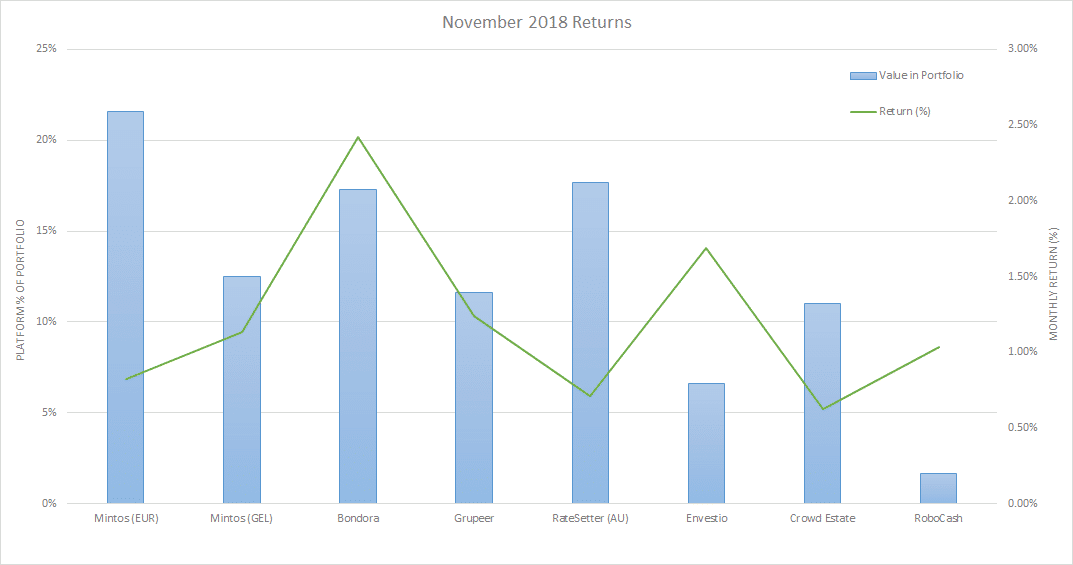

My portfolio of investment returns for November 2018 is below.

Platform | Nov 18* | Dec 18* | Deposits / Withdrawals | Month Return |

Mintos (EUR) | 0.393 | 0.346 | -0.050 | 0.82% |

Mintos (GEL) | 0.228 | 0.230 | 0.000 | 1.13% |

0.315 | 0.322 | 0.000 | 2.42% | |

0.212 | 0.217 | 0.003 | 1.24% | |

RateSetter (AU) | 0.322 | 0.324 | 0.000 | 0.71% |

0.120 | 0.122 | 0.000 | 1.69% | |

0.201 | 0.302 | 0.100 | 0.62% | |

0.030 | 0.030 | 0.000 | 1.03% | |

Average Return | 1.20% | |||

US Shares | 0.752 | 0.793 | 0.000 | 5.39% |

*All values have been brought back to EUR and have been standardised. The important thing is to not show you how much I am investing per se, rather how much return is possible each month.

This Month:

This month showed great returns from Bondora (again), and some other solid return through Envestio and Grupeer. Currently Grupeer does not have any loans available, but have suggested that they are working on adding more projects on their platform. Lets hope that they do add projects soon, and the projects are of the same quality as the ones previous.

I was also happy to see returns starting to be produced from Envestio and Crowd Estate. Envestio projects offer massive returns (over 20%) and I do wonder how sustainable those are. Crowd Estate can produce lumpy returns as some of the projects invested in will only be paid out at their completion.

This month I have also opened an account with Fast Invest, which I hope to bring you more information and articles on soon.

I have started to shy a little away from Mintos and Robo.Cash for various reasons. With Mintos I feel that some of the loans on offer are not of the best quality. A lot that I have come across have had late or no past payments, or were offering a sub-par interest rate. I always look for payment history (Read more here) as I find it can help determine if a borrower will pay you back on time! Robo.cash on the other hand released an announcement this month saying that all new loans added to Robo.cash will provide an annual return not exceeding 12%.

Personally this month was another busy one leading up to Christmas, I assume the next few will be similar. Hopefully I can make some time to do some writing over the Christmas break.

Hi

Interesting site but was keen to know on average how much to invest or start investing on these platforms?

What risks should I be aware of and how much time do you invest in following and tracking performances?

I am a bit in the dark and do not know how much I should consider investing to see real returns? 300euro 3000 euros?

Hi Warren,

Your the only one that can answer those questions!

Some people may start investing with as little as €50, and others may invest with €50,000. It all comes down to your risk tolerance. I generally try to keep a diversified approach among P2P lenders, and also other investment activities (shares etc.). I don’t like to keep all the eggs in one basket!

The risks are similar to other investment classes. You can check out a previous article on investment risks here. Specifically, P2P also has risks of defaults (which are generally mitigated my most loan originators), and risks that the loan originators themselves default. One of the biggest issues is that the loan originators are unregulated – meaning that they don’t have to abide by certain rules. However, each P2P platform is tied to a bank, and the banks face their own legislation.

Most of my loans are set through different reinvestment strategies, so I don’t need to spend much time selecting investments. Each month I spend an evening or two compiling these updates, which create an overview and easily allows me to track monthly performance.

At the moment I am averaging returns of ~12%. Based on 12%, you would need to invest €2,500 to receive €300 each year; €25,000 to receive €3000 each year; €30,000 to receive €300 each month.

Matt