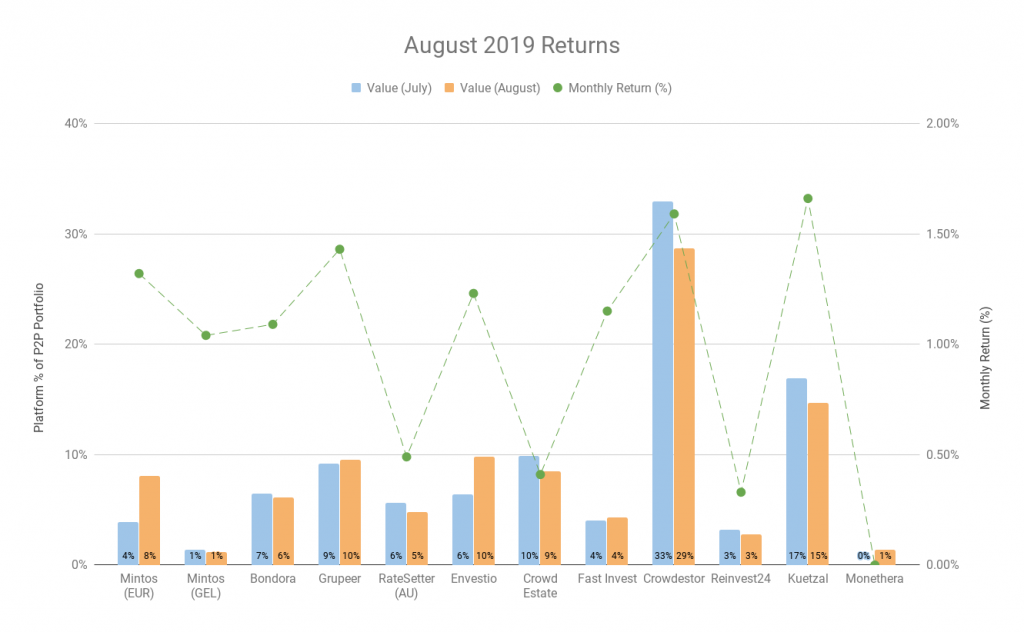

In August my P2P and Crowdfunding investment profile returned an average of 1.28%. These highest of these returns came from:

- Kuetzal (+1.66%)

- Crowdestor (+1.59%)

- Grupeer (+1.43%).

Quick Summary

The main items that happened this month include:

- $100 worth of free cryptocurrency through Coinbase Earn

- Investing through a new platform – Monethera

- Being accepted into a MBA program

- New articles:

My Returns This Month – Passive Income

[visualizer id=”35446″]

This graph shows how my returns were generated this month. Both interest rate and size in my portfolio are taken into consideration here.

[visualizer id=”35423″]

My current crowdlending portfolio distribution.

P2P and Crowdlending

This month saw my profile grow on average by 1.28%, which is the same as last month. If I can keep this rate up, I would see my yearly return being equal to 15.5%.

- Since the start of this year, my P2P and Crowdlending portfolio has returned 8.38%

- Since the beginning of tracking my portfolio, I have been able to make 13.8%.

This month I saw higher than expected returns through Grupeer and Mintos platforms. Grupeer utilised the 2% cashback offers. Mintos received interest income on loan rebuys (i.e. the interest that would have accumulated while a loan heading towards default).

I invested in only a handful few loans from the P2B platforms this month. These include:

Envestio

- Fashion wholesale company financing (11 months 17.3% p.a.)

Increase of working capital of a fashion wholesaling company

- Biomass fuel-Factoring 9 (9 months, 16% p.a.)

Factoring-type financing for the purchase of raw woodchips

- Financing the construction of Briana 4 residential – part 3 (12 months, 18%)

Financing of reconstruction and building a premium real estate project in Riga, Latvia

Monethera (new platform)

- Sturgeon farm productions extension (6 months, 18.2% p.a.)

Production extension and creating new special hangars for growing sturgeon’s uteruses and caviar harvesting.

I am currently trying out Monethera to see how the loans and the platform perform. At this stage, there have been no problems, and I have already received an interest payment (for next months update).

