms. The above platforms will and will join other alternate investment platfoforms such as The Sun Exchange (solar panel leasing) and AxiaFunder (litigation funding).

[visualizer id=”37515″ lazy=”no” class=””]

With the above new reconfiguration in mind, I am specifically reducing my positions in Bondora, Fast Invest and Plenti. This money will then get redistributed into Reinvest24 and The Sun Exchange. I will go into detail as to how I have made my choice:

Bondora

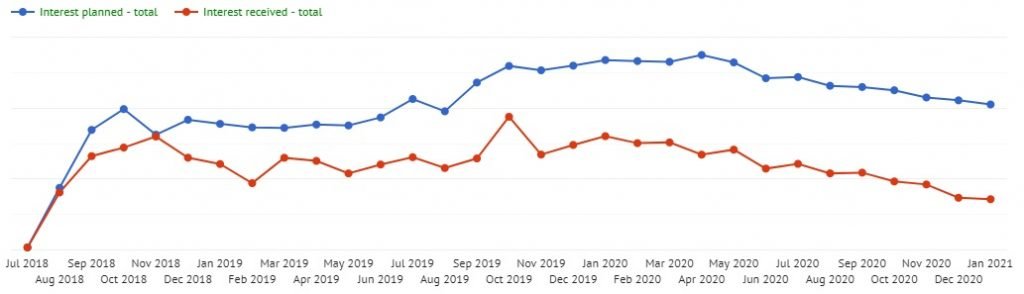

So, I think this has been a while coming. I had noticed that other bloggers had started to reduce positions, but I held my ground and made sure that I only invested in quality loans (i.e. ones that had a previous history of payments from people with high credit ratings). But once COVID hit, the gap between interest planned and interest received greatly increased. Now I’m at the point of getting only 30% of my planned interest each month. From the look of this cashflow graph, that gap only looks to be increasing.

Now this could be all come down to COVID and delays on payments. Maybe people will start paying again in a few months. Also maybe not. There are many other platforms that have performed much better. For me, I am going to say goodbye to Bondora.

Fast Invest

For me personally, I have been shying away from platforms that offer loans to individuals, and instead have been looking at investing into real estate and the stock market.

I don’t think I have to say too much about why I have chosen to reduce my investing in this platform. Basically, when the peak of COVID hit, the platform took more than 5 months to pay out money that was showing in our accounts. I don’t know what happens behind the scenes, (i.e. what was causing the delay), but I know that my other withdrawals from other crowdfunding platforms paid out within a few days.

I also think that the redesign of the website has removed a lot of the transparency as to the management team behind the platform. It is extremely difficult to find out who works for the company, or who is currently running it. Has there been any management changes that (as a investor) would be helpful to inform your investing decisions?

Plenti

This is the most simple one. I have been investing with Plenti for over 5 years. It’s my longest investment. It’s also the investment that receives the smallest return (max 6%). I believe that I can make that return (and more) through my share portfolio. Additionally, late last year, Plenti announced their IPO, which I decided to purchase shares in.

Crowdestor

Moving onto platforms that I am going to keep, but not add any money into. Crowdestor was my favorite platform for the majority of last year.

Unfortunately, some of these loans have been unexpectedly delayed.

Reinvest24

So, I have been talking a lot about investing more into Reinvest24 lately. But why do I like it so much? Well, there are so many things to like – you know who the management are, you’re not overwhelmed with the number of projects, all projects are real estate that can be confirmed through various other means, there is constant communication. Additionally Reinvest24 can provide a solid exposure to Real Estate, through fractional investing. This means that many people are able to combine together to purchase a building, or office space.

I personally prefer the tangible projects such as residential buildings or office spaces.

Reinvest24 currently have their first project in Spain, which is a buy-to-sell residential building, expecting to pay over 15% return. This project has many similarities to the Majaka 54 example. You can find more about Majaka 54, and why I like the platform in my Reinvest24 review.

This month I purchased shares in:

- Residential building in Xirivella (15.8%)

A flagship project on a new market – Spain. The unfinished building was bought at 450 EUR per sq. The estimated appraisal is almost twice as high.

Others

Mintos will stay the same. I am not currently withdrawing or reinvesting any more. I also am not adding any more funds to AxiaFunder currently. I discuss the Sun Exchange further down.

