What is Bondora?

Bondora is a Peer-2-Peer (P2P) investment platform (more on those here), allowing one a person (the borrower) to take a loan from another person (the investor). This allows a person to bypass a bank or other official financial institution in obtaining financial assistance. The result:

- a better loan interest rates for the borrower

- a higher investment interest rate return for the investor.

These returns can be much higher than interest, term deposits and other financial investments.

Affiliate disclaimer: Some of the links below may be affiliate links (disclosure). If you use these links to buy something we may earn a commission (which come at no additional cost to you). Thanks.

About Bondora

Bondora (www.bondora.com) is an Estonian P2P lending platform founded in 2009. The platform only allows investments in Euros, and focuses on unsecured consumer lending throughout Finland, Spain and Estonia. The platform has over 188,000 investors from 85 different countries and boasts historical annual returns between 9.5% – 17.5%.

Registration

The registration process is very simple and easy. Initially, new investors are just required to enter a name, email address and phone number into the sign-in form. Once completed, Bondora will send through an email with further instructions on account creation.

Before you make a withdrawal, you will need to supply identification documents to prove your identity.

Automatic Investing

Investments through the primary market in Bondora are only offered through Portfolio Manager or Portfolio Pro. These are two very similar tools that will automatically match your investment with borrowers. There is no manual selection of loans through Bondora.

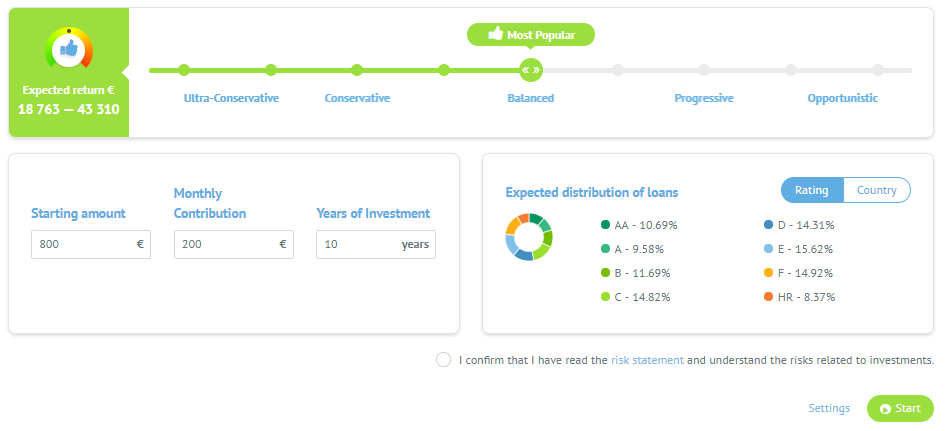

Portfolio Manager

Portfolio Manager is a quick way for investors to build a portfolio based on risk appetite. Investors can choose between ultra-conservative to opportunistic. Based on the risk, the proposed amount to be invested, and the proposed number of years of investment, Bondora provide an expected distribution of loans and an expected return for the time period selected.

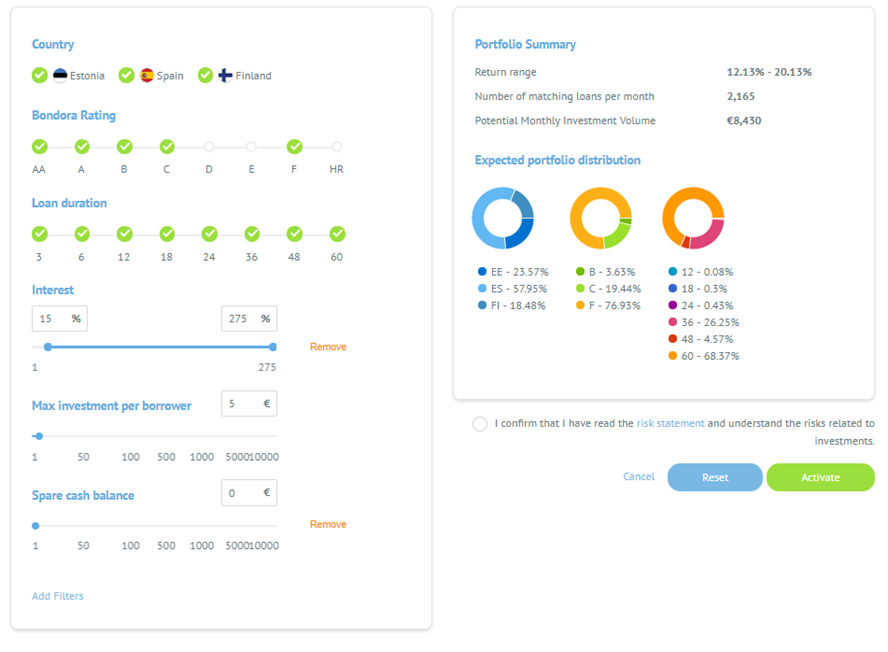

Portfolio Pro

Portfolio Pro provides more options and flexibility than the Portfolio Manager, however, you have to access your own risk. Investors can choose loans from certain countries, with certain ratings, for certain time periods and at varying interest rates. Here, Bondora matches the settings up with the number of loans currently in the system, and also with an expected rate of return.

Portfolio Manager vs Portfolio Pro

The Portfolio Manager and Portfolio Pro both act as an auto investment tool.