This month I also doubled my holdings in Mintos. The invested money went straight into the Invest and Access account, where I can generally access it when required. If you need a refresher on how the Invest & Access account works, you can check out my review article here. No new loans were bought from Kuetzal, Crowd Estate or Reinvest 24.

Other crowdlending platforms such as Fast Invest, Grupeer, Rate Setter, and Bondora kept churning away. No news to report.

Agrikaab

Agrikaab has commenced building the Galkacyo rain pond this month. Forecasts for Autumn rains look promising!!

Read more as to why I invested in rain harvesting ponds in Africa here.

Share Portfolio

Nothing new to report. No buys or sells. Just waiting patiently for opportunities to pick up some low hanging fruit!

Cryptocurrency

I am still playing Crytpo Idle Miner, which is a game that provides real cryptocurrency (HORA Tokens) as a reward. You can find my Crypto Idle Miner review here. As of today, my free HORA tokens are worth ~0.00139725 BTC, which equates to a nice 14 USD. That’s about 40% less than what they were worth last month.

Looks like my goal to make 1 free BTC may be a while away yet.

But wait! This month I have found another way to earn some free cryptocurrency. It’s through Coinbase Earn. I wrote an in-depth article that you can find here. If you can’t be bothered going into the article, then here is the rundown:

- Create an Account with Coinbase

- Watch some videos (2 mins max) about different cryptocurrencies and how they work

- Get rewarded with small amounts of those cryptocurrencies

So far, I have made $100 AUD (~65 USD) for learning about crypto (about 20 mins in total). I earned some Ethereum (ETH), Stellar Lumens (XLM), EOS (EOS), Basic Attention Tokens (BAT), and Dai (DAI). My crypto journey continues…

Other Side Hustles

My little hydroponics setup. Sigh… This month everything was going so well, but (..of course, there is a but), I forgot to stake up plants properly. Strong winds came overnight and knocked my prized (not monetary wise, but in terms of my first hydroponics achievement) tomato plant. But we learn and move on.

The plants that are inside (capsicum, chilli, artichoke) are fine, however, I think they need some stronger lights. So, I will need to invest in a bigger setup. Hopefully, something comes out of it. Still, a long way to go until its producing some profit!

On the other side of things, I was able to get a tomato plant growing (in the garden). Here is a picture!

Socials and Traffic

Everything is still continuing up up up! This month was no exception.

- My twitter followers have increased from 287 to 346.

- My website sessions have increased by 60%.

- Pinterest is fairly stagnant ~15 followers.

Summary

Here is the summary of how my investments turned out this month:

[table id=15 responsive=scroll /]

Thanks again for checking out my update this month! I do encourage you to comment below, and sign up to my newsletter. The newsletter comes out once a month and includes this update and any other articles published during the month.

Good blog thanks for it !

I like it very much !

Why do you speak only in percentage, and never give the real value of your portofolio ?

Personnaly I choose to be fully transparent on my blog dmo-consulting.fr investing 50k€ in P2P Lending.

Hi DMO,

Thanks for the comment and for stopping by.

I don’t show numbers mainly for security reasons.

I also believe that just providing earnings from a crowdlending platform doesn’t really provide a clear picture to the readers. I would need to show my entire finances (income, earnings, expenses etc) to provide context. At this stage, I am not ready to do that.

It may change in the future, but not over the next few years.

I aim to write an article explaining it all soon!

Matt

Hi Matt,

I find your September 2019 update very useful. I am not sure if you are publishing a graph with the evolution of your blog views/sessions? It would interesting to see it, overall since you had a 60% increase this month!

Looking forward to more portfolio updates.

Gonzalon

Hi Gonzalon, thanks for stopping by!

I think the jump this month was because the blog was listed in the top 50 P2P lending blogs of 2019 – https://learnbonds.com/peer-to-peer-lending/top-50-p2p-lending-blogs

The graph wouldn’t be that amazing at the moment – the sessions are still under 10k.

Thanks for the feedback though! Once the views get up a bit, I will look at including them

Matt