What Is Crowdestor?

Crowdestor is a crowdlending investment platform, providing a connection between businesses requiring financing and investors. Investors can be attracted to such loans as they provide a much higher than interest compared to a bank account. The platform offers various investments in diverse projects with returns north of 20%. Continue reading for my Crowdestor review below.

- What Is Crowdestor?

- About Crowdestor

- Statistics

- Account Setup

- My Crowdestor Returns

- Account Dashboard

- What types of loans are available through Crowdestor?

- The Secondary Market

- Crowdestor's Provision Fund

- How does the Crowdestor Provision Fund work?

- Early Investment Reward Scheme

- Detailed Project Information

- Crowdestor Trustpilot Score

- Crowdestor Equity Campaign

- Crowdestor Team

- Investor Relations

- Questions Answered by the CEO

- Referrals

- Crowdestor Fees

- Crowdestor Review

About Crowdestor

Crowdestor (www.crowdestor.com) is an Estonian crowdlending platform created in 2017. The name Crowdestor is a combination of Crowd and Investor. The platform connects investors with businesses seeking project funding. The amount of projects on offer varies each each month, with most seeking funding between €12,000 and €750,000. Projects span many industries including real estate, hospitality, retail, concerts, renewable energy, and more recently, forestry, movies and games. Most projects are covered by a Provision Fund (previously buyback guarantee fund), which is a stash of money to reimburse investors if a project was to default. The provision fund currently has a pool value of over €360,000+. Other features of the platform include:

- No fees to the investor

- Secondary market

- Minimum investment of €50 per project

- Minimum withdrawal is €10

- Early investment reward scheme

As with other P2P platforms, transfers will work through Wise (formerly TransferWise) or Revolut. However, Crowdestor will not return withdrawals into a Wise account.

Statistics

- Crowdestor is a private limited company registered 12 December 2017

- Average Interest rate: Projects range from 12.5% – 26%

- Registered Investors: 13,375 (Apr 2020)

- Total funds invested: 33,471,560

- Projects funded: 348

Register now with Crowdestor. Use this link to receive a bonus 1% cashback on investments made within the first 90 days after registration.

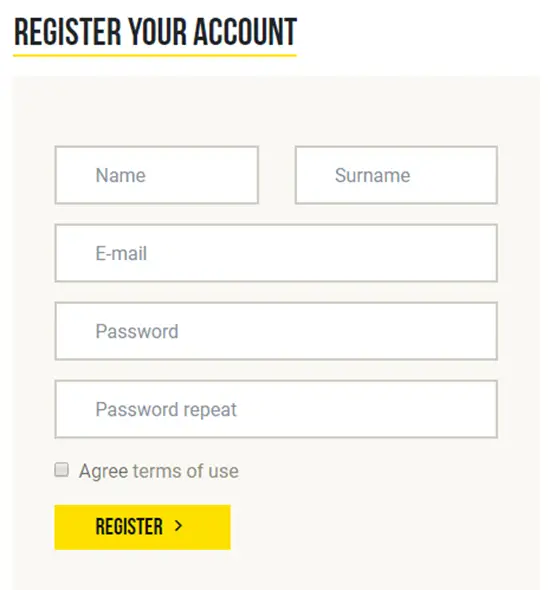

Account Setup

Once you have loaded the Crowdestor page, there is a login/register page that allows new investors to sign up.

Investors can be from anywhere in the world, as long as they are over 18, and have a European IBAN. The sign-up process is simple with a form seeking name, email and password.