The Portfolio Manager has been designed as more of a basic automatic investment, which allows investors to select their risk rating and time of investment. Bondora calculates an estimate of the returns to be paid to the investor (€).

The Portfolio Pro tool has been designed more for investors looking to have control over specific investment settings. Bondora calculates how many loans are available, and the estimated interest rate (%).

A further difference is that the Portfolio Manager will invest through the secondary market as well as the primary, whereas Portfolio Pro will only match with borrowers from the primary market.

Overall, Portfolio Manager, Portfolio Pro, and the API can all be used to purchase loans simultaneously. Selecting one does not restrict the others.

Bondora Secondary Market

Bondora has a secondary market where investors are able to buy and sell purchased loans to each other. Investors can choose to trade either single loans or whole portfolios. Before using the secondary market, investors must agree to the Secondary Market Settings.

When selecting loans part of whole portfolios, make sure you check to see the status of all loans in the portfolio. You may just find that the seller has mixed defaulted loans with some current loans, to make the whole portfolio look like a good deal. Investing in these can be one way to lose money. If you have the time, the secondary market can be a good place to find some good deals.

The Good Parts of Investing with Bondora

- No fees for investing through Bondora

- Secondary Market – Just like Mintos, Bondora offers a secondary market where people can buy and sell loans at either a discount or premium

- Advance analytics about how investments work

- Easy-to-use automatic investing tools

- Borrowers are allocated investment groups based on credit history and risk

- Highest yielding P2P lending platform across the globe

- Investors can use TransferWise to deposit money.

The Not-So-Good Parts of Investing with Bondora

- No buyback guarantees on investments.

- No primary market. Bondora removed the primary market on November 1, 2016, as the speed of automated services means that loans are filled before they become visible. You can read more on the forums here

- Only people over the age of 18 and living in the EU, Switzerland or Norway can invest through Bondora.

Register with Bondora and receive a € 5 sign up bonus.

Expected Returns

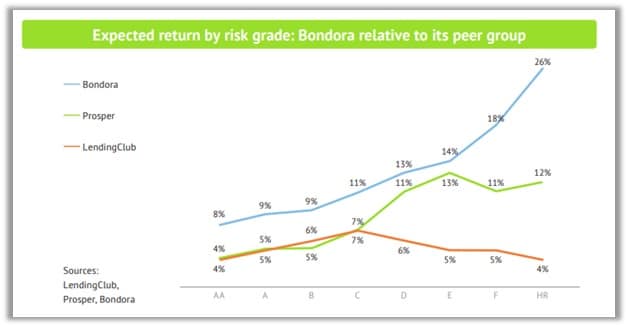

Bondora has suggested that it has the highest yielding returns in the P2P marketplace, throughout the globe (reference here), and have shown some statistics to back that fact up.

Through the statistics found on the Bondora platform, you can see that, the:

- average:

- loan amount is €2,200

- loan duration is 47 months

- interest rate is 32.4%

- loans issued are €138 million

- net return is 11.3%.

Find more statistics on the Bondora Statistics page here.

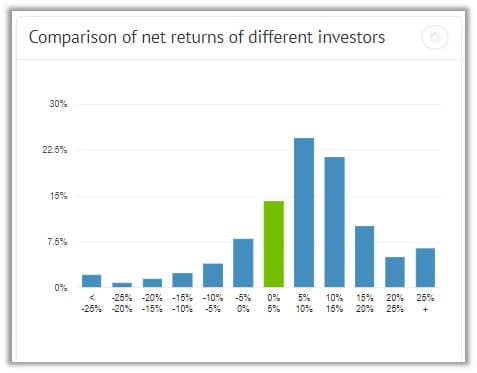

Nearly 70% of investors earn between 5 and 25% returns on Bondora, with a select 6.5% earning higher than 25%.

In the above picture, you can see that Bondora outperforms other p2p investing platforms Propser and Lending Club, which use the similar AA-HR (High Risk) rating system.

Related Articles:

Go and Grow

Go & Grow is an automated investment tool, which allows investors to add money to an account paying 6.75% p.a. Investors are able to track returns on a daily basis, and investments can be liquidated at any time. The investment is catered for people looking for lower-risk, fast liquidity and automated features. Find my full review of Go and Grow here.

Bondora Review

Bondora was one of the first platforms I invested through, due to their high rate of return and small initial investment amount. They are consistently producing the highest returns in my portfolio (see my returns). I am, however, diversifying through other European platforms that have more systems in place to guarantee returns.

Many new investors may flock to Bondora due to their high-interest rates (over 30%), but after taking in overdue payments, the recovery process, and defaults, that rate of interest can be closer to 10-15%.

Another aspect that I do not like, is that there are currently 10% of investors that have actually seen a return of less than 0%. i.e. they are losing money through the platform. Tread carefully with this platform. It may require you to be more active with management than other platforms throughout Europe.

Affiliate Program

Bondora offers a competitive affiliate program, which rewards both the referring investor and the new investor with a bonus. If a friend or other investor creates an account through your unique link, they will receive a €5 start bonus. When the new investor invests €10 or more in the first 30 days, the referring investor will receive a bonus of 5% of their invested amount. This is paid for by Bondora. No money from the new investor will be passed to the referring investor.

The calculation of the reward to both the new and referring investor will be done after 30 days from the registration date. More on the terms and conditions can be found here.

Please note: Before investing in anything do your own due diligence and research. Nothing in this article is financial advice. Just one man trying to share his working and investing experiences!