Here are the graphs and returns separated by platform –

Mintos

[visualizer id=”36035″ lazy=”no” class=””]

[visualizer id=”36027″ lazy=”no” class=””]

Bondora

[visualizer id=”36032″ lazy=”no” class=””]

[visualizer id=”36025″ lazy=”no” class=””]

Grupeer

[visualizer id=”36034″ lazy=”no” class=””]

[visualizer id=”36026″ lazy=”no” class=””]

Plenti (previously RateSetter)

[visualizer id=”36036″ lazy=”no” class=””]

[visualizer id=”36028″ lazy=”no” class=””]

Fast Invest

[visualizer id=”36033″ lazy=”no” class=””]

[visualizer id=”35990″ lazy=”no” class=””]

Crowdestor

[visualizer id=”35989″ lazy=”no” class=””]

[visualizer id=”36024″ lazy=”no” class=””]

Reinvest24

[visualizer id=”36037″ lazy=”no” class=””]

[visualizer id=”36029″ lazy=”no” class=””]

The Sun Exchange

A few months ago, I purchased some solar cells from The Sun Exchange (if you use the affiliate link, then you will get 1 free solar cell on your first purchase!). The Sun Exchange is the world’s first peer-to-peer solar cell micro-leasing platform. If you are interested in finding our more about the sun exchange, please check out my full platform review.

[visualizer id=”36117″ lazy=”no” class=””]

This month my cells were able to generate 104 kWh of energy (paid out in BTC), and I was able to purchase solar cells in the supermarket:

- Nhimbe Fresh – Packhouse & Cold Store | 510.3 kW Solar + 1 MWh Storage | Marondera, Zimbabwe (IRR 16.71%)

Helping an agricultural leader install solar panels and (for the first time) an integrated battery storage.

If you are seriously thinking about joining The Sun Exchange, the current Nibmbe Fresh project is hands down the one with the highest return on the platform (>16%). What makes it unique, is that its the project includes an integrated battery, which means that solar is being used 24 hours a day. Additionally the lease is denominated in USD (instead of South African Rand), and the lease payments are fixed per cell per month. You can find the information packet here, which contains everything you need to know.

Obviously do your own due diligence before investing.

My total energy generated through The Sun Exchange is currently at 715 kWh, which would allow me to drive 2,654 American miles in a Tesla Model 3 (just need to buy one first).

For some comparison, with 1 kWh you can, toast 160 slices of bread. So in that regard, I have generated enough power to toast 114,400 slices of bread.

AxiaFunder

Recently I invested in litigation funding through AxiaFunder. This is external to other platforms, as the income is not controlled by borrowers ability to pay a loan on time, the currency exchange rate, the markets, or other global health pandemics.

AxiaFunder connects investors with carefully pre-vetted commercial litigation opportunities. The platform invests in legal cases where there is a high probability of winning at court, with potential returns of 20%-30% pa. The only downside with litigation funding – returns are not guaranteed, there is a risk of loosing all of the investment if the case fails, and in some very extreme circumstances, could have to pay more than the amount you put in. (every case is insured, but if the insurance company was to default, then the investors would need to fund more of the project).

Projects are few and far between, and usually last for long periods of time >12 months.

Journey to 1 free Bitcoin

My journey is still an ongoing work in progress. Playing games, making Coin. If you want to see what this is about, I encourage you to find out more through my main article – My Journey to One Free Bitcoin

Coinbase Earn

Coinbase Earn now offers a couple of dollars learning about NuCypher. NuCypher brings data privacy to public blockchains using end-to-end encryption and threshold cryptography.

Here is how it works

You watch some short videos through Coinbase, on how various cryptocurrencies work. From there you earn various cryptocurrencies as a reward. I have earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). I wrote an in-depth article that you can find here.

Money Savings

With so much work, and not a lot of time to be on Twitter, so there haven’t any original tweets in a while now!

Progress on Internal Changes

In a past update, I made a pledge to update sections of my blog. I will keep this section here until these tasks are fully complete. The remaining tasks are:

- (Priority #1) Adding a page outlining some basic steps for how due diligence can be performed. (started writing this)

- (Priority #2) Adding a section to each platform review with my own due diligence.

- (Priority #3) Placing stronger disclaimers within each platform review page saying how my interests lie within the article.

(Note: currently, there are already disclaimers on all of the pages, however, I will look to have them as more of a focus) .

You read it all the way through to the end (or you just skipped half of it)! Regardless, thanks for checking out my update this month!

I do encourage you to comment below, and sign up for my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.

I’m finally taking a serious look at the crypto market. Have you heard of BlockFi? I heard about it on the Animal Spirits podcast. Seems like a unique spin on a crypto wallet, with the ability to earn daily interest in BTC.

Hey,

Yep, I have heard of BlockFi, and even written something quickly about it in one of my cryptocurrency posts. I am using MyConstant at the moment to grow BTC, and it seems to be working well. About 8% for BTC! I think with BlockFi you only get about 6%?

Hi,

I researched your investment in Spain but it is nor advertised anymore. Is this because the funding has been completed?

Many thanks

Hi Kitt,

Yep, the funding for the Residential building in Xirivella, Spain, has now fully funded. You can still find people selling their shares in the Secondary Market, but these are usually sold with a small premium. There is another spain development project “Montesano residential complex – 5 houses” that was released in the last week or so. That also looks interesting!

Matt

Thanks! What happens if a project does not achieve 100% funding?

That’s a good question. It hasn’t happened yet. In the past I think there was one close to being finished, and they extended the date by a month.