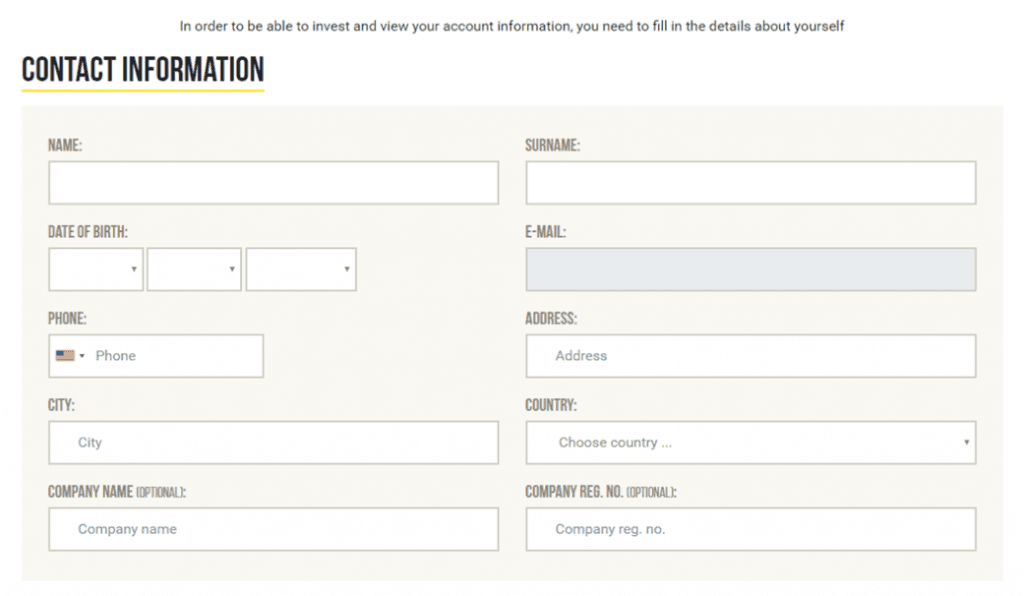

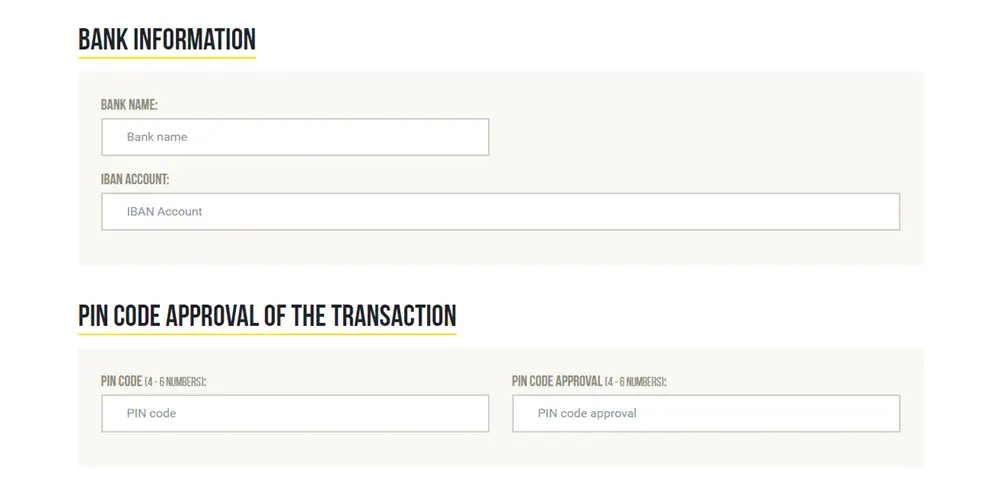

Once that form is complete, the investor will be asked some more questions about date of birth, nationality, and if they have registered as a company or not. The investor will also be asked about bank information and will be required to set up a pin code to be used when signing transactions.

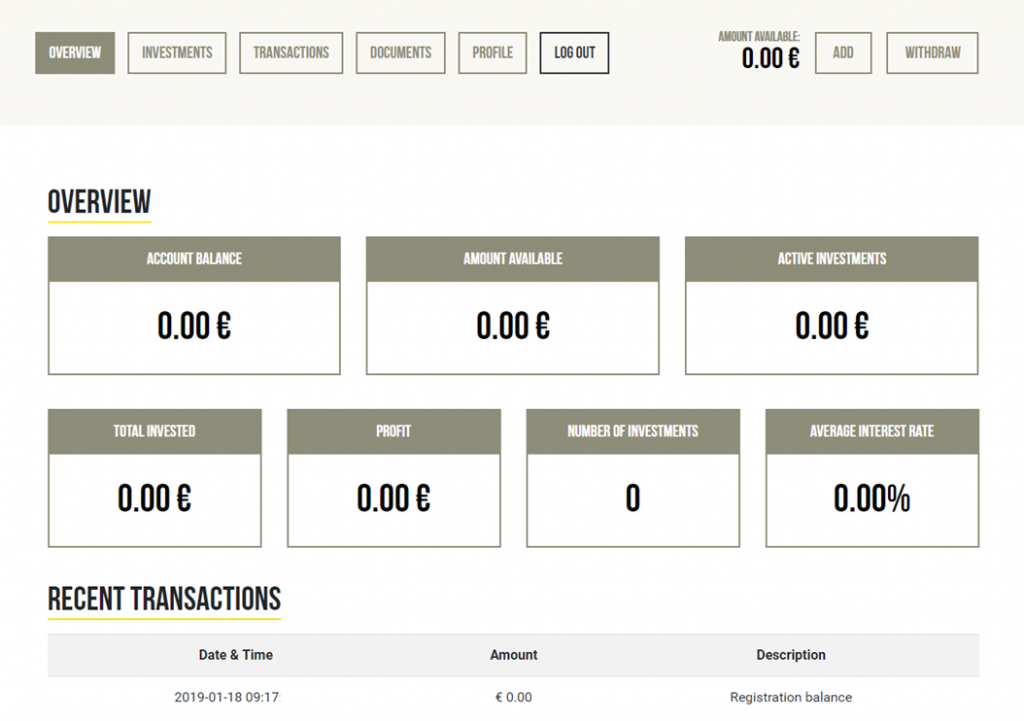

Once your details have been reviewed and accepted, your account is activated and you can see the profile page.

My Crowdestor Returns

I have invested in the platform since February 2019, and I am very happy with the results so far. More of my results can be found here.

Account Dashboard

From the dashboard, users can see an overview of their profile including current balance, money available, total invested, active investments, profits, number of investments and average interest rate. Below the statistics, there is also a list of most recent transactions. From the dashboard, investors can easily add or withdraw money.

What types of loans are available through Crowdestor?

The platform offers a wide variety of loans, in projects including:

- Real Estate (housing, apartments and retirement villages)

- Hotel or Apartment Renovations

- Businesses (Bars, Retail, Fashion, Health Care, Grocery Stores)

- Summer Concerts

- Renewable Energy

- Forestry

The Secondary Market

In October 2020, Crowdestor released new updates to their system, which included a new dashboard, and the secondary market.

The secondary market allows investors to buy and sell investments from others in a quick and easy fashion. There is a filter function which allows users to select investments based on the project number.

Investors are able to sell any of their investments easily by going into the “My Investments” tab. from there, you just need to click on “sell” and select how much you want to sell the whole

The Secondary Market is very much in its infancy, and there have been many improvement suggestion raised. These include being better understand the premium and discounts, and remove or alter secondary loan orders.

If you are buying on the secondary market, ensure that you know work out how much you are paying, and how much is expected to be returned to you. There are no take-backs!

Crowdestor’s Provision Fund

Crowdestor offers a Provision fund (previously Buyback Guarantee Fund), which is used to safeguard an investors return in case a borrower defaults on their loan.

A percentage of each project (0.5%) will enter the provision fund. The fund was expected to reach €100,000 by the end of 2019, however, this goal was reached halfway through 2019. By June 2020 the fund has over $360,000 available.

How does the Crowdestor Provision Fund work?

So, what happens if a borrower was to default on their loan? Let’s work out how much would be paid back out.

Crowdestor’s description: The amount of the defaulted loan will be divided by 10% of the outstanding loans. Here is an example:

To work out how much the provision fund will return, we first need to work out the current amount of all outstanding loans. In July 2020 this number was at $20 million. Crowdestor say that they will pay out 10% of this figure. Therefore, 10% of $20 million is $2 million.

If the amount of the defaulted loan was $100,000, then to work out how much will be returned to investors, we have to divide that by the 10% of outstanding loans ($2 million).

$100k / $2 million = 5%.

This is now the percentage of the provision fund that will be allocated to the defaulted project. The provision fund is at $360k (July 2020).

5% of $360k = $18,000

So, in this above example, $18k would be paid out, if a $100k loan was to default.

Please note: This payout supplements the security / collateral that is already provided by the borrower. Investors of defaulted projects will be provided with funds coming from selling loan securities.

Early Investment Reward Scheme

In addition to the already high-interest rates, Crowdestor runs an early investment reward scheme which provides additional interest to investors who commit to projects before funding deadlines. The additional interest is calculated according to the project interest rate, and the timeliness of your investment in relation to the funding deadline.

If the project is not successfully funded, the additional interest will still be paid into your investment account.

Additional interest is included in the first interest rate payment.

Detailed Project Information

Once a project has been released on the platform, prospective investors are able to see a lot of information that relates to the borrower. The information usually includes:

- a summary of the project

- the loan conditions (amount, interest rates, expected payment dates, and loan run time)

- security and/or collateral placed on the account

- information about the borrower (including financials and offered services)

- future plans of the company or industry

- what makes it a good investment

- the risks associated

- supporting documentation.

Crowdestor Trustpilot Score

The Platform is currently sitting on a Trustpilot score of 2.7 out of 45 reviews. Poor reviews mainly relate to project delays, and the support team takes a long time to meet responses.

Crowdestor Equity Campaign

Crowdestor aims to become a top 3 crowdfunding platform in Europe. operating in SME/business sector. To do that they are seeking various equity raisings. This money raised will improve automatization solutions such as financial data aggregation, OCR technologies, automated scoring and underwriting processes. In total, the platform aims to expand to 5 new EU countries in 2020 and another 5-7 countries in 2021.

In order for that plan to be met, The platform offer investors a chance to take part in the platform. People that invest in the Crowdestor equity campaign will recieve a minimum return of 26% per year, with a potential of 30x your investment in 4-5 years. Crowdestor has released a whitepaper that members can download the next time an equity campaign round opens up.

Crowdestor Team

The Crowdestor team consists of various people found here. Some notable mentions include:

- Janis Timma CEO & co-founder

- Gunars Udris COO & co-founder

- Artur Geisari Head of SME

Investor Relations

The Crowdestor team constantly talk with, and update investors on the goings on of the platform. There has is a Facebook page set up by Janis Timma, which allows constant communication with the management team.

The Facebook page can be found here. To join you must be a member on the Crowdestor platform.

Questions Answered by the CEO

Every now and then, Crowdestor will run a 10in10 session, answering 10 questions in 10 minutes. You can find some of the previous episodes below:

Referrals

Crowdestor offers a nice bonus referral system if you were interested in investing. If you use this link there will be 1% for you + 1% for me = for 90 days

Invite a friend, and you both will earn 1% each from the investment that your friend will make.

Starting from the first investment, you will continually receive 1% for the next 90 days.

Crowdestor Fees

There are no fees for investors that register through the platform:

Account Sign up | €0 |

Account management | €0 |

Contracts | €0 |

Making an investment | €0 |

However, if you are planning on borrowing money, then there are fees for structuring the loan, administration, establishing and releasing the mortgage by Crowdestor Security Agent, and Notary fees.

Crowdestor Review

Crowdestor is not my favourite platform (anymore). It was my favourite platform for a while, however it is hard to skip over the fact that so many of their projects are delayed. Of course this has something to do with Covid, however there could have been more communication and organisation. In one specific example, the day before a project was meant to pay out, we get a message saying that there will be a three month delay as the borrower needs to refinance. No other payments of the project were delayed, and there were no warnings signs.

In 2020 the platform released more information about their provision fund, including the distribution rules for payout of the fund. The fund was seen initially as a safety net, however, as stated on the website, “the existence of the Fund does not guarantee the full or partial repayment of lost investments and investors must still consider all the risks involved with their investments.” The money can be used to offset some of the burden of default, however will have to be used in combination with any collateral. Crowdestor is still the only platform that has this fund available, proving that they can actually pay something back to investors. Crowdestor makes it very clear. It is important for the investor to choose projects that utilise the provision guarantee, as not all do. You can find this information under the “loan” section of each investment. This fund isn’t the only backstop for loans defaulting through the platform. There are usually securities placed on each loan, ranging from guarantees, land pledges or pledges of real estate. The value of the provision fund is publicly listed on the website, and can be found here.

The platform will act as co-financiers or co/developers for each project on the platform. This means that there is more accountability from the development partners.

Crowdestor will provide advanced notice of projects to provide time for investors to (1) add funds to their account, or (2) find out more about a project. Even with the advanced notice, projects take a few days to get fully funded.

The platform provides very detailed information about projects, including key metrics (such as probability of default, loss given default, and improvements among other things) backstories about projects, financials, company outlooks, and performance of investments. It does seem like Crowdestor is preparing for the regulation of crowdlending platforms later on in the year. This does provide confidence that they will be around in years to come.

Thank you for the review! You’re not the only P2P blogger who has the largest share of their portfolio invested in Crowdestor. As a sceptic I see many red flags on the portal. There is close to no visibility in terms of overall performance statistics (total loan portfolio, remaining portfolio, late payments, successful exits). Information concerning funded projects is limited only to investors. 4 out of 5 open projects already individually aim to loan more than the buyback fund is currently worth. Some are obviously secured with mortgage but working capital loans are exposed to defaulting. What are your takes on the aforementioned concerns?

Anyway, stumbled on your blog accidentally and I enjoyed what I read here. Looking forward to future posts. 🙂

Hi Marko,

Thanks for stopping by! I see where you are coming from in terms of the red flags. I can’t speak on behalf of Crowdestor, but I can comment from my side.

I have been invested now in Crowdestor for the last 7 months, and the company has only been existent for the last 18 months. In the short time that I have been investing, I have invested in 10 projects. All of these projects have had their interest paid according to the payment schedule, including one of the projects being fully repaid (Restaurant & Lounge – AQUA LUNA). I agree that the platform lacks appropriate statistics. You can find that some of the earlier projects have already been paid back (but you have to scroll through the investment pages to see).

I am not sure why the platform makes that past information only available to previous investors. Maybe they think it’s not relevant for others, or possibly they don’t want to have certain things copied?

The buyback fund complements the collateral that is already on the investments. Even the working capital have some securities of assets and pledges. I think of the buyback as an added protection.

For example, platforms like Envestio, Widefund, Monethera, Kuetzal etc only have the collateral as security (some of these say they have a buyback investor to pay out on defaults – however, there is no evidence of this).

Crowdestor provides the evidence. The buyback fund has only been in place since the 1st of March, so it will take a little while to build up.

The other thing that Crowdestor offers over the above-mentioned platforms, is that they take part as co-financiers and/or co-developers. I find this to be pretty important, as then they see how the company is running and using the provided finance.

Matt

Hello Matt!

Can you withdraw the winnings to a revolut card and not to the bank account you funded?

Thank you!

Hi Groege,

Thanks for the comment. I have only ever funded my account with my Revolut card, so I am unsure whether you can withdraw to another account.

It’s likely you would need to have sent money from your Revolut card to confirm the account (and allow money to be sent back).

There will be an update to their platform soon, so this may also be covered in that!

Otherwise, shoot Crowdestor an email to find out!

Matt